New ETF creation activity picked up in September as 27 new products came on the market. New arrivals consisted of 25 ETFs and two ETNs. Vanguard was singularly responsible for the majority of new listings, launching 16 new ETFs in two separate waves. Particularly noteworthy about the Vanguard launches is the fact that all 16 ETFs follow the same indexes as existing ETFs from iShares and SPDRs. In all 16 cases Vanguard chose to differentiate itself on price and brand. Vanguard is not content with its current position of being the third largest ETF supplier.

New ETF creation activity picked up in September as 27 new products came on the market. New arrivals consisted of 25 ETFs and two ETNs. Vanguard was singularly responsible for the majority of new listings, launching 16 new ETFs in two separate waves. Particularly noteworthy about the Vanguard launches is the fact that all 16 ETFs follow the same indexes as existing ETFs from iShares and SPDRs. In all 16 cases Vanguard chose to differentiate itself on price and brand. Vanguard is not content with its current position of being the third largest ETF supplier.

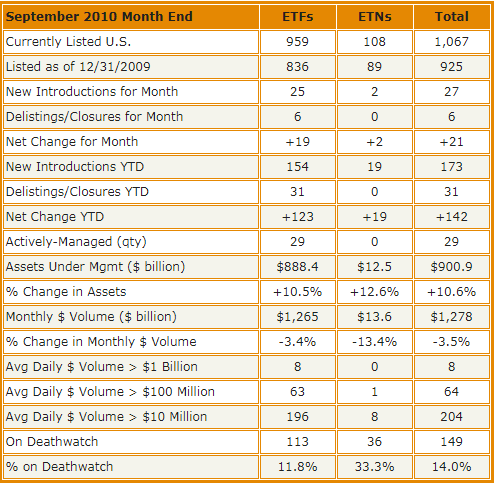

Six ETFs were delisted during in September, leaving the net increase for the month at 21. The number of currently listed products stands at 1,067 (959 ETFs and 108 ETNs) as of September 30. A total of 173 products have been launched year-to-date and 31 have closed for a net increase of 142. Six additional closures for October have already been announced, and more new listings are a sure bet.

Trading picked up in September following the normally slow month of August. Average trading activity came in at $60.9 billion per day, up about 1% over August. Since there was one less trading day in September, the small daily increase did not carry over into the monthly stats where total ETP dollar volume declined -3.5% to $1.28 trillion.

The number of ETFs in the Billion Dollar Club, averaging more than $1 billion in daily trading activity, remained at eight again this month. Products averaging more than $100 million per day came in at 64, a slight increase from August. At the other extreme, the number of products on ETF Deathwatch decreased by four to 149.

Two of the new ETF introductions were actively-managed, pushing the selection of actively-managed ETFs currently on the market to 29. One of the new “passively-indexed” products, Barclays ETN+ S&P VEQTOR ETN (VQT), pushes the envelope on indexing by incorporating daily reconstitution that can alter 100% of the holdings in a single day.

Assets in ETFs and ETNs increased +10.6% for the month and now sit at $900.9 billion, a +13.9% increase for the year-to-date period.

Data sources: AUM from National Stock Exchange, individual security price and volume from Norgate Premium Data, fund counts and all other information compiled by Invest With An Edge.

New products launched in September (in chronological order):

- Barclays ETN+ S&P VEQTOR ETN (VQT) (VQT: S&P 500 With A Volatility Hedge)

- iShares MSCI New Zealand Investable Market Index Fund (ENZL) (Finally, an ETF for New Zealand: ENZL)

- Vanguard S&P 500 ETF (VOO) (Vanguard Declares War in Fight for Broad Market ETF Supremacy)

- Vanguard S&P 500 Growth ETF (VOOG)

- Vanguard S&P 500 Value ETF (VOOV)

- Vanguard S&P Mid-Cap 400 ETF (IVOO)

- Vanguard S&P Mid-Cap 400 Growth ETF (IVOG)

- Vanguard S&P Mid-Cap 400 Value ETF (IVOV)

- Vanguard S&P Small-Cap 600 ETF (VIOO)

- Vanguard S&P Small-Cap 600 Growth ETF (VIOG)

- Vanguard S&P Small-Cap 600 Value ETF (VIOV)

- Emerging Global Shares Dow Jones Emerging Markets Consumer Titans Index Fund (ECON) (ECON: Targeting Emerging Market Consumers)

- SPDR S&P Global Natural Resources ETF (GNR) (GNR: SPDR S&P Global Natural Resources ETF Launched)

- PIMCO Build America Bond Strategy Fund (BABZ) (PIMCO Introduces BABs and Corporate Bond ETFs)

- PIMCO Investment Grade Corporate Bond Index Fund (CORP)

- Vanguard Russell 1000 ETF (VONE) (Vanguard Launches Second Assault on iShares)

- Vanguard Russell 1000 Growth ETF (VONG)

- Vanguard Russell 1000 Value ETF (VONV)

- Vanguard Russell 2000 ETF (VTWO)

- Vanguard Russell 2000 Growth ETF (VTWG)

- Vanguard Russell 2000 Value ETF (VTWV)

- Vanguard Russell 3000 ETF (VTHR)

- WisdomTree Dreyfus Commodity Currency Fund (CCX) (CCX: New Actively-Managed Commodity Currency ETF)

- iShares MSCI Brazil Small Cap Index Fund (EWZS) (EWZS: New Brazil Small Cap ETF from iShares)

- iShares MSCI China Small Cap Index Fund (ECNS) (ECNS: New China Small Cap ETF from iShares)

- iShares MSCI Philippines Investable Market Index Fund (EPHE) (EPHE: The First Philippines ETF Arrives)

- UBS E-TRACS AG 1x Monthly Short MLP ETN (MLPS) (First Inverse MLP Product Hits The Market: MLPS)

Product closures/delistings in September:

- Claymore/Beacon Global Exchanges, Brokers & Asset Managers Index ETF (former ticker EXB) (Claymore Closing Four ETFs: EXB, ROB, CRO, and IRO)

- Claymore/Robb Report Global Luxury Index ETF (former ticker ROB)

- Claymore/Zacks Country Rotation ETF (former ticker CRO)

- Claymore/Zacks Dividend Rotation ETF (former ticker IRO)

- Geary OOK, Inc. (former ticker OOK) (OOK and TXF Noncompliant with NYSE Arca Listing Standards)

- Geary TXF Large Companies ETF (former ticker TXF)

Product changes in September:

- ESG Shares North American Sustainability Index Fund changed its name to Pax MSCI North America ESG Index ETF (NASI) 9/1/10

- iShares FTSE KLD 400 Social Index Fund changed its name to iShares MSCI KLD Social Index Fund (DSI) 9/1/10

- iShares FTSE KLD Select Social Index Fund changed its name to iShares MSCI USA ESG Select Social Index Fund (KLD) 9/1/10

- iShares COMEX Gold Trust changed its name to iShares Gold Trust (IAU) 9/15/10

- EGShares DJ Emerging Markets Titans Composite (EEG) had 2:1 spilt 9/16/10

- EGShares DJ Emerging Markets Energy Titans (EEO) had 2:1 spilt 9/16/10

- EGShares DJ Emerging Markets Financial Titans (EFN) had 2:1 spilt 9/16/10

- EGShares DJ Emerging Markets Metals & Mining Titans (EMT) had 3:1 spilt 9/16/10

- Direxion changed “10-Year” to “7-10 Year” on its 3x ETFs (TYD and TYO) 9/17/10

- Direxion changed “30-Year” to “20+ Year” on its 3x ETFs (TMF and TMV) 9/17/10

- 32 Claymore ETFs became Guggenheim ETFs (list of 32 funds rebranded as Guggenheim ETFs) on 9/27/10

- Barclays ETN+ Inverse S&P 500 VIX Short-Term Futures ETN (XXV) changed name to iPath Inverse S&P 500 VIX Short-Term Futures ETN (XXV) (article) 9/28/10

Announced Product Changes for October:

- 10/05/10 will be the last day of trading for Old Mutual GlobalShares (GSW, GSR, GSZ, GSO, and GSD)

- 10/15/10 iShares S&P North American Technology-Semiconductors Index Fund (IGW) will change its name and ticker symbol to iShares PHLX SOX Semiconductor Sector Index Fund (SOXX). The underlying index will also change.

- 10/19/10 will be the last day of trading for JETS Dow Jones Islamic Market International Index Fund (JVS)

Previous monthly ETF statistics reports are available here.

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.