With ETFs, it is now possible to buy nearly every publicly traded stock in the world with a single transaction and a single commission. While that is extremely convenient and efficient, sometimes investors want to tailor their exposure by emphasizing or avoiding certain regions or countries. The following paragraphs highlight various stock market classification systems and describe the 11 global benchmark ETFs I use each week to illustrate the relative strength and momentum of global investment categories.

I rely on the MSCI classification system to identify which countries are Developed Markets, Emerging Markets, or Frontier Markets. Other prominent global benchmarking and index firms include FTSE and S&P. If you are trying to target exposure to a single country or region, then the index provider may not be important to you. However, if you are building a strategic global allocation portfolio, then it may be wise to stick with a single index provider. For example, MSCI classifies South Korea as an emerging market, while FTSE considers it a developed market. If your developed-market and emerging-market ETFs use two different index providers, then you could wind up with either double exposure or no exposure to South Korea.

The characteristics I look for when selecting a benchmark ETF include market coverage, trading liquidity, and expenses. As mentioned previously, when market delineations are important, I prefer to use MSCI index-based ETFs. As for market coverage, I prefer benchmarks and ETFs that include small-capitalization stocks—the more stocks the better. Liquidity, the ease of getting into and out of a position, comes in many forms, and I look at assets under management, trading volume, and bid/ask spreads. Expense ratios also play a role in my selection.

One thing to keep in mind is that none of these benchmarks uses currency hedging. Instead, they provide the full benefit of both the stock market and underlying currency gains (or losses) when converted back into U.S. dollars. There are times to consider using a currency-hedged version of these benchmarks, but over the long term, the currency fluctuations tend to add to the diversification benefits of global investing.

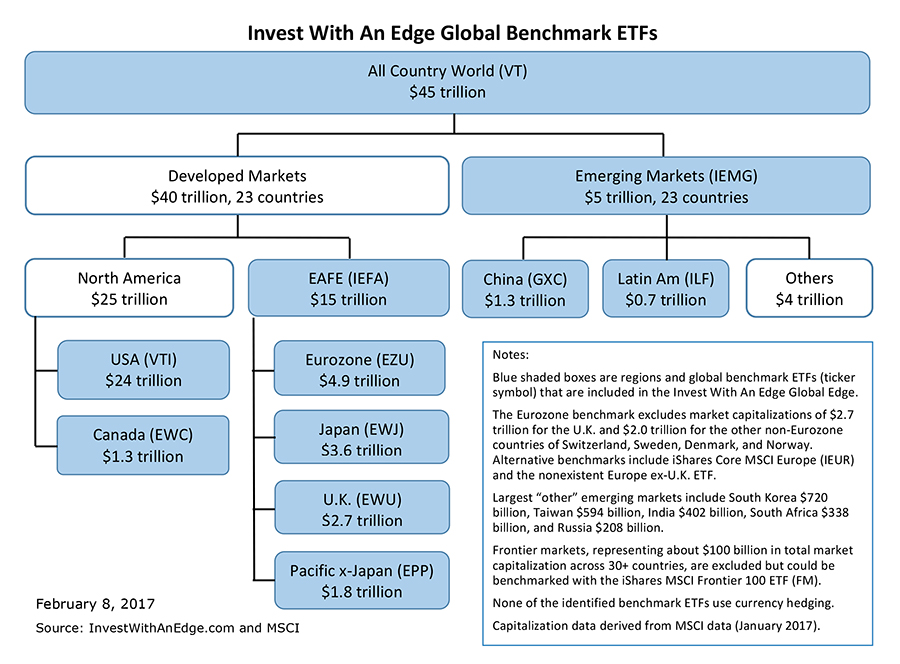

The accompanying chart illustrates the global hierarchy and the market capitalization of each segment. The entire world’s stock markets represent about $45 trillion in float-adjusted market capitalization. Of that, $40 trillion resides in the 23 developed-market countries, $5 trillion is in the 23 emerging-market nations, and another $100 billion is in 30+ frontier markets. As the name implies, frontier markets are less advanced than emerging markets and are not represented here.

Here are my 11 global benchmark ETFs arranged in order of market capitalization:

World Equity—Vanguard Total World Stock (VT): This ETF holds more than 7,600 stocks across all developed and emerging markets in the FTSE Global All Cap Index, representing about $45 trillion in stock market capitalization. It has $6.4 billion in assets and an expense ratio of 0.14%. Top country weightings include the U.S. 54.0%, Japan 8.2%, U.K. 6.0%, Canada 3.3%, France 2.9%, and Germany 2.9%.

USA—Vanguard Total Stock Market (VTI): This ETF holds more than 3,500 large-, mid-, and small-capitalization stocks in the CRSP US Total Market Index, representing about $25 trillion in stock market capitalization. It has $70 billion in assets and an expense ratio of 0.05%. Top sector weightings include Financials 20.7%, Technology 16.3%, Consumer Services 13.0%, Industrials 12.9%, and Health Care 12.3%.

EAFE—iShares Core MSCI EAFE (IEFA): The EAFE acronym stands for Europe, Australasia, and Far East. This ETF tracks an index of large-, mid-, and small-capitalization equities of developed markets excluding the North American countries of the U.S. and Canada. The ETF holds 2,540 stocks, $18 billion in assets, and has an expense ratio of 0.08%. Its largest country allocations include Japan 25%, the U.K. 18%, France 9%, Germany 9%, Switzerland 8%, and Australia 7%. It provides a better benchmark than the older iShares MSCI EAFE (EFA) because it includes small-cap stocks and has a lower expense ratio.

Eurozone—iShares MSCI Eurozone (EZU): This ETF tracks a benchmark of developed-market countries that use the euro as their official currency. The ETF holds 247 stocks, has $8 billion in assets, and an expense ratio of 0.49%. Major country allocations include France 32%, Germany 30%, Netherlands 11%, Spain 10%, and Italy 6%. The U.K., Switzerland, Sweden, and Denmark are the largest European nations excluded from this benchmark.

Emerging Markets—iShares Core MSCI Emerging Markets (IEMG): This ETF tracks an index of large-, mid-, and small-capitalization equities across 23 emerging-market countries. It holds more than 1,800 stocks, has $21.5 billion in assets, and a net expense ratio of 0.14%. Its largest country allocations include China 24.6%, South Korea 15.0%, Taiwan 12.8%, India 8.8%, Brazil 7.5%, and South Africa 6.3%.

Japan—iShares MSCI Japan (EWJ): This ETF covers about 85% of Japan’s equity market by holding 319 large- and mid-cap stocks. It has $16.4 billion in assets and an expense ratio of 0.49%. Top sector weightings include Consumer Discretionary 20.2%, Industrials 19.9%, Financials 14.2%, Technology 10.9%, and Health Care 7.5%.

UK—iShares MSCI United Kingdom (EWU): This ETF covers about 85% of the United Kingdom’s equity market by holding 109 large- and mid-cap stocks. It has $2.5 billion in assets and an expense ratio of 0.49%. Top sector weightings include Financials 21.8%, Consumer Staples 17.1%, Energy 14.9%, Health Care 10.3%, Consumer Discretionary 8.7%, and Materials 8.7%.

Pacific x-Japan—iShares MSCI Pacific ex Japan (EPP): This benchmark ETF encompasses 85% of the Pacific region developed-market equities excluding Japan by holding 150 large- and mid-cap stocks. Its country allocations consist of Australia 61%, Hong Kong 27%, Singapore 10%, and New Zealand 2%. The ETF holds $2.4 billion in assets and has an expense ratio of 0.49%.

China—SPDR S&P China (GXC): This ETF tracks the S&P China BMI Index of 675 large-, mid-, and small-cap publicly traded companies domiciled in China but legally available to foreign investors. It has $835 million in assets and an expense ratio of 0.59%. Top sector weightings include Technology 28.7%, Financials 24.5%, Consumer Discretionary 10.8%, Industrials 7.1%, and Telecommunications 6.1%.

Canada—iShares MSCI Canada (EWC): This ETF covers about 85% of the Canada’s equity market by holding 94 large- and mid-cap stocks. It has $3.5 billion in assets and an expense ratio of 0.49%. Top sector weightings include Financials 42.8%, Energy 21.3%, Materials 11.7%, Industrials 7.2%, and Consumer Discretionary 4.7%.

Latin America—iShares Latin America 40 (ILF): This ETF tracks the S&P Latin America 40 Index. It has $1 billion in assets and an expense ratio of 0.49%. Its country allocations consist of Brazil 59.8%, Mexico 23.4%, Chile 10.1%, Peru 4.5%, and Colombia 1.7%. Top sector weightings include Financials 35.1%, Materials 17.2%, Consumer Staples 15.3%, and Energy 12.6%.

Disclosure: Author has no positions in any of the securities mentioned and no positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) is received from, or on behalf of, any of the companies or ETF sponsors mentioned.