Investors live with volatility. It’s as much a part of the market as trends, support and resistance levels, and, of course, prices. According to Investopedia, volatility is a statistical measure of the dispersion of returns for a given security. It can be measured by standard deviation or variance between returns from a related index or itself. In other words, volatility measures historical price fluctuations. Note that volatility can be in either direction. Whether a stock moved up or down by a given amount doesn’t matter. The point is that it moved.

Measuring volatility is especially important for options traders. Since options work within a limited time frame, you want to know how likely it is for the underlying security to make a big move while you’re holding an option. An easy way to think about it: when volatility is low, it’s time to buy options. When volatility is high, it’s time to sell options – assuming everything else is in line. It gets more complicated, but you get the idea.

One of the things options traders like to review is the VIX. The VIX is the ticker symbol for the Chicago Board Options Exchange Volatility Index. Popularly known as the ‘Fear Index’, the VIX measures the implied volatility of the S&P 500 index options over the next 30 days. Practically speaking, the VIX is the expected movement in the S&P 500 index over the next 30-day period, on an annualized basis. The higher the VIX, the higher the likelihood of price fluctuations. The lower the VIX, the lower the likelihood of price fluctuations. That’s important when considering the current market environment.

The market has enjoyed a generous run in recent months. A dramatic reversal helped the S&P 500 to an impressive 50% climb since early March. If the market rolls over, we expect volatility to spike once again. A correction may have begun this week as the market fell on rising volume. This decline could accelerate after Labor Day when more investors return from vacation. That’s why now may be time to consider a volatility play.

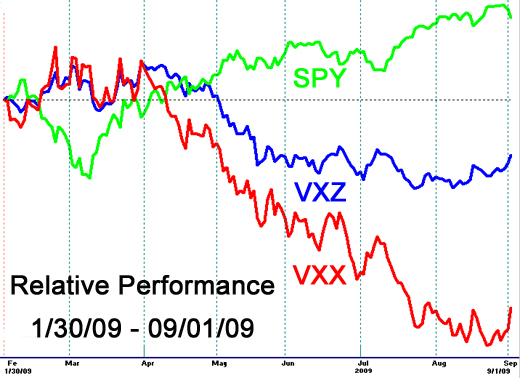

Until recently, the primary way investors bought and sold market volatility was through options. That’s still the main way to do it. However, last January Barclays introduced two exchange traded products that track the VIX futures market: iPath S&P 500 VIX Mid-Term Futures ETN (VXZ) and iPath S&P 500 VIX Short-Term Futures ETN (VXX). These ETNs help investors play the risk of the market unlike any fund before. We first told you about these funds earlier this year. We think now could be a great time to employ them.

Both VXZ and VXX have been trending down since early April when stock prices began their ascent. That decline now seems to have abated. It appears that VXZ is ready to break a short-term high in the next few days, and VXX may not be far behind. Another few down-days for the S&P and we should see a spike in volatility, to the benefit of VXX and VXZ.

This is not a long-term play. It’s simply a way to take advantage of a declining market while not selling-short the market. In addition, it’s a useful hedge if you want to maintain your long positions. To play a potential spike in volatility, go with VXZ or VXX.