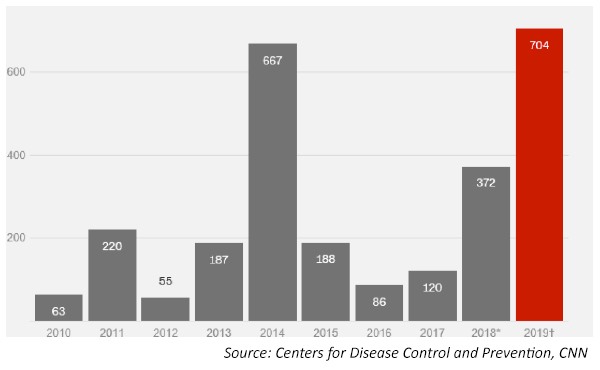

The year was 2000. A new century had begun and the Centers for Disease Control and Prevention (CDC) announced that measles had been eradicated in the United States. Yet this year we have already seen more than 700 cases of the childhood disease.

Prior to 1963, when the first measles vaccine was developed, having the measles was a sometimes-deadly rite of passage for most youngsters. Virtually all children contracted it, and out of each 1,000 cases contracted, one or two children would lose their lives.

Since science provided an alternative to getting the disease, public health officials have waged a campaign to get the country vaccinated. In 2000, the country went more than 12 months with no transmission of the disease. This was a far cry from the millions of cases per year prior to the availability of the vaccine.

Yet the number of cases has begun to creep higher, and this year’s 700 cases in just four months (including 40 in my own county in Michigan) have already registered the highest annual total in 25 years!

This has resulted in health alerts in a number of states around the country. Although over 90% of the U.S. population has been vaccinated, that still leaves enough unvaccinated individuals (about 30 million) to cause concern.

According to the CDC, nearly 90% of those who contracted the disease this year were either unvaccinated or had an unknown vaccination status. Fortunately, there have not been any deaths associated with the disease so far this year.

I thought of the current surge in measles infections this week when an out-of-state visitor to my office mentioned that he had gone to his doctor to get a measles booster shot when he learned about Michigan’s outbreak.

The discussion that followed yielded two thoughts investors should consider.

Vaccinate your portfolio

First, I thought about how reactive the press has been to any danger we Americans face. As we moved above 400 cases earlier this year, the stories started appearing. Now there are daily updates.

Yet the probability of dying from the measles for most Americans is smaller than getting hit by lightning (1 in 15,300). For example, if you have already had the disease, or have had both of the two-part vaccination, the chances are just 1 in 2.2 million.

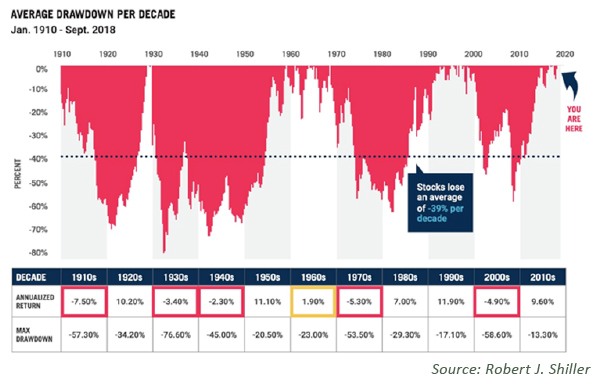

Americans are shocked that we have had 700 cases in our nation of 330 million people, and the press is mobilized. Yet, based on history, the chance of those same people going through a recession in the next five years is nearly 100%. And the chance of a 30%-plus loss in the stock market in that same period is also 100%. Where’s the urgency to prepare for these near certainties?

What makes the measles outbreak truly upsetting is that it is so preventable—just get vaccinated. At the same time, a financial crisis and stock market decline has an astronomically higher chance of happening and most people have done little to protect themselves.

Of course, just as vaccination does not eliminate all chance of being infected by the measles, dynamic risk management can’t eliminate all risk of losses in investing. However, our risk-management efforts since our founding in 1981 have mitigated the losses.

Although most people infected by the measles get the rash and high fever of the disease, very few die from it—and even those who get vaccinated sometimes experience mild symptoms. Similarly, while investors who use dynamic risk management may succumb to some of the mild symptoms of a “baby bear” (a 10% to 20% correction), the real savings occur during the “super bears.” These ravage investment portfolios for 30% to 75% losses when they occur, resulting in an average loss per decade since 1910 of 39%.

Beware of FOMO disease

Second, I thought about the other side of the spectrum—profits from the markets. For the rest of 2019, I believe investors are more likely to be infected by a disease other than the measles: Fear of Missing Out (FOMO) disease.

So far, FOMO has gone undetected by the CDC. The disease usually surfaces after the markets have experienced some losses but then come roaring back. The last six months fit the bill.

As profits pile up for investors returning to the market, investors on the sidelines begin to display a contagion of nervousness and fear. As the markets travel higher, these symptoms break out into envy tinged with red spots of greed. At the very end, the foaming frenzy reaches its final stage and investors stop fighting and succumb to buying back into the market.

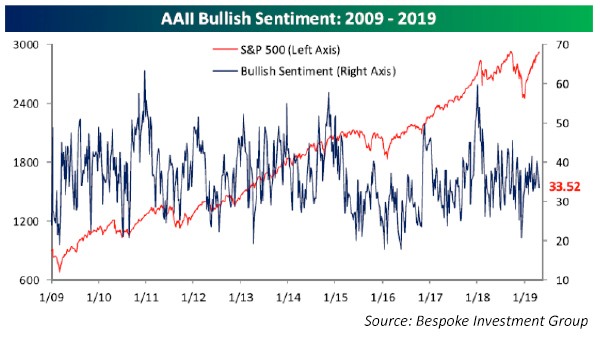

The time is ripe for FOMO. The markets have churned steadily higher and profits have multiplied since the market-correction bottom on December 24, 2018. As evidence that the contagion is spreading, notice the American Association of Individual Investors’ Sentiment Index (see the following chart). Despite a new all-time high in virtually all of the stock market indexes, small investors are lining the sidelines. Bullish sentiment is falling and is nearer to a low than a high.

But remember, you can still be vaccinated. By using a diversified portfolio of dynamic risk-managed strategies, you can confidently invest now, knowing that you are employing strategies designed to mitigate the effects of the long-dormant super bear.

You can get into the market before those infected with FOMO rush once again into stocks and drive prices even higher. By doing so, you can be symptom-free and simply enjoy the benefits of the breakout.

And while you’re relaxing, check out https://www.cdc.gov/measles/vaccination.html and get you and your children vaccinated against measles and other childhood diseases that can be bad for kids—and even worse for adults if they contract them. Let’s once again celebrate the achievement of the new millennium and be measles-free.

Market update

Most of the stock market indexes continued to gain ground last week. The S&P 500, Russell 2000, and the NASDAQ rose more than 1%. In contrast, the Dow Jones Industrial Average, bogged down by the bad earnings of some of its components, slumped about 0.06%. Bonds gained a small fraction, as did gold.

The S&P 500 and the NASDAQ hit new all-time highs last week—the first time the S&P 500 has done so in over six months. Historically, when the S&P 500 has hit a new high more than six months after its last high, the Index has averaged a 12.9% gain over the next 12 months. In addition, gains were achieved in over 94% of the occurrences (17 of the 18 times).

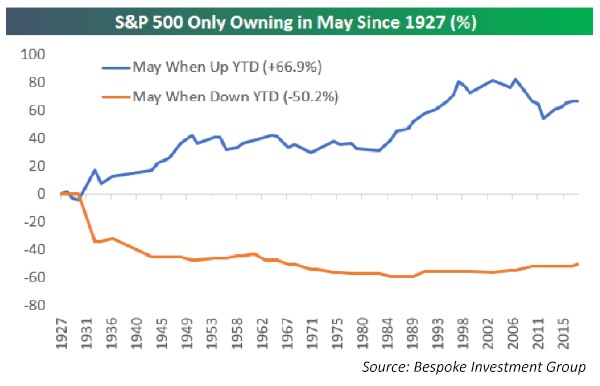

With May coming this week, many market commentators are reminding us to “sell in May and go away.” It’s true that, generally, May is one of the weakest months of the year (while April has once again shown that it is one of the strongest). In some years, selling in May can be in your best interest.

But the following chart shows that if the stock market has posted gains for the year to date, as it certainly has this year, the fate of investors can be very different.

As to the conventional wisdom of “going away in May” for six months and not returning until November, it, too, appears to be turned on its head when the stocks have been as strong as this year. Instead of falling (or, more accurately, being flat) during what is termed the “worst six months of the year for the market,” the S&P 500 Index has gained an average of 7.3% when stocks have not had a stumble of 5% or more in the first four months of the year. According to Quantifiable Edges, six-month gains were achieved in 13 out of the 16 occurrences (81%) and maximum drawdown has averaged just 4.7%.

Last week’s GDP announcement was certainly a surprise. The 3.2% annualized rate blew right through even the best guesses (2.5%) of economists. While most of the economic indicators reported last week did not fare as well as the GDP in beating analyst expectations (only about 50% did so), the ones that count are doing fine, with manufacturing growing strongly, full employment, and low inflation. Under such circumstances, it seems unlikely that the Federal Reserve will cause a stir at its May 1 meeting.

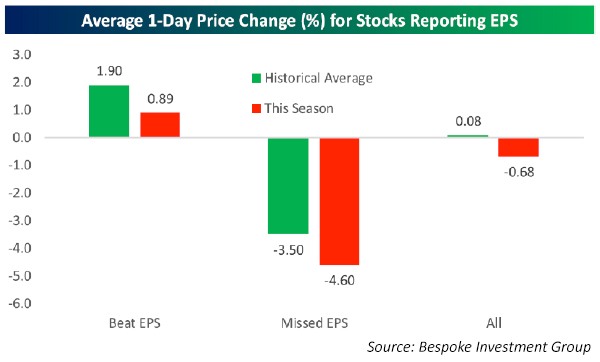

Earnings reports have been a mixed bag so far this quarter. While Google has been a significant exception, positive earnings surprises have jumped nicely to 68% from previous reporting quarters of around 60%, revenues have beat at a rate of only just over 50%. Worse still, stocks reporting positive earnings surprises have gained less than in the past, and stocks reporting negative earnings surprises have lost more on reporting day.

With the stock market overbought and some internal measures failing to keep up, it would not be out of character for the stock market to experience a pause here or even a decline of as much as 5%. But that’s merely a cold, not the measles. At the present time, it looks more likely that stocks will continue to be in good health for the rest of the year.

Disclosure: No communication by Dynamic Performance Publishing or our employees to you should be deemed as personalized investment advice. Any investment recommended in this newsletter should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. Dynamic Performance Publishing, its affiliates, and clients may hold positions in the recommended securities. Results are not indicative of holdings for clients of Flexible Plan Investments. Forwarding, copying, or otherwise duplicating this information for the use by anyone other than the intended recipient is expressly forbidden. These results are not representative of those achieved by clients of Flexible Plan Investments, Ltd. (FPI) due to differences in security selection, timing of trades, transaction fees, and FPI’s management fees.