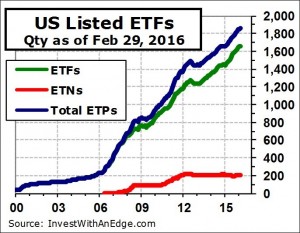

Thirteen new products came to market in February: seven exchange-traded funds (“ETFs”) and six exchange-traded notes (“ETNs”). Closures were on the light side, with just three products being liquidated during the month. The net increase of 10 listings pushes the overall count to 1,863, consisting of 1,659 ETFs and 204 ETNs. Assets declined for the third consecutive month and now total $2.02 trillion.

In January, three ETNs encountered early terminations. Some of the February introductions were intended to replace those previously terminated ETNs. Two UBS ETRACS ETNs providing leveraged exposure to master limited partnerships (“MLPs”) fell victim to their own anti-ruination triggers on January 20 due to the steep price plunge among MLPs. These two ETNs were liquidated on February 1, and eight days later, UBS rolled out their replacements: ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure Index Series B ETN (MLPQ) and ETRACS 2xMonthly Leveraged S&P MLP Index Series B ETN (MLPZ).

In January, three ETNs encountered early terminations. Some of the February introductions were intended to replace those previously terminated ETNs. Two UBS ETRACS ETNs providing leveraged exposure to master limited partnerships (“MLPs”) fell victim to their own anti-ruination triggers on January 20 due to the steep price plunge among MLPs. These two ETNs were liquidated on February 1, and eight days later, UBS rolled out their replacements: ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure Index Series B ETN (MLPQ) and ETRACS 2xMonthly Leveraged S&P MLP Index Series B ETN (MLPZ).

ProShares also brought out a replacement product in February. However, unlike UBS, which rushed to fill the gap created by prior terminations, ProShares brought out its “new and improved” version before its predecessor disappeared. ProShares Managed Futures Strategy (FUT), launched 2/18/16, is a more shareholder-friendly version of the existing ProShares Managed Futures Strategy (FUTS). The major difference between the two is that the new FUT will issue 1099s at tax time, while FUTS has been issuing K-1 forms. The underlying structural and regulatory differences prevented ProShares from a merger or simple transformation of the “old” into the “new.” Therefore, ProShares went with a “launch one and close the other” plan and provided shareholders with a one-month overlap.

An event occurred in February that you will not see in our statistics. On February 26, 2016, the NASDAQ began listing Eaton Vance Stock NextShares (EVSTC). You may have read some articles declaring these to be the next generation of actively managed ETFs. Technically, they are classified as exchange-traded managed funds (“ETMFs”), and ETMFs are not ETFs.

For starters, the U.S. Securities and Exchange Commission has placed some tough restrictions on ETMF advertising. Namely, ETMF sponsors and issuers

- cannot call them an open-end investment company;

- cannot call them a mutual fund;

- cannot call them ETFs; and

- must include a statement that says shares are not individually redeemable (when talking about creation/redemption of shares).

There you have it. They are not ETFs and will not be included in our ETF statistics at this time. Additionally, they are not mutual funds or open-end investment companies either. They are ETMFs with their own unique set of order types (buy at a future net asset value [“NAV”] plus premium, sell at a future NAV minus discount) and only one broker (Folio Investing) that can currently process these strange orders.

The quantity of ETFs with more than $10 billion in assets grew from 51 to 53 in February, and these vital few hold 59.9% of industry assets. The number of products with at least $1 billion in assets increased from 243 to 246. The median asset level is just $61.5 million, which is a far cry from the “average” level of $1.09 billion. Trading activity slid 13.9% lower for the month to $1.87 trillion, reflecting a 92% turnover ($ volume/industry assets) for the month.

| February 2016 Month End | ETFs | ETNs | Total |

|---|---|---|---|

| Currently Listed U.S. | 1,659 | 204 | 1,863 |

| Listed as of 12/31/2015 | 1,644 | 201 | 1,845 |

| New Introductions for Month | 7 | 6 | 13 |

| Delistings/Closures for Month | 1 | 2 | 3 |

| Net Change for Month | +6 | +4 | +10 |

| New Introductions 6 Months | 113 | 13 | 126 |

| New Introductions YTD | 20 | 6 | 26 |

| Delistings/Closures YTD | 5 | 3 | 8 |

| Net Change YTD | +15 | +3 | +18 |

| Assets Under Mgmt ($ billion) | $2,001 | $19.4 | $2,021 |

| % Change in Assets for Month | -0.1% | -4.1% | -0.1% |

| % Change in Assets YTD | -4.6% | -9.7% | -4.6% |

| Qty AUM > $10 Billion | 53 | 0 | 53 |

| Qty AUM > $1 Billion | 242 | 4 | 246 |

| Qty AUM > $100 Million | 759 | 33 | 792 |

| % with AUM > $100 Million | 45.8% | 16.2% | 42.5% |

| Monthly $ Volume ($ billion) | $1,789 | $78.9 | $1,868 |

| % Change in Monthly $ Volume | -13.8% | -19.9% | -13.9% |

| Avg Daily $ Volume > $1 Billion | 14 | 1 | 15 |

| Avg Daily $ Volume > $100 Million | 108 | 6 | 114 |

| Avg Daily $ Volume > $10 Million | 335 | 12 | 347 |

| Actively Managed ETF Count (w/ change) | 137 | +3 mth | 0 ytd |

| Actively Managed AUM ($ billion) | $24.3 | +1.6% mth | +5.9% ytd |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge.

New products launched in February (sorted by launch date):

- CS X-Links WTI Crude Oil Index ETN (OIIL), launched 2/9/16, is an ETN issued by Credit Suisse AG that provides exposure to the Bloomberg WTI Crude Oil SubIndex Total Return. The Index is intended to reflect the returns that are potentially available through an unleveraged investment in rolling West Texas Intermediate crude oil futures contracts, plus the Treasury Bill rate of interest that could be earned on funds committed to the trading of the underlying contracts. It has an expense ratio of 0.55% (OIIL overview).

- ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure Series B ETN (MLPQ), launched 2/9/16, is an ETN issued by UBS AG linked to the monthly compounded 2X leveraged performance of Alerian MLP Infrastructure Index, less investor fees of 0.85%. MLPQ pays a variable quarterly coupon linked to the cash distributions, if any, on the Index constituents. This ETN essentially replaces the ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure ETN (MLPL), which encountered an early termination trigger in January (MLPQ overview).

- ETRACS 2xMonthly Leveraged S&P MLP Series B ETN (MLPZ), launched 2/9/16, is an ETN issued by UBS AG linked to the monthly compounded 2X leveraged performance of S&P MLP Index, less investor fees of 0.95%. MLPV pays a variable quarterly coupon linked to the cash distributions, if any, on the Index constituents. This ETN essentially replaces the ETRACS 2xMonthly Leveraged S&P MLP ETN (MLPV), which encountered an early redemption trigger in January (MLPZ overview).

- Guggenheim Total Return Bond ETF (GTO), launched 2/10/16, is an actively managed ETF offering the opportunity to capitalize on changing relative values in fixed-income securities and sectors. GTO will normally invest in a portfolio of fixed-income instruments of varying maturities and of any credit quality. It uses a strategy that invests primarily in investment-grade fixed-income securities across multiple sectors in any country. It seeks maximum total return comprised of income and capital appreciation, and it has an expense ratio of 0.50% (GTO overview).

- UBS AG FI Enhanced Europe 50 ETN (FIEE), launched 2/16/16, is an ETN issued by UBS AG linked to the STOXX Europe 50 USD (Gross Return) Index. The ETNs are designed to provide a two times leveraged long exposure to the performance of the Index compounded on a quarterly basis, reduced by the accrued fees of 1.95% per annum (FIEE overview).

- ETRACS S&P GSCI Crude Oil Total Return Index ETN (OILX), launched 2/18/16, is an ETN issued by UBS AG linked to the performance of the S&P GSCI Crude Oil Total Return Index, less investor fees of 0.50% (OILX overview).

- ProShares Managed Futures Strategy (FUT), launched 2/18/16, delivers a managed-futures exposure inside of an actively managed ETF. It pursues a long/short strategy with a risk-weighting methodology. It allocates holdings across a broad range of commodity, currency, and financial assets, equally weighting each component based on estimated risk. It uses the S&P Strategic Futures Index as a “performance” benchmark. The new fund will issue 1099s for tax reporting and will essentially be an “improved structure” replacement for FUTS, the ProShares managed-futures ETF that issues K-1 forms and will be closed in March. FUT has an expense ratio of 0.75% (FUT overview).

- UBS AG FI Enhanced Global Yield ETN (FIHD), launched 2/22/16, is an ETN issued by UBS AG linked to the return on the MSCI World High Dividend Yield USD Gross Total Return Index. The Index reflects both the price performance and the reinvestment of dividends, and therefore FIHD will not pay dividends. The ETN is designed to provide a two times leveraged long exposure to the performance of the Index compounded on a quarterly basis, reduced by its expense ratio of 1.65% (FIHD SEC filing).

- Cambria Sovereign High Yield Bond ETF (SOVB), launched 2/23/16, is an actively managed ETF seeking income and capital appreciation from investments that provide exposure to sovereign and quasi-sovereign bonds. The fund’s holdings consist of liquid sovereign debt issues with high-yield characteristics. It seeks high income generation and capital appreciation and provides exposure to a basket of foreign currencies. Rather than adhering to traditional notions of emerging and developed markets, the strategy seeks the most attractively priced debt securities from a global opportunity set with an expense ratio of 0.59% (SOVB overview). Note: The website mentions the Cambria Sovereign Bond Index, but since the EFT is actively managed, it is not clear what purpose the Index serves.

- Pacer Global High Dividend ETF (PGHD), launched 2/23/16, seeks to track the total return performance of the Pacer Global Cash Cows Dividends 100 Index. The strategy attempts to provide a continuous stream of income and capital appreciation over time by screening for companies with a high free-cash-flow yield and a high dividend yield. Starting with the FTSE All World Developed Large-Cap Index of approximately 1,000 companies in developed markets worldwide, the strategy selects the 300 companies with the highest trailing 12-month free-cash-flow yield. From those, the strategy selects the 100 companies with the highest trailing 12-month dividend yield. PGHD has an estimated initial yield of 4.4% and an expense ratio of 0.60% (PGHD overview).

- WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW), launched 2/24/16, seeks to track the performance, before fees and expenses, of the CBOE S&P 500 PutWrite Index, a collateralized put write strategy on the S&P 500 Index. The strategy is designed to receive a premium from the option buyer by selling (writing) a sequence of one-month, at-the-money, S&P 500 Index put options. However, if the value of the S&P 500 Index falls below the strike price, the option finishes in-the-money and PUTW must pay the option buyer the difference between the strike price and the value of the S&P 500 Index. This strategy attempts to partially offset a decline in the value of the S&P 500 Index to the extent of the premiums received. In theory, it could help lower portfolio beta and reduce downside risk. PUTW has an expense ratio capped at 0.38% (PUTW overview).

- Janus Small Cap Growth Alpha ETF (JSML), launched 2/25/16, seeks investment results that correspond to the performance of the Janus Small Cap Growth Alpha Index. The underlying strategy seeks risk-adjusted outperformance relative to the U.S. small-cap growth asset class by investing in resilient Smart Growth companies that have proven operational excellence and represent the top 10% of the eligible universe. The Index follows a disciplined process that evaluates key fundamental factors such as growth, profitability, and capital efficiency that are believed to more accurately identify companies poised for long-run sustainable growth. The new ETF has an expense ratio of 0.50% (JSML overview).

- Janus Small/Mid Cap Growth Alpha ETF (JSMD), launched 2/25/16, seeks investment results that correspond to the performance of the Janus Small/Mid Cap Growth Alpha Index. It is a small- and mid-cap growth ETF that systematically identifies Smart Growth companies using a process based on Janus’ fundamental research. The strategy seeks to provide risk-adjusted outperformance by identifying top-tier U.S. small- and mid-cap companies with some of the strongest fundamentals and the capability of delivering sustainable growth in a variety of market environments. It has an expense ratio of 0.50% (JSMD overview).

Product closures in February and last day of listing:

- ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure ETN (MLPL) 1/29/16*

- ETRACS 2xMonthly Leveraged S&P MLP ETN (MLPV) 1/29/16*

- Janus Equal Risk Weighted Large Cap (ERW) 2/24/16

*Note: The last day of listing for MLPL and MLPV was 1/29/16 (the last business day of January), and they were available to trade throughout January. Therefore, the closures are classified as occurring in February.

Product changes in February:

- Van Eck Global acquired the Yorkville MLP ETFs. The Yorkville High Income Infrastructure MLP (YMLI) became the Market Vectors High Income Infrastructure MLP ETF (YMLI), and the Yorkville High Income MLP (YMLP) became the Market Vectors High Income MLP (YMLP) effective February 22.

Announced product changes for coming months:

- EGShares Emerging Markets Domestic Demand (EMDD) will become EGShares EM Strategic Opportunities (EMSO) and reduce its expense ratio to 0.65% effective March 1. Despite the name and ticker change, the underlying index still claims to be “a 50-stock free-float market capitalization-weighted index designed to measure the performance of companies in emerging markets that are tied to domestic demand.”

- Global X FTSE Greece 20 ETF (GREK) will change its underlying index and its name to Global X MSCI Greece (GREK) effective March 1.

- The iShares iBonds target maturity ETFs will be renamed to include “Term” in their names, and the “AMT-Free” funds will be renamed “Muni Bond” ETFs effective March 1.

- ETFS Physical White Metal Basket Shares (WITE) will close and liquidate, with its last day of trading occurring March 2.

- Invesco PowerShares will change the names and underlying indexes on four ETFs, with two receiving new ticker symbols, effective March 18. PowerShares S&P Emerging Markets High Beta (EEHB) will become PowerShares S&P Emerging Market Momentum (EEMO), PowerShares S&P International Developed High Beta (IDHB) will become PowerShares S&P International Developed Momentum (IDMO), PowerShares S&P International Developed High Quality (IDHQ) will become PowerShares S&P International Developed Quality (IDHQ), and PowerShares S&P 500 High Quality (SPHQ) will become PowerShares S&P 500 Quality (SPHQ).

- Invesco PowerShares will close four ETFs, with March 18 being their last day of listed trading. The affected funds are PowerShares China A-Share (CHNA), PowerShares Fundamental Emerging Markets Local Debt (PFEM), PowerShares KBW Capital Markets (KBWC), and PowerShares KBW Insurance (KBWI).

- ProShares Managed Futures Strategy (FUTS) will have its last day of trading on March 18.

- Barclays is seeking shareholder approval to add an early termination trigger to the iPath S&P GSCI Crude Oil Total Return ETN (OIL) and reduce the investor fee from 0.75% to 0.70% effective April 29.