case you missed it, last Friday was the first day of spring in the Northern Hemisphere. Happy people planted gardens, expecting a harvest in a few months. Meanwhile, Obama and company were planting their own seeds in our nation’s capital. However, these seeds won’t turn into cauliflower or cucumbers. No, your leaders planted seeds of inflation, the likes of which we’ve probably never seen in this country before.

Political expedience is now in control. The new administration is clearly more interested in preserving the stock market than upholding the dollar. After seeing his poll numbers drop faster than Bush’s at this time in his presidency, Obama may be concerned his economic team appears unfit for the task. Regardless of the motivation, the Federal Reserve is happy to comply with his wishes. The whole thing is unfolding like a bad movie:

The economy is in the tank. A bloated US government needs money to fix a broken stock market. China doesn’t want to lend any more. Bloated government taps central bank for a cash infusion. Central bank prints hundreds of billions to fund government’s economic science projects. Market goes up, and economy is saved.

The End – or is it?

That’s right. The Fed is set to print money – literally make $300 billion in electronic entries – to finance our government’s forecasted $2.5 trillion deficit this year. But why go nuclear? Well, class, when the US can’t find buyers for its debt, they have to get financing from somewhere – you wouldn’t want your Congressman to go hungry would you?

To add insult to injury, China is actively pushing an alternative to US-based economic dominance. Chinese advisors are pressing for a new global reserve currency. China’s own central bank governor just proposed dumping the dollar in favor of a new world currency. And guess what, Treasury head Timothy Geithner admits not being on the uptake regarding the Chinese proposal.

Whatever your political affiliation, your currency allegiance should be hard and fast. When the formerly-solid US government turns Banana Republic with its central bank, you know it’s time for a change. If some of your assets are in stocks, use the rally to punch out with lighter losses. It’s time to short the dollar.

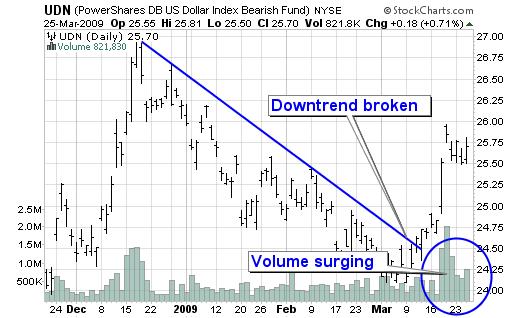

One of the easiest ways to sell the greenback is with PowerShares DB US Dollar Index Bearish (UDN). This ETF tracks the inverse of the dollar index. Whenever the dollar gains against other currencies, UDN goes down. Whenever the dollar loses against other currencies, UDN goes up. And that’s precisely what we expect in the coming weeks and months.

The chart confirms our analysis. UDN just rallied past a former trading range and could be beginning a big move to the upside. In addition, this ETF has good liquidity, with daily volume typically over a half-million shares. UDN is liquid enough to handle your investment.

Still, we acknowledge the irony in this trade. If it works out, you’ll gain in your portfolio, but the gain will be measured in dollars. These dollars would be worth less than they are right now, but it’s better than keeping them under your mattress. At least you’ll have more to show for your efforts. To immunize yourself to a devalued dollar, go with UDN.