Barclays introduced the iPath S&P 500 Dynamic VIX ETN (XVZ) on August 18, 2011, providing investors with exposure to a strategy that dynamically allocates between short-term and mid-term VIX futures contracts.

The new exchange-traded notes (“ETNs”) will track the S&P 500 Dynamic VIX Futures Total Return Index minus a 0.95% annual investor fee. The index dynamically allocates between the S&P 500 VIX Short-Term Futures Index Excess Return and the S&P 500 VIX Mid-Term Futures Index Excess Return by monitoring the steepness of the implied volatility curve. It seeks to react positively to overall increases in market volatility and aims to lower the roll cost of investments linked to future implied volatility.

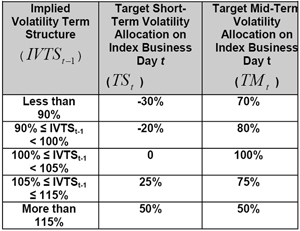

The Implied Volatility Term Structure (“IVTS”) is the ratio of the 30-day VIX (volatility index) to the 93-day VIX and is used to determine the daily allocations to short-term and mid-term VIX futures using the accompanying table (a negative weighting indicates an inverse or target short position).

Allocations are determined daily and are subject to a daily rebalancing limit of 12.5% for each underlying index. This implies that large changes will require muiltiple days to implement.

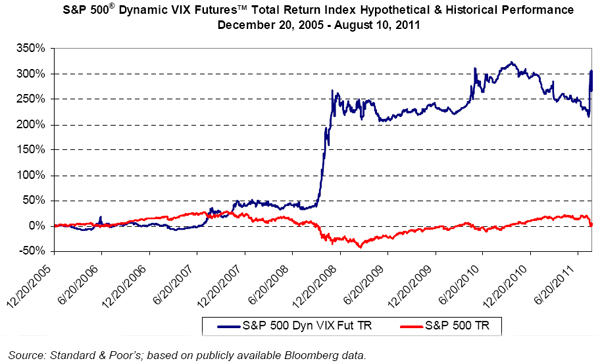

The index has only been in existence since June 13, but the folks at Barclays were kind enough to include the hypothetical backtest results as part of the prospectus (pdf). One of the charts is shown below, and a cursory review looks quite favorable. Historically, the index has provided significant gains during times when the S&P 500 encountered price declines or increased volatility. Additionally, the dynamic nature of the index indicates it also has the potential to hold on to much of those gains when more favorable stock market conditions return.

From a competition perspective, UBS introduced the first volatility strategy ETP back in December 2010. The UBS ETRACS Daily Long-Short VIX ETN (XVIX) tracks the S&P 500 VIX Futures Term-Structure Index ER, which measures the return from taking a 100% long position in the Mid-Term Index and a 50% short, or inverse, position in the Short-Term Index. Unfortunately, XVIX has not lived up to expectations by declining during the recent volatility and showing a loss since its inception. The dynamic nature of the new XVZ will hopefully overcome the shortcomings of XVIX.

For additional information, please consult the overview page, press release (pdf), and fact sheet (pdf).

Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.