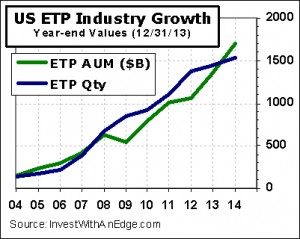

Eleven new exchange traded products (“ETPs”) came to market in December, consisting of ten ETFs and one ETN. For the year, sponsors launched 158 new products. Six closures took place in December, two ETFs and four ETNs, for a closure count of 67 for the year. As 2013 came to an end, there were 1,536 products (1,332 ETFs and 204 ETNs) listed for trading, a net increase of 91 for the year. The count of actively managed ETFs now sits at 71, an increase of two for December and 16 for the year.

Regarding new introductions, 2013 was only the seventh most prolific year as it failed to surpass every year since 2006 except 2009. Meanwhile, the annual closure count was second only to last year’s record of 102. The ratio of launches to closures came in at 2.36.

Six of December’s new offerings were bond ETFs, which is somewhat surprising given the underperformance of bond funds in 2013. To be fair, five of the six new bond funds utilize short positions in an attempt to profit from rising interest rates. Three of the other new products target income investors while avoiding direct exposure to bonds. An emerging market stock fund and a currency fund round out the new offerings.

The two ETF closures were Guggenheim BulletShares that matured at the end of the year, and the four ETN closures were VelocityShares leveraged and inverse commodity plays that failed to attract investor interest.

ETP assets climbed 1.9% in December to a new record high of $1.7 trillion. For the year, assets climbed 25.2%, keeping pace with broad market gains. Only 36 funds can boast having more than $10 billion in assets, and while they represent less than 2.4% of the overall ETP quantity, they hold more than 54% of industry assets. The year ended with 215 ETPs having assets of $1 billion or more, and these 14% have a very strong 88.7% market share. ETPs unable to garner more than $10 million in assets now number 311.

ETP assets climbed 1.9% in December to a new record high of $1.7 trillion. For the year, assets climbed 25.2%, keeping pace with broad market gains. Only 36 funds can boast having more than $10 billion in assets, and while they represent less than 2.4% of the overall ETP quantity, they hold more than 54% of industry assets. The year ended with 215 ETPs having assets of $1 billion or more, and these 14% have a very strong 88.7% market share. ETPs unable to garner more than $10 million in assets now number 311.

Trading activity increased 12.6% in December to $1.24 trillion. Of that, SPDR S&P 500 ETF (SPY) accounted for 32.6%. A total of eight ETPs averaged more than $1 billion a day in trading, and those eight accounted for 55.2% of all trading activity. The turnover ratio (total dollar volume / assets under management) was 0.73 for December.

| December 2013 Month End | ETFs | ETNs | Total |

|---|---|---|---|

| Currently Listed U.S. | 1,332 | 204 | 1,536 |

| Listed as of 12/31/2012 | 1,239 | 206 | 1,445 |

| New Introductions for Month | 10 | 1 | 11 |

| Delistings/Closures for Month | 2 | 4 | 6 |

| Net Change for Month | +8 | -3 | +5 |

| New Introductions 6 Months | 79 | 7 | 86 |

| New Introductions YTD | 143 | 15 | 158 |

| Delistings/Closures YTD | 50 | 17 | 67 |

| Net Change YTD | +93 | -2 | +91 |

| Actively-Managed Listings | 71 (+2) | n/a | 71 (+2) |

| Assets Under Mgmt ($ billion) | $1,674 | $23.2 | $1,697 |

| % Change in Assets for Month | +1.9% | +3.4% | +1.9% |

| Qty AUM > $10 Billion | 36 | 0 | 36 |

| Qty AUM > $1 Billion | 209 | 6 | 215 |

| Qty AUM > $100 Million | 656 | 32 | 688 |

| % with AUM > $100 Million | 49.3% | 15.7% | 44.8% |

| Monthly $ Volume ($ billion) | $1,202 | $35.4 | $1,237 |

| % Change in Monthly $ Volume | +12.0% | +37.2% | +12.6% |

| Avg Daily $ Volume > $1 Billion | 7 | 1 | 8 |

| Avg Daily $ Volume > $100 Million | 69 | 2 | 71 |

| Avg Daily $ Volume > $10 Million | 249 | 10 | 259 |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge.

New products launched in December (sorted by launch date):

- Cambria Foreign Shareholder Yield ETF (FYLD), launched 12/3/13, will invest in 100 companies with the best combined rank of dividend payments, net stock buybacks, and low financial leverage. The universe of stocks include those in foreign developed countries with market capitalizations over $200 million, with further analysis to determine stocks trading below intrinsic value. The managers indicate the methodology resulted in a minimum “shareholder” yield of approximately 4% as of December 3, 2013. The expense ratio is 0.59% (FYLD overview).

- SPDR MSCI EM Beyond BRIC ETF (EMBB), launched 12/5/13, is comprised of the constituents of the MSCI Emerging Markets Index while excluding companies domiciled in Brazil, Russia, India, and China (BRIC). Countries with a more than 10% weighting include Taiwan, South Korea, South Africa, and Mexico. Investors will pay 0.55% to own this ETF (EMBB overview).

- ETRACS Monthly Pay 2xLeveraged Closed-End Fund ETN (CEFL), launched 12/11/13, is an exchange traded note designed to provide a variable monthly coupon linked to 2 times the cash distributions of the 30 income-producing, closed-end funds of the ISE High Income Index. The ETN will reset its leverage monthly. The underlying index yields 9.7% (19.4% when leveraged). If the yield remains in that range, investor yield should be about 18.9% after the 0.50% tracking fee is deducted (CEFL overview).

- Recon Capital Nasdaq-100 Covered Call ETF (QYLD), launched 12/12/13, will hold the 100 stocks in the NASDAQ-100 Index and then write covered calls against those stocks in an effort to generate income and lower volatility. The calls will generally be written to have about one month left to expiration. The fund plans to pay monthly dividends and has an expense ratio of 0.60% (QYLD overview).

- iShares Liquidity Income ETF (ICSH), launched 12/13/13, is an actively managed ETF providing exposure to short-term bonds and money market instruments. The ETF has an effective duration of just 0.36 years, and currently has a 20% weighting in Treasury bills. It will compete with PIMCO Enhanced Short Maturity Strategy (MINT) and FlexShares Ready Access Variable Income (RAVI). ICSH carries an expense ratio of 0.18% (ICSH overview).

- WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU), launched 12/18/13, is an actively managed ETF seeking to outperform the Bloomberg Dollar Total Return Index before expenses. It provides exposure to the U.S. dollar against a basket of foreign currencies using Treasury bills, other investment-grade money market securities, and short-term currency forward contracts of developed and emerging market currencies. The fund will select 10 currencies and their weightings on an annual basis and will rebalance to the targets monthly. The fund carries a 0.50% management fee (USDU overview).

- WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund (AGZD), launched 12/18/13, will hold long positions in investment grade fixed income securities and short positions in Treasury bonds or futures. The short positions should nearly match the long portfolio, providing the fund with a zero duration in an effort to reduce the risk of rising interest rates while maintaining bond income. The fund’s expense ratio is 0.23% (AGZD overview).

- WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund (AGND), launched 12/18/13, will take long positions in investment grade fixed income securities and short positions in Treasury bonds or futures. The short positions should exceed the long positions and produce a duration of about negative five years in an effort to profit from higher interest rates while maintaining bond income. Investors will pay 0.28% per year (AGND overview).

- WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund (HYZD), launched 12/18/13, will hold long positions in high yield bonds with remaining maturities under five years and short positions in Treasury bonds or futures. The short positions should nearly match the long portfolio in an effort to produce a zero duration and reduce the risk of rising interest rates while maintaining bond income. The portfolio will cost investors 0.43% annually (HYZD overview).

- WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund (HYND), launched 12/18/13, will take long positions in high yield bonds with remaining maturities under five years and short positions in Treasury bonds or futures. The short positions should exceed the long positions and produce a duration of about negative seven years in an effort to profit from higher interest rates while maintaining bond income. The fund’s management fee is 0.48% (HYND overview).

- WisdomTree Japan Interest Rate Strategy Fund (JGBB), launched 12/18/13, is designed to capitalize on rising Japanese interest rates and a falling yen. The fund will maintain long positions in U.S. Treasury bills maturing in three months or less, short positions in Japanese government bonds maturing in 5-10 years, and short positions in the yen. Investors will pay an annual 0.50% fee (JGBB overview).

Product closures/delistings in December:

- VelocityShares 2x Inverse Platinum ETN (IPLT)

- VelocityShares 2x Long Platinum ETN (LPLT)

- VelocityShares 3x Inverse Brent Crude ETN (DOIL)

- VelocityShares 3x Long Brent Crude ETN (UOIL)

- Guggenheim BulletShares 2013 Corporate Bond (BSCD)

- Guggenheim BulletShares 2013 High Yield Bond (BSJD)

Product changes in December:

- AdvisorShares Global Alpha & Beta ETF (RRGR) underwent an extreme makeover, becoming the AdvisorShares EquityPro ETF (EPRO) effective December 2 (press release). The actively managed fund’s new manager, The Elements Financial Group, uses a unique quantitative approach, rendering this change an extreme makeover. EPRO is capping its 6.98% expense ratio at 1.48% for a year.

- Market Vectors LatAm Aggregate Bond ETF (BONO) underwent an extreme makeover, becoming the Market Vectors Emerging Markets Aggregate Bond ETF (EMAG) effective December 10. Contrary to what the press release (pdf) says, this is not a new product launch.

- Direxion Daily China Bull 3x Shares (YINN) and Direxion Daily China Bear 3x Shares (YANG), changed their underlying index from the BNY Mellon China Select ADR Index to the FTSE China 25 Index effective December 12.

Announced Product Changes for Coming Months:

- PowerShares announced (pdf) its intention to close four ETFs. February 18 will be the last day of trading for PowerShares KBW International Financial (KBWX), PowerShares MENA Frontier Countries (PMNA), PowerShares Dynamic MagniQuant (PIQ), and PowerShares Lux Nanotech (PXN).

- Effective February 19, Invesco PowerShares will change the names on 10 ETFs from “Dynamic” to “DWA” reflecting a change in the underlying indexes to ones provided by Dorsey, Wright & Associates. The affected products include the nine Dynamic sector portfolios and the Dynamic OTC portfolio. Further details and the product list are available in the press release (pdf).

Previous monthly ETF statistics reports are available here.

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.