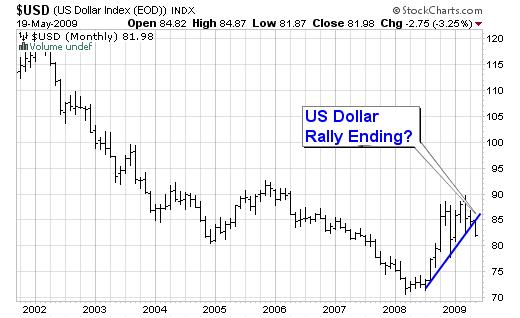

The U.S. Dollar is crumbling, down 3.25% this month. Reality is finally sinking in: enormous budget deficits, out-of-control spending, monster bailouts, and banana republic tactics have put a bulls-eye on the greenback. Don’t get trampled as the dollar gets taken to the woodshed!

Fortunately, some ETFs and ETNs are designed to exploit such an environment. We have highlighted many of them here at investwithanedge.com. Here are are two currency and two gold plays that will allow you to profit from the falling dollar.

PowerShares DB US Dollar Index Bearish Fund (UDN): This one is straight-forward. It’s the inverse of the US Dollar Index – a basket of major currencies. If the USD gains against the index, this ETF goes down. When the Dollar loses, this baby goes up. Any questions? Good, you may proceed to the next level.

CurrencyShares Australian Dollar Trust (FXA): Getting long the Australian dollar is akin to being short the US Dollar, and you are also playing the commodity theme since Australia is rich in natural resources. A slam dunk!

iShares COMEX Gold Trust (IAU): The traditional inflation hedge, and the bunker of choice when investors around the world seek safety from the greenback. Gold is a must-own commodity in this difficult market. Avoiding precious metals can be dangerous to your health.

Goldcorp (GG): As the dollar falls, gold will reflate. Own one of the largest miners on the planet, with a portfolio of mining operations in SAFE parts of the world, i.e., primarily N. America. GG is a company one can own with confidence and sleep well at night.

Finally, we would be remiss in not making sure you have oil and agriculture exposure when inflation kicks in. If you want a fighting chance in the new economy, harness the horsepower of the ag space via PowerShares DB Agriculture Fund (DBA). DBA gets you long corn, soybeans, sugar, and wheat. The way to play oil and gas is thru the US Oil Fund (USO) and US Natural Gas Fund (UNG).

Bottom line: the reckless stimulus and spending plans rolling out of the nation’s capital aren’t just driving the nation to the brink of bankruptcy: they’re sending the once-mighty U.S. dollar over the edge and into the woodshed. This will inevitably create a surge in commodity prices as investors seek to store value in hard assets. Nothing on Wall Street is bulletproof anymore, but a portfolio with anti-dollar currency plays, precious metals, agriculture, and oil/gas will give you a chance to survive the coming dollar melt-down.

Disclosure: Long UDN, various gold and oil exchange-traded funds, and mining equities.