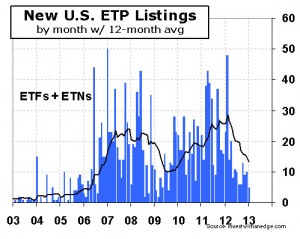

Only five new exchange traded products (“ETPs”) came to market in January, the lowest introduction rate since August 2009. The five debuts represent the slowest yearly kickoff since 2006, when January’s new arrivals totaled just three. The month’s three ETF and two ETN launches happened alongside the closures of three ETFs and one ETN. The net result was an increase in active listings of only one. The current count of 1,446 ETPs consists of 1,239 ETFs and 207 ETNs.

Only five new exchange traded products (“ETPs”) came to market in January, the lowest introduction rate since August 2009. The five debuts represent the slowest yearly kickoff since 2006, when January’s new arrivals totaled just three. The month’s three ETF and two ETN launches happened alongside the closures of three ETFs and one ETN. The net result was an increase in active listings of only one. The current count of 1,446 ETPs consists of 1,239 ETFs and 207 ETNs.

Assets grew at a brisk pace in January, increasing 4.9% to $1.42 trillion. Industry reports indicate record inflows are responsible, but we think much of it can be attributable to market gains, like the nearly 5.2% surge in the S&P 500. There are now 28 ETFs with assets in excess of $10 billion, and these ETFs account for more than half (52.2%) of all ETP assets.

Trading activity increased by only 1.3% to $1.15 trillion for the month. The SPDR S&P 500 (SPY) was responsible for one third of all ETP dollars traded in January. ETPs averaging more than $1 billion per day in dollar volume number only five yet are responsible for the majority (50.8%) of value traded. Products averaging more than $100 million per day declined from 68 to 65 while capturing 84.7% of the action.

| January 2013 Month End | ETFs | ETNs | Total |

|---|---|---|---|

| Currently Listed U.S. | 1,239 | 207 | 1,446 |

| Listed as of 12/31/2012 | 1,239 | 206 | 1,445 |

| New Introductions for Month | 3 | 2 | 5 |

| Delistings/Closures for Month | 3 | 1 | 4 |

| Net Change for Month | +0 | +1 | +1 |

| New Introductions 6 Months | 39 | 10 | 49 |

| New Introductions YTD | 3 | 2 | 5 |

| Delistings/Closures YTD | 3 | 1 | 4 |

| Net Change YTD | +0 | +1 | +1 |

| Actively-Managed Listings | 56 | – | 56 |

| Assets Under Mgmt ($ billion) | $1,404 | $17.3 | $1,422 |

| % Change in Assets for Month | +4.9% | +6.7% | +4.9% |

| Qty AUM > $10 Billion | 28 | 0 | 28 |

| Qty AUM > $1 Billion | 186 | 3 | 189 |

| Qty AUM > $100 Million | 571 | 25 | 596 |

| Monthly $ Volume ($ billion) | $1,120 | $27.5 | $1,148 |

| % Change in Monthly $ Volume | +1.2% | +4.6% | +1.3% |

| Avg Daily $ Volume > $1 Billion | 5 | 0 | 5 |

| Avg Daily $ Volume > $100 Million | 63 | 2 | 65 |

| Avg Daily $ Volume > $10 Million | 252 | 9 | 261 |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge.

New products launched in January (sorted by launch date):

- iPath S&P MLP ETN (IMLP) [IMLP overview]

- Global X Junior MLP ETF (MLPJ), a C-corp [New Junior MLP ETF Has 38% Daily Tracking Error]

- Credit Suisse Gold Shares Covered Call ETN (GLDI) [GLDI overview]

- Forensic Accounting ETF (FLAG) [FLAG overview]

- WisdomTree Global Corporate Bond Fund (GLCB) [GLCB overview]

Product closures/delistings in January (sorted by delisting date):

- Barclays ETN+ S&P 500 Leveraged Short C ETN (BXDC) [First Four ETP Closures of 2013]

- Direxion Large Cap Insider Sentiment (INSD)

- Direxion S&P 1500 DRRC Volatility Response (VSPR)

- Direxion S&P Latin America 40 DRRC Volatility Response (VLAT)

Product changes in January:

- Citi Volatility Index ETN (CVOL) underwent a 1:10 reverse split effective January 2.

- Vanguard MSCI Emerging Markets ETF (VWO) became Vanguard FTSE Emerging Markets ETF (VWO) tracking a new index effective January 10.

- WisdomTree dropped the word “Dreyfus” from its five currency ETFs (BZF, CYB, ICN, CCX, and CEW) effective January 14.

- Creations were halted for United States 12 Month Natural Gas Fund (UNL) and United States Short Oil Fund (DNO) from January 10 (when updated regulatory paperwork was filed with the SEC) until January 17 (when the updates were approved).

- The SPDR S&P 500 ETF (SPY), the first ETF listed in the U.S., turned 20 years old on January 29 [SPY Turns 20].

- Vanguard changed four of its ETFs (MGC, VV, VO, VB) with MSCI underlying indexes to CRSP indexes effective January 31.

Announced Product Changes for Coming Months:

- The “db-X” series of 10 ETFs will be renamed “db X-trackers” effective February 1.

- Market Vectors Morningstar Wide Moat Research ETF (MOAT) will become the Market Vectors Wide Moat ETF (MOAT) effective February 1.

- ProShares Credit Suisse 130/30 (CSM) will be renamed ProShares Large Cap Core Plus (CSM) and have its expense ratio reduced from 0.95% to 0.45% effective February 7.

- ProShares will change the names and underlying indexes of its four Brazil (UBR and BZQ) and Mexico (UNX and SNK) ETFs to reflect a move to using “capped” indexes effective February 11.

- Vanguard fired MSCI as the underlying index provider for 22 of its funds. During the first half of 2013, six international funds will move from MSCI to FTSE indexes while 16 domestic products will transition from MSCI to CRSP indexes (Vanguard announcement of 10/2/12).

- Invesco PowerShares is set to close 13 ETFs with February 26 being the last day of trading for PIC, PYH, PJB, PSTL, PLK, PWND, PMA, PKOL, PKN, PTO, PAO, PCA, and CVRT (press release).

Previous monthly ETF statistics reports are available here.

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.