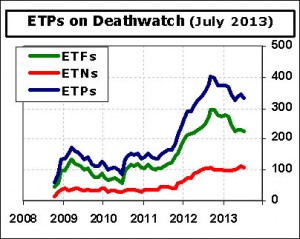

ETF Deathwatch membership rolls peaked last September at 403 and have been trending lower ever since. As discussed in ETF Deathwatch for April 2013, the trend is likely to continue for most of 2013. This is because peaks and valleys in the number of struggling ETFs historically trail peaks and valleys in launch activity by three or four quarters. Product launch rates appear to have bottomed in the first quarter of this year, which in turn forecasts a late 2013 bottom for the number of products on ETF Deathwatch.

For July, the list shrinks by eleven. The objective criteria added nine new names and removed twenty. Eleven ETFs came off the list due to improvements in assets or trading activity. The other nine ETPs came off the hard way – they closed and liquidated last month. The overall count now stands at 331, consisting of 224 ETFs and 107 ETNs.

There are inherent risks in owning an ETF that closes, but liquidity concerns are perhaps a more real and present danger with the products on this list. An extreme example is iPath Short Enhanced MSCI Emerging Markets ETN (EMSA). EMSA has yet to post its first trade of 2013 and was quoted today with a $54.81 bid and a $164.40 asking price. It is one of eight ETPs going the entire month of June without trading. It is also one of the 142 products posting zero volume on the last day of the month.

Complete List of 331 Products on ETF Deathwatch for July 2013

The 9 ETPs added to ETF Deathwatch for July:

- AdvisorShares Pring Turner Business Cycle (DBIZ)

- ALPS/GS Momentum Builder Asia ex-Japan Equities and U.S. Treasuries Index ETF (GSAX)

- ALPS/GS Momentum Builder Growth Markets Equities and U.S. Treasuries Index ETF (GSGO)

- ALPS/GS Momentum Builder Multi-Asset Index ETF (GSMA)

- ALPS/GS Risk-Adjusted Return U.S. Large Cap Index ETF (GSRA)

- Credit Suisse Long/Short Liquid ETN (CSLS)

- EGShares China Infrastructure (CHXX)

- FlexShares Quality Dividend Dynamic (QDYN)

- ProShares Merger (MRGR)

The 11 ETPs removed from ETF Deathwatch due to improved health:

- AdvisorShares TrimTabs Float Shrink (TTFS)

- EGShares Beyond BRICs (BBRC)

- First Trust Asia Pacific Ex-Japan AlphaDEX (FPA)

- First Trust Emerging Markets Small Cap AlphaDEX (FEMS)

- FlexShares Ready Access Variable Income (RAVI)

- Global X Brazil Mid Cap (BRAZ)

- iShares MSCI Hong Kong Small-Cap (EWHS)

- iShares Target Date 2015 (TZE)

- PowerShares Dynamic Lux Nanotech (PXN)

- ProShares Ultra Consumer Goods (UGE)

- SPDR S&P Aerospace & Defense (XAR)

The 9 ETPs removed from ETF Deathwatch due to death and delisting:

- ETRACS DJ-UBS Commodity Index 2-4-6 Blended Futures ETN (BLND)

- ETRACS Monthly 2x Leveraged ISE Cloud Computing Total Return ETN (LSKY)

- ETRACS Inverse UBS Bloomberg CMCI Platinum Excess Return ETN (PTD)

- ETRACS Next Generation Internet ETN (EIPO)

- ETRACS Monthly 2x Leveraged Next Generation Internet ETN (EIPL)

- ETRACS ISE Solid State Drive Index ETN (SSDD)

- ETRACS Monthly 2x Leveraged ISE Solid State Drive Index ETN (SSDL)

- AdvisorShares Rockledge SectorSAM ETF (SSAM)

- Guggenheim Yuan Bond ETF (RMB)

Additional Data/Resources:

Five Steps to Avoid Disaster When Your ETF Closes

ETF Deathwatch Criteria (objective criteria used to generate list)

ETF Deathwatch Archives (past monthly issues)

Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.