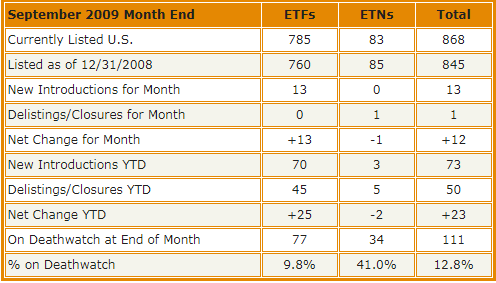

September brought 13 new ETFs while one ETN was delisted, a net change of +12 in the number of listed funds. The official count at the end of the month stood at 868, consisting of 785 ETFs and 83 ETNs.

September brought 13 new ETFs while one ETN was delisted, a net change of +12 in the number of listed funds. The official count at the end of the month stood at 868, consisting of 785 ETFs and 83 ETNs.

ETF volume averaged 1.48 billion shares per day. The total dollar value traded for the entire month was $1.312 trillion, a modest +1.8% increase from the typically slow month of August. Trading in SPDR S&P 500 (SPY) averaged $18.8 billion per day, accounting for 30% of all ETF value traded.

Notes: The ETF counts include MacroShares, which technically are not ETFs. The quantity of new introductions and closings do not include the XGC extreme makeover in July. Closed-end funds are not included.

New products launched in September (in chronological order):

- PIMCO 15+ Year U.S. TIPS Index Fund (LTPZ) (article on LTPZ & TIPZ)

- PIMCO Broad U.S. TIPS Index Fund (TIPZ)

- ETFS Physical Swiss Gold Shares (SGOL) (article)

- PIMCO 7-15 Year U.S. Treasury Index Fund (TENZ) (article)

- Dent Tactical ETF (DENT) (article)

- EGS Dow Jones Emerging Markets Financials Titans Index Fund (EFN) (article)

- SPDR Wells Fargo Preferred Stock ETF (PSK) (article)

- Jefferies | TR/J CRB Global Commodity Equity Index Fund (CRBQ) (article)

- United States Short Oil Fund (DNO) (article)

- SPDR S&P VRDO Municipal Bond ETF (VRD) (article)

- iShares Russell Top 200 Index Fund (IWL) (article on IWL, IWX, & IWY)

- iShares Russell Top 200 Value Index Fund (IWX)

- iShares Russell Top 200 Growth Index Fund (IWY)

Product closures/delistings in September:

- PowerShares DB Crude Oil Double Long ETN (DXO) (article)

ETF statistics reports for prior months are available here.

Disclosure: no positions