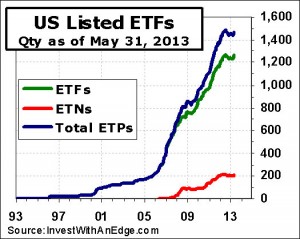

Nine new ETFs and two new ETNs came to market in May. The month also saw one ETF closure. The net increase of 10 places the current exchange traded product count at 1,469 as of the end of May, consisting of 1,259 ETFs and 210 ETNs.

Nine new ETFs and two new ETNs came to market in May. The month also saw one ETF closure. The net increase of 10 places the current exchange traded product count at 1,469 as of the end of May, consisting of 1,259 ETFs and 210 ETNs.

For the past 12 months, the net increase in the quantity of listed products is only four, which equates to an annual growth rate of just 0.3%. A month ago, the 12-month change was two, and for March, the net increase was just one. The last time the annual net increase was is the single digits for three months running was in April 2000, more than 13 years ago. However, the product count went from 30 to 38 in the 12 months ending April 2000, which was a very healthy 26.7% annual growth rate.

Asset growth paints a more positive picture. Although assets grew by only 0.4% in May to $1.495 trillion, they are up an impressive 31.6% from the $1.136 trillion level of a year ago. Successful products have been able to generate substantial inflows. Even with the modest gains of May, the number of funds above the $10 billion threshold climbed from 31 to 34. These 34 ETFs are just 2.3% of the products available, but they control 53.9% of the assets.

Asset growth paints a more positive picture. Although assets grew by only 0.4% in May to $1.495 trillion, they are up an impressive 31.6% from the $1.136 trillion level of a year ago. Successful products have been able to generate substantial inflows. Even with the modest gains of May, the number of funds above the $10 billion threshold climbed from 31 to 34. These 34 ETFs are just 2.3% of the products available, but they control 53.9% of the assets.

Trading activity declined 3.6% for the month with a total of $1.38 trillion of ETFs and ETNs changing hands. Only 0.5% of the products averaged more than $1 billion per day in trading, yet these seven ETFs accounted for more than half (53.2%) of all trading activity. Talk about a lopsided market. The monthly turnover rate (total dollar volume divided by assets under management) came in at 0.92.

| May 2013 Month End | ETFs | ETNs | Total |

|---|---|---|---|

| Currently Listed U.S. | 1,259 | 210 | 1,469 |

| Listed as of 12/31/2012 | 1,239 | 206 | 1,445 |

| New Introductions for Month | 9 | 2 | 11 |

| Delistings/Closures for Month | 1 | 0 | 1 |

| Net Change for Month | +8 | +2 | +10 |

| New Introductions 6 Months | 58 | 6 | 64 |

| New Introductions YTD | 48 | 6 | 54 |

| Delistings/Closures YTD | 28 | 2 | 30 |

| Net Change YTD | +20 | +4 | +24 |

| Actively-Managed Listings | 62 | n/a | 62 |

| Assets Under Mgmt ($ billion) | $1,477 | $18.3 | $1,495 |

| % Change in Assets for Month | +0.4% | +1.3% | +0.4% |

| Qty AUM > $10 Billion | 34 | 0 | 34 |

| Qty AUM > $1 Billion | 201 | 3 | 204 |

| Qty AUM > $100 Million | 617 | 24 | 641 |

| % with AUM > $100 Million | 49.0% | 11.4% | 43.6% |

| Monthly $ Volume ($ billion) | $1,349 | $29.6 | $1,379 |

| % Change in Monthly $ Volume | -2.9% | -27.1% | -3.6% |

| Avg Daily $ Volume > $1 Billion | 7 | 0 | 7 |

| Avg Daily $ Volume > $100 Million | 64 | 2 | 66 |

| Avg Daily $ Volume > $10 Million | 256 | 11 | 267 |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge.

New products launched in May (sorted by launch date):

- Direxion Daily Brazil Bear 3x Shares (BRZS) [BRZS overview]

- Direxion Daily South Korea Bear 3x Shares (KORZ) [KORZ overview]

- First Trust Senior Loan ETF (FTSL) [FTSL overview]

- PowerShares Fundamental Emerging Markets Local Debt Portfolio (PFEM) [PFEM overview]

- Cambria Shareholder Yield ETF (SYLD) [product review: Redefining Yield With Cambria Shareholder Yield ETF]

- Barclays ETN+ FI Enhanced Global High Yield ETN (FIGY) [FIGY prospectus]

- WisdomTree U.S. Dividend Growth Fund (DGRW) [DGRW overview]

- Barclays ETN+ FI Enhanced Europe 50 ETN (FEEU) [FEEU prospectus]

- ProShares High Yield – Interest Rate Hedged (HYHG) [HYHG overview]

- SPDR Barclays 1-10 Year TIPS ETF (TIPX) [TIPX overview]

- SPDR S&P Global Dividend ETF (WDIV) [WDIV overview]

Product closures/delistings in May (sorted by delisting date):

- iShares Diversified Alternatives Trust (ALT) [iShares Closing Actively Managed Diversified Alternatives ETF]

Product changes in May:

- SPDR FTSE/Macquarie Infrastructure 100 ETF (GII) became the SPDR S&P Global Infrastructure ETF (GII) effective May 1.

- Effective May 1, two iShares ETFs dropped “index” from their names, becoming iShares MSCI Frontier 100 Fund (FM) and iShares MSCI Kokusai Fund (TOK). They will continue to be passively managed index funds.

- Six ETFs from Global X (GLDX, URA, JUNR, ARGT, CHIM, and GGGG) underwent reverse splits effective May 16.

- Vanguard MSCI EAFE ETF (VEA) went from a MSCI to FTSE index and changed its name to Vanguard FTSE Developed Markets (VEA) effective May 29.

- db X-trackers MSCI Canada Hedged Equity Fund (DBCN) underwent an extreme makeover, becoming the db X-trackers MSCI Germany Hedged Equity Fund (DBGR) effective May 31.

Announced Product Changes for Coming Months:

- First Trust Strategic Value Index Fund (FDV) will undergo an extreme makeover, becoming the First Trust Capital Strength ETF (FTCS) effective June 3.

- Vanguard Total Stock Market ETF (VTI) will change its underlying MSCI index to the CRSP US Total Market Index effective June 3.

- UBS will close seven ETRACS ETNs (BLND, LSKY, PTD, EIPO, EIPL, SSDD, and SSDL) with the last day of trading being June 5. [UBS Calls 7 ETRACS ETNs For Redemption]

- Seven ProShares (UGE, UPRO, UMDD, UWC, RXL, UCC, and URTY) will undergo 2-for-1 share splits effective June 10.

- Eight ProShares (DUG, FINZ, TTT, SJF, EFU, KOLD, VIXY, and UVXY) will undergo reverse splits and receive new CUSIP numbers effective June 10.

- Four iShares ETFs (IBCD, IBCC, IBCD, and IBCE) will have new CUSIP numbers effective June 10.

- Guggenheim Yuan Bond ETF (RMB) will close and liquidate. Its last day of trading will be June 14. [Guggenheim Yuan Bond ETF (RMB) To Close]

- Effective June 21, the Sustainable North American Oil Sands ETF (SNDS) will undergo an extreme makeover, becoming the YieldShares High Income ETF (YYY) with a different investment objective.

Previous monthly ETF statistics reports are available here.