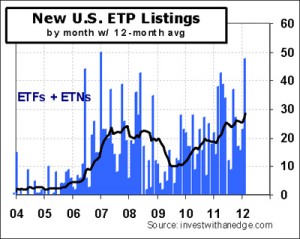

Launch activity continued at a blistering pace last month. February’s new product count of 48 (40 ETFs and 8 ETNs) was second only to the 50 launches in January 2007. BlackRock’s iShares brand accounted for 23 of February’s new products and 35 of the 71 year-to-date total. The iShares brand name currently adorns 269 US-listed funds.

Launch activity continued at a blistering pace last month. February’s new product count of 48 (40 ETFs and 8 ETNs) was second only to the 50 launches in January 2007. BlackRock’s iShares brand accounted for 23 of February’s new products and 35 of the 71 year-to-date total. The iShares brand name currently adorns 269 US-listed funds.

February also brought the year’s first casualties with eight Global X ETFs delisting on February 16, resulting in a net increase of 40 products for the month. The active product count now stands at 1,432 consisting of 1,221 ETFs and 211 ETNs. The year-to-date net increase is 63 (55 ETFs and 8 ETNs). Actively managed funds numbered only 41 at the end of the month.

The industry’s assets under management climbed 4.6% to $1.20 trillion with ETNs registering a 12.9% increase. Trading activity climbed for the first time in months. Total dollar volume (value traded) approached $1.23 trillion, resulting in an asset turnover of 102%.

ETFs averaging more than $1 billion per day of trading held steady at eight. The number of ETPs averaging more than $100 million in dollar volume per day slipped to 71, and the number with more than $10 million per day grew from 229 to 235.

| February 2012 Month End | ETFs | ETNs | Total |

|---|---|---|---|

| Currently Listed U.S. | 1,221 | 211 | 1,432 |

| Listed as of 12/31/2011 | 1,166 | 203 | 1,369 |

| New Introductions for Month | 40 | 8 | 48 |

| Delistings/Closures for Month | 8 | 0 | 8 |

| Net Change for Month | +32 | +8 | +40 |

| New Introductions 6 mths | 126 | 42 | 168 |

| New Introductions YTD | 63 | 8 | 71 |

| Delistings/Closures YTD | 8 | 0 | 8 |

| Net Change YTD | +55 | +8 | +63 |

| Actively-Managed Listings | 41 | 0 | 41 |

| Assets Under Mgmt ($ billion) | $1,184 | $17.5 | $1,202 |

| % Change in Assets for Month | +4.4% | +12.9% | +4.6% |

| Monthly $ Volume ($ billion) | $1,195 | $31.7 | $1,227 |

| % Change in Monthly $ Volume | +4.6% | +72.3% | +5.8% |

| Avg Daily $ Volume > $1 Billion | 8 | 0 | 8 |

| Avg Daily $ Volume > $100 Million | 69 | 2 | 71 |

| Avg Daily $ Volume > $10 Million | 224 | 11 | 235 |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data, AUM from ETF Industry Association, fund counts and all other information compiled by Invest With An Edge.

New products launched in February (sorted by sponsor):

- First Trust Australia AlphaDEX Fund (FAUS) [15 More International ETFs for February]

- First Trust Canada AlphaDEX Fund (FCAN)

- First Trust Developed Markets ex-US Small Cap AlphaDEX Fund (FDTS)

- First Trust Emerging Markets Small Cap AlphaDEX Fund (FEMS)

- First Trust Germany AlphaDEX Fund (FGM)

- First Trust Hong Kong AlphaDEX Fund (FHK)

- First Trust Switzerland AlphaDEX Fund (FSZ)

- First Trust Taiwan AlphaDEX Fund (FTW)

- First Trust United Kingdom AlphaDEX Fund (FKU)

- Global X Permanent ETF (PERM) [Global X Brings Permanent Portfolio Concept To ETFs]

- iShares Aaa – A Rated Corporate Bond Fund (QLTA) [9 New Bond ETFs in February]

- iShares Barclays CMBS Bond Fund (CMBS)

- iShares Barclays GNMA Bond Fund (GNMA)

- iShares Barclays U.S. Treasury Bond Fund (GOVT)

- iShares Financials Sector Bond Fund (MONY)

- iShares Industrials Sector Bond Fund (ENGN)

- iShares Utilities Sector Bond Fund (AMPS)

- iShares Asia/Pacific Dividend 30 Index Fund (DVYA) [BlackRock Floods ETF Market In Early 2012]

- iShares Emerging Markets Dividend Index Fund (DVYE)

- iShares MSCI All Country Asia ex-Japan Small Cap Index Fund (AXJS)

- iShares MSCI All Country Asia Information Technology Index Fund (AAIT)

- iShares MSCI Emerging Markets Asia Index Fund (EEMA)

- iShares MSCI Emerging Markets Consumer Discretionary Sector Index Fund (EMDI)

- iShares MSCI Emerging Markets Energy Sector Capped Index Fund (EMEY)

- iShares MSCI Emerging Markets Growth Index Fund (EGRW)

- iShares MSCI Emerging Markets Value Index Fund (EVAL)

- iShares MSCI Global Agriculture Producers Fund (VEGI)

- iShares MSCI Global Energy Producers Fund (FILL)

- iShares MSCI Global Gold Miners Fund (RING)

- iShares MSCI Global Select Metals & Mining Producers Fund (PICK)

- iShares MSCI Global Silver Miners Fund (SLVP)

- iShares MSCI India Index Fund (INDA)

- iShares MSCI India Small Cap Index Fund (SMIN)

- Market Vectors Unconventional Oil & Gas ETF Fund (FRAK) [Conventional ETF Access to Unconventional Oil & Gas]

- PowerShares S&P Emerging Markets High Beta Portfolio (EEHB)

- PowerShares S&P International Developed High Beta Portfolio (IDHB)

- ProShares UltraPro 10 Year TIPS/TSY Spread (UINF)

- ProShares UltraPro Short 10 Year TIPS/TSY Spread (SINF)

- SPDR MSCI ACWI IMI ETF (ACIM)

- SPDR MSCI EM 50 ETF (EMFT)

- VelocityShares 2x Inverse Copper ETN (SCPR) [VelocityShares Rolls Out Leveraged Energy and Copper ETNs]

- VelocityShares 2x Long Copper ETN (LCPR)

- VelocityShares 3x Inverse Brent Crude ETN (DOIL)

- VelocityShares 3x Inverse Crude ETN (DWTI)

- VelocityShares 3x Inverse Natural Gas ETN (DGAZ)

- VelocityShares 3x Long Brent Crude ETN (UOIL)

- VelocityShares 3x Long Crude ETN (UWTI)

- VelocityShares 3x Long Natural Gas ETN (UGAZ)

Product closures/delistings in February (sorted by name):

- Global X Farming (BARN) [First ETF Closures of 2012]

- Global X Fishing Industry (FISN)

- Global X Food (EATX)

- Global X Mexico Small-Cap (MEXS)

- Global X Oil Equities (XOIL)

- Global X Russell Emerging Markets Growth (EMGX)

- Global X Russell Emerging Markets Value (EMVX)

- Global X Waste Management (WSTE)

Product changes in February:

- Five of the Van Eck’s new ETFs that replaced HOLDRS underwent share splits effective February 14 (pdf). Market Vectors Oil Services (OIH), Market Vectors Biotech (BBH), and Market Vectors Retail (RTH) split 3-for-1. Market Vectors Pharmaceutical (PPH) and Market Vectors Bank and Brokerage (RKH) split 2-for-1.

- Guggenheim Solar ETF (TAN) underwent a 1-for-10 reverse split effective 2/15/12.

- United States Natural Gas Fund (UNG) underwent a 1-for-4 reverse split effective 2/22/12.

- Credit Suisse halted creation of VelocityShares Daily 2x VIX Short-Term ETN (TVIX) on February 22, effectively converting to a closed-end fund. TVIX immediately began trading well above its net asset value and finished the month with a +13.5% premium. Traders should be aware that the premium will collapse when share creation resumes.

Announced Product Changes for Coming Months:

- PowerShares Dynamic Developed International Opportunities Portfolio (PFA) will change its name, ticker, and index becoming PowerShares S&P International Developed High Quality Portfolio (IDHQ) effective 3/1/12.

- PowerShares S&P 500 High Quality Portfolio will change its ticker from PIV to SPHQ effective 3/1/12.

- All Rydex ETFs will be renamed Guggenheim ETFs effective 3/1/12. A total of 27 ETFs are affected.

- ProShares Ultra VIX Short-Term Futures ETF (UVXY) will undergo a 1-for-six reverse split effective 3/8/12.

- Guggenheim will close eight ETFs with a last trading day of March 23. The affected funds are:

- CurrencyShares Russion Ruble Trust (FXRU)

- CurrencyShares Mexican Peso Trust (FXM)

- Guggenheim EW Euro-Pacific LDRs ETF (EEN)

- Guggenheim International Small Cap LDRs ETF (XGC)

- Guggenheim Ocean Tomo Growth Index ETF (OTR)

- Guggenheim Ocean Tomo Patent ETF (OTP)

- Guggenheim Sector Rotation ETF (XRO)

- Rydex MSCI All Country World Equal Weight ETF (EWAC)

Previous monthly ETF statistics reports are available here.