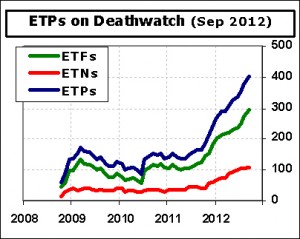

ETF Deathwatch membership takes another huge leap this month, topping 400 for the first time ever. Names totaling 403 (293 ETFs and 110 ETNs) are on the list for September, a hefty +147% increase of 240 over the 163 of a year ago. Century marks are flying by, with the count surpassing 200 in October 2011 and blasting through 300 in May of this year.

ETF Deathwatch membership takes another huge leap this month, topping 400 for the first time ever. Names totaling 403 (293 ETFs and 110 ETNs) are on the list for September, a hefty +147% increase of 240 over the 163 of a year ago. Century marks are flying by, with the count surpassing 200 in October 2011 and blasting through 300 in May of this year.

Growth in the membership list will likely slow in coming months, and it’s entirely possible the current count could represent a short-term peak. The reason for this is two-fold. First, as detailed in ETF Stats for August 2012, new product introductions are declining, meaning fewer products will be emerging from the six-month incubation period. Second, product closings are on a record pace this year, and most of those closures remove products from the list.

ETF Stats for August 2012, new product introductions are declining, meaning fewer products will be emerging from the six-month incubation period. Second, product closings are on a record pace this year, and most of those closures remove products from the list.

Even with 15 products coming off the list this month, there are 41 new names joining, for a net increase of 26. The 15 escapees consist of a dozen ETFs that closed in August and three removed based on increased assets or trading activity.

The average product on ETF Deathwatch is 27.2 months old, has only $6.2 million in assets, and has an expense ratio of 0.76%. In other words, these 403 products generate an average of $47,000 in annual gross revenue for their sponsors, which is not enough to cover their overhead costs. A full 60 ETPs have less than $2 million in assets, making profitability even further illusionary.

On the last day of August, there were 210 listed products posting zero volume for the day, and three went the entire month without a trade. iPath Long Enhanced MSCI EAFE ETN (MFLA) hasn’t traded since January 18. One has to wonder if Barclays even remembers this product exists.

In other industries, foreign suppliers routinely face “dumping” charges when selling products at a loss to U.S. consumers. Those rules appear not to apply in the financial services arena, where suppliers can apparently lose as much money as they desire.

The 41 ETPs added to Deathwatch for September (sorted by name):

- First Trust Australia AlphaDEX (FAUS)

- First Trust Canada AlphaDEX (FCAN)

- First Trust Developed Markets x-US Small Cap AlphaDEX (FDTS)

- First Trust Emerging Markets Small Cap AlphaDEX (FEMS)

- First Trust Germany AlphaDEX (FGM)

- First Trust Hong Kong AlphaDEX (FHK)

- First Trust Switzerland AlphaDEX (FSZ)

- First Trust Taiwan AlphaDEX (FTW)

- iPath US Treasury Steepener ETN (STPP)

- iShares Asia/Pacific Dividend 30 (DVYA)

- iShares MSCI All Country Asia Info Tech (AAIT)

- iShares MSCI All Country Asia x-Japan Small Cap (AXJS)

- iShares MSCI Emerging Markets EMEA (EEME)

- iShares MSCI Emerging Markets Small Cap (EEMS)

- iShares MSCI Emerging Markets Cons Discretionary Sector (EMDI)

- iShares MSCI Emerging Markets Energy Sector (EMEY)

- iShares MSCI Global Energy Producers (FILL)

- iShares MSCI Global Select Metals & Mining Producers (PICK)

- iShares MSCI Global Silver Miners Fund (SLVP)

- iShares MSCI India Small Cap (SMIN)

- iShares S&P Global Clean Energy (ICLN)

- iShares S&P Target Date 2025 Index Fund (TZI)

- Market Vectors Latin America Small-Cap (LATM)

- Market Vectors Renminbi Bond ETF (CHLC)

- PowerShares Riverfront Tactical Growth & Income (PCA)

- PowerShares S&P Emerging Markets High Beta (EEHB)

- PowerShares S&P Intl Developed High Beta (IDHB)

- ProShares UltraPro 10 Year TIPS/TSY Spread (UINF)

- ProShares UltraPro Short 10yr TIPS/TSY Spread (SINF)

- ProShares UltraShort DJ-UBS Commodity (CMD)

- SPDR MSCI ACWI IMI ETF (ACIM)

- SPDR MSCI EM 50 ETF (EMFT)

- SPDR S&P International Industrial (IPN)

- Vanguard S&P Small-Cap 600 Value ETF (VIOV)

- VelocityShares 2x Inverse Copper ETN (SCPR)

- VelocityShares 2x Long Copper ETN (LCPR)

- VelocityShares 3x Inverse Brent Crude ETN (DOIL)

- VelocityShares 3x Inverse Crude ETN (DWTI)

- VelocityShares 3x Long Brent Crude ETN (UOIL)

- VelocityShares 3x Long Crude ETN (UWTI)

- VelocityShares Daily 2x VIX Med-Term ETN (TVIZ)

15 ETPs were removed from Deathwatch for September. The following three were removed due to increased assets or trading activity:

- ETRACS Next Generation Internet ETN (EIPO)

- PowerShares DB Commodity Short ETN (DDP)

- ProShares Ultra MSCI EAFE (EFO)

The following 12 were removed because they closed in August:

- AdvisorShares Dent Tactical ETF (DENT)

- Focus Morningstar Basic Materials Index ETF (FBM)

- Focus Morningstar Communication Services ETF (FCQ)

- Focus Morningstar Consumer Cyclical ETF (FCL)

- Focus Morningstar Consumer Defensive ETF (FCD)

- Focus Morningstar Financial Services ETF (FFL)

- Focus Morningstar Health Care Index ETF (FHC)

- Focus Morningstar Industrials Index ETF (FIL)

- Focus Morningstar Mid Cap Index ETF (FMM)

- Focus Morningstar Real Estate Index ETF (FRL)

- Focus Morningstar Utilities Index ETF (FUI)

- IQ South Korea Small Cap ETF (SKOR)

Additional Data/Resources:

- ETF Deathwatch: September 2012 (complete list of 403 ETPs on Deathwatch)

- ETF Deathwatch Criteria (objective criteria used to generate list)

- ETF Deathwatch Archives (past monthly issues/)

Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.