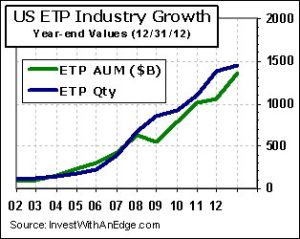

Ten products came and ten products went in December, resulting in a steady month-end count of 1,445 ETPs (1,239 ETFs and 206 ETNs). This remains below the 1,457 active listings at the end of April, resulting in negative growth for the past eight months. It is also 45 less than the intra-month high of 1,490 established August 15, 2012.

December’s ten introductions consisted entirely of exchange traded funds (ETFs), while closures included four exchange traded notes (ETNs) and six ETFs. There were 178 launches during the year and 102 closures. The net increase of just 76 was the smallest since 2005 when the quantity went from 172 to 224 for a gain of 52.

On a percentage basis, the 6.1% growth in active listings for 2012 was the lowest ever recorded so far in the 21st Century. There have been only two years with lower percentage growth rates since 1993 when the first U.S. listing of an ETF occurred. Those two years, 1994 and 1997, also happen to be the only two years that failed to produce any new product introductions.

Assets in ETPs grew from $1.06 trillion to $1.36 trillion during 2012, a very robust 27.8% increase. This is the largest asset growth rate since the 46.7% increase of 2009 when the ETF industry and financial markets were rebounding from a dismal 2008.

Assets and listing counts have a fairly consistent tracking relationship, with about $1 billion in assets for every ETP on average. The primary exception was 2008 when assets dropped by more than 12% while listings surged more than 25%. The relationship quickly got back on track in subsequent years. However, the “average” is far from typical as only 180 of the current 1,445 listings have assets above $1 billion. They represent just 12.5% of the quantity of listed products while grabbing 88.3% of the assets.

For the month of December, assets increased +3.1%. Only 26 ETFs have assets exceeding $10 billion, but they account for more than half (51.6%) of all ETP assets.

Trading activity declined in December with total dollar volume slipping 5.6% to $1.1 trillion. SPDR S&P 500 (SPY) was responsible for 36.4% of all ETP dollars traded in U.S. markets. ETPs averaging more than $1 billion per day in dollar volume fell from six to five while capturing a 53.1% share. Products averaging more than $100 million per day grew from 63 to 68 while capturing 87.8% of trading activity.

| December 2012 Month End | ETFs | ETNs | Total |

|---|---|---|---|

| Currently Listed U.S. | 1,239 | 206 | 1,445 |

| Listed as of 12/31/2011 | 1,166 | 203 | 1,369 |

| New Introductions for Month | 10 | 0 | 10 |

| Delistings/Closures for Month | 6 | 4 | 10 |

| Net Change for Month | +4 | -4 | +0 |

| New Introductions 6 Months | 45 | 9 | 54 |

| New Introductions YTD | 155 | 23 | 178 |

| Delistings/Closures YTD | 82 | 20 | 102 |

| Net Change YTD | +73 | +3 | +76 |

| Actively-Managed Listings | 55 | – | 55 |

| Assets Under Mgmt ($ billion) | $1,338 | $16.2 | $1,355 |

| % Change in Assets for Month | +3.1% | -2.4% | +3.1% |

| Qty AUM > $10 Billion | 26 | 0 | 26 |

| Qty AUM > $1 Billion | 177 | 3 | 180 |

| Qty AUM > $100 Million | 558 | 23 | 581 |

| Monthly $ Volume ($ billion) | $1,107 | $26.3 | $1,133 |

| % Change in Monthly $ Volume | -5.1% | -18.6% | -5.6% |

| Avg Daily $ Volume > $1 Billion | 5 | 0 | 5 |

| Avg Daily $ Volume > $100 Million | 66 | 2 | 68 |

| Avg Daily $ Volume > $10 Million | 237 | 9 | 246 |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge.

New products launched in December (sorted by launch date):

- PowerShares S&P 500 Downside Hedged Portfolio (PHDG) [Stocks, VIX, Active Management, and Indexing In One ETF]

- ProShares Merger ETF (MRGR) [MRGR overview]

- AdvisorShares Pring Turner Business Cycle ETF (DBIZ) [Review of DBIZ by Trang Ho]

- FlexShares Quality Dividend Defensive Index Fund (QDEF) [QDEF overview]

- FlexShares Quality Dividend Dynamic Index Fund (QDYN) [QDYN overview]

- FlexShares Quality Dividend Index Fund (QDF) [QDF overview]

- ALPS/GS Momentum Builder Asia ex-Japan Equities and U.S. Treasuries Index ETF (GSAX) [ALPS Goldman Sachs Index ETF Series]

- ALPS/GS Momentum Builder Growth Markets Equities and U.S. Treasuries Index ETF (GSGO)

- ALPS/GS Momentum Builder Multi-Asset Index ETF (GSMA)

- ALPS/GS Risk-Adjusted Return U.S. Large Cap Index ETF (GSRA)

Product closures/delistings in December (sorted by delisting date):

- WisdomTree Dreyfus Japan Yen (JYF) [WisdomTree Closing 3 ETFs in December]

- WisdomTree Dreyfus South African Rand (SZR)

- WisdomTree LargeCap Growth (ROI)

- IQ Emerging Markets Mid Cap ETF (EMER) [EMER Becomes 96th ETP Closure of 2012]

- Guggenheim BulletShares 2012 Corporate Bond (BSCC) [Final maturity distributions for BSCC and BSJC (pdf)]

- Guggenheim BulletShares 2012 High Yield Bond (BSJC)

- VelocityShares 2x Inverse Palladium ETN (IPAL) [Six More ETP Closures For 2012]

- VelocityShares 2x Long Palladium ETN (LPAL)

- VelocityShares 2x Inverse Copper ETN (SCPR)

- VelocityShares 2x Long Copper ETN (LCPR)

Product changes in December:

None

Announced Product Changes for Coming Months:

- Vanguard fired MSCI as the underlying index provider for 22 of its funds. During the first half of 2013, six international funds will move from MSCI to FTSE indexes while 16 domestic products will transition from MSCI to CRSP indexes (Vanguard announcement of 10/2/12).

- Barclays ETN+ Short C Leveraged ETN hit its stop-loss early termination trigger and will be delisted and liquidated the second week of January (press release).

- DirexionShares to close three ETFs with January 18 being the last day of trading for INSD, VSPR, and VLAT (press release).

- Invesco PowerShares to close 13 ETF with January 26 being the last day of trading for PIC, PYH, PJB, PSTL, PLK, PWND, PMA, PKOL, PKN, PTO, PAO, PCA, and CVRT (press release).

Previous monthly ETF statistics reports are available here.

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.