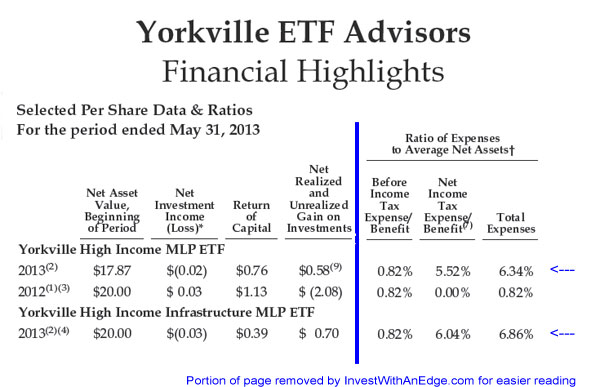

Yorkville ETF Advisors manages two MLP ETFs. The Yorkville High Income MLP ETF (YMLP) became the second C-corporation ETF with its March 2012 launch, and the Yorkville High Income Infrastructure MLP ETF (YMLI) joined the menu in February 2013. At the time of their launches, I warned investors about the horrendous undisclosed expenses of C-corporation ETFs and the severe performance degradation of an entity with a 37% effective tax rate. Yorkville recently released its semi-annual report showing expense ratios of 6.34% and 6.86%.

Yorkville ETF Advisors manages two MLP ETFs. The Yorkville High Income MLP ETF (YMLP) became the second C-corporation ETF with its March 2012 launch, and the Yorkville High Income Infrastructure MLP ETF (YMLI) joined the menu in February 2013. At the time of their launches, I warned investors about the horrendous undisclosed expenses of C-corporation ETFs and the severe performance degradation of an entity with a 37% effective tax rate. Yorkville recently released its semi-annual report showing expense ratios of 6.34% and 6.86%.

The summary pages for both YMLP and YMLI clearly indicate an Annual Operating Expense of 0.82% without any asterisks. The mangers boldly claim, “Our YETF product line tracks MLP indexes.” Again, no asterisk or disclaimer about the actual total expenses and their effect on performance.

Clicking through to the YMLP fact sheet (pdf) produces more of the same: a stated expense ratio of 0.82% without further explanation. However, looking closely at the performance data starts to reveal a clue. From inception through 6/30/13, YMLP had a total annual return of +3.64% while the underlying Solactive High Income MLP Index returned +9.69%.

Contrary to Yorkville’s claim that its products track MLP indexes, YMLP has lagged its index by 6.05% annually. It has delivered less than 38% of the index’s return. The YMLI fact sheet (pdf) reveals a similar story, lagging its index by 4.53% after less than five months on the market.

Even the March 2013 prospectus (pdf) claims an expense ratio of 0.82% and “other expenses” of 0.0%. The footnotes state other expenses are assumed to be zero because as of November 30, 2012 the fund had not yet paid any income taxes.

The real story is buried in the Yorkville May 31, 2013 Semi-Annual Report (pdf). There on page 7 (page 9 of the pdf), aligned sideways in small print, the truth finally comes out. The Yorkville High Income MLP ETF (YMLP) has Total Expenses of 6.34%, and Yorkville High Income Infrastructure MLP ETF (MYLI) has Total Expenses of 6.86%.

I continue to be amazed the SEC allows this apparently blatant misrepresentation of the expenses incurred by C-corporations masquerading as ETFs. Regulators are allowing products to advertise expense ratios of just 0.82% and claim they track an index when the reality is quite different. Burying the real expenses in the semi-annual report falls far short of adequate disclosure to the investing public.