Factor investing has come of age. Although factor investing has been in use for decades (I have personally been using the momentum factor for more than 30 years), it is only in the past few years that exchange-traded funds (“ETFs”) have attempted to isolate these factors. Growth and value are two examples of investment approaches that are familiar to most investors, and they are also examples of factors.

Another common investment approach is selecting stocks based on their dividends, which is the yield factor. Picking stocks based on recent performance is consistent with using a momentum factor. Today, there are ETFs targeting many different factors. Additionally, ETF sponsors are hard at work trying to come up with combinations of factors that have produced above-average long-term performance. The reason? It is because no factor works best all of the time.

Much like sectors, styles, and geographical regions, each factor has periods of outperformance and periods of underperformance. Rather than attempting to find the combination that worked the best in the past decade and hope that it continues to do so in the future, we believe a dynamic approach is preferable.

Today, we are introducing our Factor Edge lineup of 11 different investment factors. Each week, we will graphically illustrate the relative strength ranking of these factors in the same manner we display the relative strength of our sector and global categories.

A description of each of these factors and the ETF we are using as a benchmark follows:

Market Capitalization: When the discussion turns to investment factors, analysts often exclude market capitalization except for comparative references. However, it was the primary factor guiding nearly all indexing for years. Our benchmark is the iShares Russell 1000 (IWB), a capitalization-weighted portfolio of the largest 1,000 U.S. incorporated stocks.

Size: The size factor refers to “small” size, and it is based on the observation that smaller-capitalization securities tend to outperform their larger brethren over the long term, albeit with additional risk and volatility. There are many ways investors can increase exposure to the size factor, including capitalization constraints and equal weighting. We have selected the iShares Russell 2000 (IWM) as our benchmark. The underlying Russell 2000 Index is the most widely followed U.S. small-cap benchmark and consists of the smallest 2,000 stocks within the Russell 3000. Although it uses capitalization weighting, it represents only about 8% of the market capitalization of the Russell 3000 Index.

Growth: The growth factor seeks to isolate the characteristics of growing companies while eliminating those with value and blended characteristics. The Guggenheim S&P 500 Pure Growth (RPG) benchmark selects and weights holdings based on sales growth, earnings growth, and price momentum.

Value: The value factor seeks to isolate the characteristics of companies that are underpriced relative to their intrinsic value, while eliminating those with growth and blended characteristics. The Guggenheim S&P 500 Pure Value (RPV) benchmark selects and weights stocks based on their price-to-book ratio, sales-to-price ratio, and earnings-to-price ratio.

Quality: Not everyone’s definition of quality is the same, but as you might expect, the quality factor attempts to filter out companies in questionable financial condition. Our benchmark, the iShares Edge MSCI USA Quality Factor (QUAL), considers return on equity, earnings variability, and debt-to-equity measurements in constructing a cap-weighted, sector-neutral portfolio of the highest quality stocks.

Low Volatility: Low-volatility portfolios tend to have smaller declines and lower risk measurements than the broader market. The goal is to not sacrifice too much of the return in this endeavor, hopefully leading to superior risk-adjusted performance. Our benchmark, the iShares Edge MSCI Min Vol USA (USMV), uses a rules-based methodology to optimize and determine weights for securities to minimize total risk.

Momentum: In its basic form, momentum is an easy concept to understand, as it is a representation of recent performance. However, complexity and differences arrive through the application of different time intervals and seemingly endless combinations of intervals. Our benchmark, the iShares Edge MSCI USA Momentum Factor (MTUM), uses a risk-adjusted measurement of price momentum over six-month and 12-month periods. The risk-adjustment process uses the three-year weekly standard deviation of returns.

Yield: The yield factor targets stocks with the highest current dividend yield calculations. Our benchmark, the iShares Core High Dividend (HDV), is comprised of 100 of the highest dividend-yielding securities (excluding REITs) in the Dow Jones U.S. Index, a broad-based index of the total market for U.S. equity securities. To help reduce risk, the selected stocks must have non-negative five-year dividend growth rate and a five-year average dividend coverage ratio of 16 or better.

Dividend Growth: This factor seeks companies that have consistently increased their dividends. Our benchmark, the SPDR S&P Dividends (SDY), follows the S&P High Yield Dividend Aristocrats Index. It holds stocks from the S&P Composite 1500 Index that have consistently increased dividends every year for at least 20 consecutive years.

High Beta: Beta is a measure of a stock’s sensitivity to market moves, and high beta stocks tend to outperform the broader market during upswings and underperform during declines. Our benchmark, the PowerShares S&P 500 High Beta (SPHB), consists of the 100 stocks from the S&P 500 Index with the highest sensitivity to market movements, or beta, over the past 12 months.

Fundamental: Fundamental weighting seeks to eliminate technical and price factors. Our benchmark, the PowerShares FTSE RAFI US 1000 (PRF), targets stocks based on four fundamental measures: book value, cash flow, sales, and dividends. It selects the 1,000 equities with the highest fundamental strength and weights them by their fundamental scores.

Note: The Style Edge chart will no longer be included in our weekly update. Its categories were based on the Morningstar style-box matrix with extensions for mega-cap and micro-cap stocks. Much of the information it previously supplied can be derived from the first four factors listed above. Additionally, we will continue to update our investment strategy using style-box rotation every week on the Leadership Strategy page of our website.

Sectors

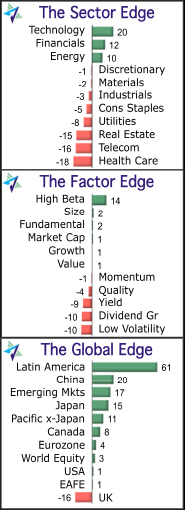

This is the third week with just three sectors posting positive momentum scores, and it has been the same three sectors each week. Technology tops the list on strong gains for semiconductor and internet stocks. Financials moved a step higher, with bank stocks being the driving force. Energy’s recent strength is coming from the equipment and services segments, although the sector is being pulled lower by weakness in exploration, production, and energy commodity prices. There was not much change for Consumer Discretionary, Materials, and Industrials over the past week. Higher-yielding sectors gained traction with investors again as Consumer Staples, Utilities, and Real Estate all climbed in the rankings. Telecom dropped three places lower to 10th as investors registered their dissatisfaction with the proposed AT&T (T) acquisition of Time Warner (TWX). Health Care slid the final step lower and replaced Real Estate as the lowest-ranked sector.

Factors

High Beta is easily the best-performing factor and has been for more than two months. The relative strength comparison illustrated in the chart shows that High Beta is the only factor delivering a significant advantage at this time. The next six factors are treading water presently, neither adding nor subtracting performance. Size, Fundamental, Market Cap, Growth, and Value are barely in positive territory. The sixth, Momentum, is slightly on the negative side of zero. Four other factors are in the red, with Quality currently ahead of Yield. Dividend Growth and Low Volatility, both strong factors over the past few years, are now on the bottom.

Global

The global rankings look like a broken phonograph record, with Latin America stuck at the top and the U.K. relegated to the bottom. As impressive as the gains have been for Latin America in recent weeks and all year long, the iShares Latin America 40 ETF (ILF) is still 24% below its September 2014 level and 35% off its 2008 peak. Plenty of upside potential remains, but you should expect volatile pullbacks to be part of the journey. China is far back in second place, followed by Emerging Markets, Japan, Pacific ex-Japan, and Canada. Four categories moved from negative to positive trends, putting all but one global category in the green. The Eurozone, World Equity, U.S., and EAFE were the four to make the transition, but they all lack conviction and could easily slip lower again. U.K. stocks and the British pound continue to pay the price for June’s Brexit vote. The market hates uncertainty, and “uncertainty” is probably one of the best one-word descriptions of the U.K. situation.

Note:

The charts above depict both the relative strength and absolute strength of various market sectors, styles, and geographic locations on an intermediate-term basis. Each grouping is sorted (top to bottom) by relative strength. The magnitude of the displayed RSM value is a measure of absolute strength, which is our proprietary method of measuring and reporting the intermediate-term strength as an annualized value.

“Both poker and investing are games of incomplete information. You have a certain set of facts and you are looking for situations where you have an edge, whether the edge is psychological or statistical.”

—David Einhorn, hedge fund manager and founder of Greenlight Capital

DISCLOSURE

© 2016 Dynamic Performance Publishing, Inc. – All Rights Reserved. This material is protected under U.S. copyright law and is provided for the exclusive use of our members for personal purposes. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by Dynamic Performance Publishing or our employees to you should be deemed as personalized investment advice. Any investment recommended in this email should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. Dynamic Performance Publishing, its affiliates, and clients may hold positions in the recommended securities. Results are not indicative of holdings for clients of Flexible Plan Investments. Forwarding, copying, or otherwise duplicating this information for the use by anyone other than the intended recipient is expressly forbidden. Any retransmission of this material by you is your authorization to us to debit your credit card, or otherwise bill you, for a full price one-year membership for each violation. It may also cause your membership to be revoked without a refund. Any such action on our part does not prevent us from seeking additional legal remedies.