Feeling a bit down? What happened in the pit of your stomach the last time you saw your statements? Did you already decide you won’t be able to retire in the next 5 years? Just a couple of years ago, you were counting down the weeks until you could leave office politics behind for a cozy home backing the 9th green. How things can change in such a short time. But it’s not as bad as it could be.

Feeling a bit down? What happened in the pit of your stomach the last time you saw your statements? Did you already decide you won’t be able to retire in the next 5 years? Just a couple of years ago, you were counting down the weeks until you could leave office politics behind for a cozy home backing the 9th green. How things can change in such a short time. But it’s not as bad as it could be.

What if you lived in Japan?

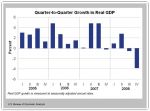

Last quarter, Japan’s economy shrank by -3.3% – it’s worst performance in 35 years. This brought annualized gross domestic product losses to -12.7% for the island nation. To gain some perspective on these numbers, compare that to here. If the U.S. were to lose 12% GDP, that would be the equivalent of shedding every manufacturing job, plant, and product from US soil – in one year. Couple recent lackluster performance with Japan’s lost decade against the backdrop of their previous economic glory days, and the Japanese people are not happy.

Prime Minister Taro Asa is feeling the brunt of their frustration. According to a new survey by Nippon Television news, Asa’s approval rating fell to 9.7%, the poorest showing for a Prime Minister since 2001 – another recession. Many analysts are projecting even further troubles for the Asian economy. This will not bode well for Asa’s political survival. But it’s not completely his fault. Japan’s export-dependent economy has been severely hampered in the global slowdown. In fact, they are in the worst economic situation since just after World War II. That’s pretty bad for Japan.

But isn’t the US in the same predicament? Not exactly.

With all this political rhetoric on why we need a $787 billion economic stimulus, shouldn’t we consider the numbers first? After all, the U.S. Government doesn’t have $787 billion to spend on this program in the first place – shouldn’t we at least be convinced about the dire economic situation that dictates the debt Obamaites want to load onto our posterity?

Bradley Schiller published an outstanding article in the Wall Street Journal on Friday about this very topic. Disagreeing with the new President’s math, Schiller suggests that we’re far away from Great Depression-era economic problems

He cited last year’s job losses at 2.2%. This mirrored 1981-82 job losses of 2.2% – not the 4.8%, 6.5%, and 7.1% losses incurred between 1930 and 1932. In addition, unemployment currently stands at 7.6%. In 1982, the peak unemployment rate was 10.8%. However, the peak unemployment rate in 1932 was 25.2%. Granted, we’re not through with our rough patch in the market, but we’re still far away from Depression-era problems.

Yes, the markets are tough right now. But no, we’re not in a second Great Depression either. To continue to make shoddy comparisons to such times will ultimately hurt the new administration. It may not make for good international relations, but it would be a hat-tip to reality for Obama to say, “Hey guys, at least we’re not Japan.” Americans might appreciate the honesty.