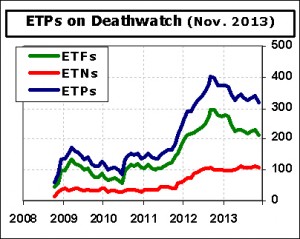

Change activity hit a new record this month with 47 ETPs changing their Deathwatch status. Thirteen new names joined the list, nineteen exited due to their improved chances of surviving, but fifteen others left because they bit the dust and are no longer with us. The net decrease of twenty-one places the current count at 318, consisting of 211 ETFs and 107 ETNs.

This is the lowest quantity since March 2012 and represents a decline of more than 21% from the September 2012 peak of 403. The number of lifetime closures now totals 369, or 19.5% of the 1,894 total product launches. The 15 closures occurring in October were all on ETF Deathwatch, so the list has been doing its job of warning investors.

This is the lowest quantity since March 2012 and represents a decline of more than 21% from the September 2012 peak of 403. The number of lifetime closures now totals 369, or 19.5% of the 1,894 total product launches. The 15 closures occurring in October were all on ETF Deathwatch, so the list has been doing its job of warning investors.

IQ Canada Small Cap (CNDA) is a surprising addition this month. It debuted in March 2010, becoming the first Canadian small cap ETF. However, it never caught on with investors, despite the fact that most U.S. investors have little or no exposure to this asset class. We attribute this lack of exposure to a flaw in the most widely followed international benchmark. The MSCI EAFE index does not include Canadian or emerging market stocks. Investors typically adjust for this by adding an emerging market fund to their asset allocation, but most do not take the next step of adding Canadian exposure too.

Less surprising are the three VelocityShares emerging market ETFs (ASDR, EMDR, and RUDR) joining the list. Prior to the launch of these non-leveraged ETFs, VelocityShares had only introduced leveraged ETNs. The out-of-character products brought little new to an arena already saturated with multiple variations of emerging market ETFs and failed to attract investor attention.

The average age of products on Deathwatch increased to 39.5 months from 38.8 in October. Average asset size slipped from $6.5 million to $6.4 million, and 54 of them have less than $2 million in assets. Six products had zero volume throughout the month of October, and iPath Short Enhanced MSCI Emerging Markets (EMSA) has now gone more than a year without a trade. EMSA is the new poster child of Zombie ETPs.

Here is the Complete List of 318 Products on ETF Deathwatch for November 2013 based on the objective ETF Deathwatch Criteria.

The 13 ETPs added to ETF Deathwatch for November:

- Direxion DailySouth KoreaBull 3X Shares (KORU)

- FlexShares International Quality Dividend Dynamic (IQDY)

- Global XBrazilMid Cap (BRAZ)

- Global X Central Asia & Mongolia Index ETF (AZIA)

- iPath Pure Beta Broad Commodity ETN (BCM)

- IQ Canada Small Cap (CNDA)

- iShares Enhanced U.S. Small-Cap ETF (IESM)

- Market Vectors Indian Rupee/USD ETN (INR)

- ProShares Short FTSEChina25 (YXI)

- ProShares UltraShort Technology (REW)

- VelocityShares EmergingAsiaDR ETF (ASDR)

- VelocityShares EmergingMarkets DRETF (EMDR)

- VelocityShares Russia DRETF (RUDR)

The 19 ETPs removed from ETF Deathwatch due to improved health:

- AdvisorShares Accuvest Global Opportunities (ACCU)

- AdvisorShares Madrona Domestic (FWDD)

- AdvisorShares Madrona International (FWDI)

- AdvisorShares WCM/BNY Mellon Focused Growth ADR (AADR)

- Credit Suisse Long/Short Liquid ETN (CSLS)

- db X-trackers MSCI Germany Hedged Equity (DBGR)

- EGSharesIndiaSmall Cap (SCIN)

- HuntingtonEcoLogical Strategy (HECO)

- iShares Financials Bond (MONY)

- iShares Global Nuclear Energy (NUCL)

- iShares MSCI Global Silver Miners (SLVP)

- Market Vectors Renminbi Bond (CHLC)

- PowerShares DB 3x Italian T-Bond Futures ETN (ITLT)

- PowerShares DB German Bund Futures ETN (BUNL)

- PowerShares Fundamental Pure Mid Core (PXMC)

- ProShares Ultra MSCI EAFE (EFO)

- SPDR S&P International Energy (IPW)

- SPDR S&P International Industrial (IPN)

- SPDR S&P Software & Services (XSW)

The 15 ETPs removed from ETF Deathwatch due to delisting:

- EGShares Basic Materials GEMS

- EGShares Consumer Goods GEMS

- EGShares Consumer Services GEMS

- EGShares Emerging Markets Metals & Mining

- EGShares Energy GEMS

- EGShares Financials GEMS

- EGShares GEMS Composite

- EGShares Health Care GEMS

- EGShares Industrials GEMS

- EGShares Technology GEMS

- EGShares Telecom GEMS

- EGShares Utilities GEMS

- JPM Quarterly Double Short US 10-Yr Treasury Futures ETN

- JPM Quarterly Double Short US Long Treasury Futures ETN

- KEYnotes FT Enhanced 130/30 Large Cap ETN

Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.