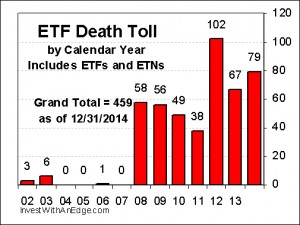

Seventy-nine exchange traded products bit the dust in 2014, marking the second highest annual death toll in the history of the ETF industry. The 72 ETF and 7 ETN closures were second only to the 102 closures of 2012. Broken down by major categories, the closures of 2014 consisted of 22 sector, 15 style and strategy, 14 global and international, 13 bond, 7 inverse, 4 leveraged, and 4 commodity. Of the 2,121 U.S. ETPs launched since the dawn of the industry in 1993, only 1,662 remain listed while 459 have closed. Said another way, the historic probability of ETP survivability is 78.4%.

Closures affected 15 brands and sponsors in 2014. Pax World was the only sponsor to exit the ETF space completely, and it did so in a very strange fashion. ETF pundits have long discussed the possibility of a large quantity of mutual funds converting to ETFs. However, no one ever thought conversions might go the other direction, but that is exactly what happened when all $64 million of the assets in the Pax MSCI EAFE ESG Index ETF (EAPS) suddenly became Institutional Class shares of the Pax World International ESG Index Fund (PXNIX), a traditional mutual fund. See ‘This Wasn’t Supposed To Happen: ETF Converts To Mutual Fund’ for additional details.

Closures affected 15 brands and sponsors in 2014. Pax World was the only sponsor to exit the ETF space completely, and it did so in a very strange fashion. ETF pundits have long discussed the possibility of a large quantity of mutual funds converting to ETFs. However, no one ever thought conversions might go the other direction, but that is exactly what happened when all $64 million of the assets in the Pax MSCI EAFE ESG Index ETF (EAPS) suddenly became Institutional Class shares of the Pax World International ESG Index Fund (PXNIX), a traditional mutual fund. See ‘This Wasn’t Supposed To Happen: ETF Converts To Mutual Fund’ for additional details.

Goldman Sachs is highly regarded on Wall Street, and it is often thought of as a firm that can do no wrong when it comes to making money. However, it hasn’t figured out the ETF space yet. Goldman attached its name and investment strategies to four ETFs sponsored by ALPS in 2012. Apparently, the Goldman name carries no weight in ETF land, and all four ETFs closed in 2014 with combined assets of less than $11 million.

For a number of reasons, the most notable closures of the year belong to iShares. First, 29 iShares ETFs had their last day of listed trading in 2014, giving iShares a 37% market share of closures. No other brands came close to this figure, with Direxion and EGShares tying for second-place “honors” with just six closures each. Second, iShares raised the bar on ETF survivability, as its 18 closings in October averaged more than $18 million in assets and two had about $70 million each. At the time, 49% of all listed ETFs and ETNs had fewer assets. Third, two of the liquidated funds (NY and NYC) had been on the market more than ten years. Longevity does not assure survival. Last, I can recall a BlackRock representative questioning why there were iShares funds on ETF Deathwatch when none had ever closed. I reminded him that iShares practically invented ETF closures with three such occurrences in 2002. He rebutted that Barclays owned the iShares brand at that time, and BlackRock had never closed an ETF. Never say never.

Some ETPs have maturation dates, namely target-date maturity bond ETFs and all ETNs. At their time of launch, these products inform investors of their likely closure and liquidation dates. For example, the Guggenheim BulletShares series of target maturity bond ETFs retire a couple of funds at the end of each calendar year. The two 2014 BulletShares ETFs (BSCE and BSJE) had their last day of trading on December 30, and next year we can expect the 2015 funds (BSCF and BSJF) to do the same. These are planned from the time of inception and are not indicative of unhealthy or failing products.

Every ETN is also issued with a maturity date. Typically, ETNs are launched with 30-year or 20-year maturities. Since the first ETNs didn’t come to market until 2006, most investors thought they wouldn’t have to deal with ETN maturation for another 10 or 20 years. However, in 2009 there were five ETNs issued as 5-year notes scheduled to mature in 2014. Three of these five triggered early terminations, including Barclays ETN+ S&P 500 Short B ETN (BXDB) last April. The two that escaped early termination, BXUC and BXUB, matured in November and were liquidated.

Most of 2014’s closures had become Zombie ETFs, and 58 of the 79 (73%) were on ETF Deathwatch at the time of their closure announcements. The major exceptions included the maturing products discussed above and many of the iShares with large amounts of assets. The average age of funds that closed in 2014 was 45.8 months (3.8 years). This is greater than the 31.4-month average lifespan of all 459 closed products, suggesting sponsors are willing to subsidize these non-profitable products longer than in years past.

The interactive table below is currently sorted by product name.

| # | Ticker | Name | Last Day | Deathwatch | Notes |

|---|---|---|---|---|---|

| 1 | GSAX | ALPS/GS Momentum Builder Asia x-Japan Eq/US-T | 08/27/2014 | Yes | |

| 2 | GSGO | ALPS/GS Momentum Builder Growth Markets Eq/US-T | 08/27/2014 | Yes | |

| 3 | GSMA | ALPS/GS Momentum Builder Multi-Asset | 08/27/2014 | Yes | |

| 4 | GSRA | ALPS/GS Risk-Adjusted Return U.S. Large Cap | 08/27/2014 | Yes | |

| 5 | BXUB | Barclays ETN+ S&P 500 Long B Leveraged ETN | 11/20/2014 | Yes | 2 |

| 6 | BXUC | Barclays ETN+ S&P 500 Long C Leveraged ETN | 11/20/2014 | – | 2 |

| 7 | BXDB | Barclays ETN+ S&P 500 Short B Leveraged ETN | 04/10/2014 | Yes | 3 |

| 8 | BRZS | Direxion Daily Brazil Bear 3x Shares | 09/23/2014 | Yes | |

| 9 | EURZ | Direxion Daily FTSE Europe Bear 3x Shares | 09/23/2014 | Yes | 4 |

| 10 | BARS | Direxion Daily Gold Bear 3x Shares | 12/26/2014 | Yes | 4 |

| 11 | JPNS | Direxion Daily Japan Bear 3x Shares | 09/23/2014 | Yes | |

| 12 | GASX | Direxion Daily Natural Gas Related Bear 3x | 09/23/2014 | – | |

| 13 | KORZ | Direxion Daily South Korea Bear 3x Shares | 09/23/2014 | Yes | |

| 14 | CHXX | EGShares China Infrastructure | 09/29/2014 | Yes | |

| 15 | EMDG | EGShares Emerging Markets Dividend Growth | 12/24/2014 | Yes | |

| 16 | EMHD | EGShares Emerging Markets Dividend High Income | 12/24/2014 | Yes | |

| 17 | IEMF | EGShares TCW EM Intermediate Term IG Bond | 09/29/2014 | Yes | 4 |

| 18 | LEMF | EGShares TCW EM Long Term IG Bond | 09/29/2014 | Yes | 4 |

| 19 | SEMF | EGShares TCW EM Short Term IG Bond | 09/29/2014 | Yes | 4 |

| 20 | OFF | ETRACS Fisher-Gartman Risk Off ETN | 05/18/2014 | Yes | |

| 21 | ONN | ETRACS Fisher-Gartman Risk On ETN | 05/18/2014 | Yes | |

| 22 | GASZ | ETRACS Natural Gas Futures Contango ETN | 01/22/2014 | – | |

| 23 | OILZ | ETRACS Oil Futures Contango ETN | 01/22/2014 | Yes | |

| 24 | CNPF | Global X Canada Preferred | 10/16/2014 | Yes | |

| 25 | GGGG | Global X Pure Gold Miners | 10/16/2014 | Yes | |

| 26 | BSCE | Guggenheim BulletShares 2014 Corp Bond | 12/30/2014 | – | 2 |

| 27 | BSJE | Guggenheim BulletShares 2014 HY Corp Bond | 12/30/2014 | – | 2 |

| 28 | GIY | Guggenheim Enhanced Core Bond | 03/07/2014 | Yes | 1 |

| 29 | MUAC | iShares 2014 AMT-Free Muni Term | 08/15/2014 | – | 2 |

| 30 | NUCL | iShares Global Nuclear Energy | 10/14/2014 | Yes | |

| 31 | FNIO | iShares Industrial/Office Real Estate Capped | 10/14/2014 | Yes | |

| 32 | AXDI | iShares MSCI ACWI ex US Consumer Discretionary | 03/25/2014 | Yes | |

| 33 | AXSL | iShares MSCI ACWI ex US Consumer Staples | 03/25/2014 | Yes | |

| 34 | AXEN | iShares MSCI ACWI ex US Energy | 03/25/2014 | Yes | |

| 35 | AXFN | iShares MSCI ACWI ex US Financials | 03/25/2014 | Yes | |

| 36 | AXHE | iShares MSCI ACWI ex US Healthcare | 03/25/2014 | Yes | |

| 37 | AXID | iShares MSCI ACWI ex US Industrials | 03/25/2014 | Yes | |

| 38 | AXIT | iShares MSCI ACWI ex US Information Technology | 03/25/2014 | Yes | |

| 39 | AXMT | iShares MSCI ACWI ex US Materials | 03/25/2014 | Yes | |

| 40 | AXTE | iShares MSCI ACWI ex US Telecom Services | 03/25/2014 | Yes | |

| 41 | AXUT | iShares MSCI ACWI ex US Utilities | 03/25/2014 | Yes | |

| 42 | EMFN | iShares MSCI Emerging Markets Financials | 10/14/2014 | Yes | |

| 43 | EMMT | iShares MSCI Emerging Markets Materials | 10/14/2014 | Yes | |

| 44 | FEFN | iShares MSCI Far East Financials | 10/14/2014 | Yes | |

| 45 | NY | iShares NYSE 100 ETF | 10/14/2014 | – | |

| 46 | NYC | iShares NYSE Composite ETF | 10/14/2014 | – | |

| 47 | RTL | iShares Retail Real Estate Capped | 10/14/2014 | Yes | |

| 48 | TZD | iShares Target Date 2010 | 10/14/2014 | – | |

| 49 | TZE | iShares Target Date 2015 | 10/14/2014 | – | |

| 50 | TZG | iShares Target Date 2020 | 10/14/2014 | – | |

| 51 | TZI | iShares Target Date 2025 | 10/14/2014 | – | |

| 52 | TZL | iShares Target Date 2030 | 10/14/2014 | – | |

| 53 | TZO | iShares Target Date 2035 | 10/14/2014 | – | |

| 54 | TZV | iShares Target Date 2040 | 10/14/2014 | – | |

| 55 | TZW | iShares Target Date 2045 | 10/14/2014 | Yes | |

| 56 | TZY | iShares Target Date 2050 | 10/14/2014 | – | |

| 57 | TGR | iShares Target Date Retirement Income | 10/14/2014 | – | |

| 58 | RKH | Market Vectors Bank and Brokerage | 12/12/2014 | Yes | |

| 59 | COLX | Market Vectors Colombia | 12/12/2014 | Yes | |

| 60 | GERJ | Market Vectors Germany Small-Cap | 12/12/2014 | Yes | |

| 61 | LATM | Market Vectors Latin America Small-Cap | 12/12/2014 | Yes | |

| 62 | CHLC | Market Vectors Renminbi Bond | 12/12/2014 | Yes | |

| 63 | EAPS | Pax MSCI EAFE ESG Index ETF | 03/21/2014 | – | 5 |

| 64 | AUD | PIMCO Australia Bond Index | 09/26/2014 | – | |

| 65 | TRSY | PIMCO Broad U.S. Treasury Index | 03/10/2014 | Yes | |

| 66 | BABZ | PIMCO Build America Bond | 09/26/2014 | – | 1 |

| 67 | CAD | PIMCO Canada Bond Index | 09/26/2014 | – | |

| 68 | BUND | PIMCO Germany Bond Index | 09/26/2014 | Yes | |

| 69 | PIQ | PowerShares Dynamic Magniquant | 02/18/2014 | Yes | |

| 70 | KBWX | PowerShares KBW International Financial | 02/18/2014 | Yes | |

| 71 | PXN | PowerShares Lux Nanotech | 02/18/2014 | Yes | |

| 72 | PMNA | PowerShares MENA Frontier Countries | 02/18/2014 | Yes | |

| 73 | GEMS | PureFunds ISE Diamonds/Gemstone | 01/23/2014 | Yes | |

| 74 | MSXX | PureFunds ISE Mining Service | 01/23/2014 | Yes | |

| 75 | NAGS | Teucrium Natural Gas | 12/18/2014 | Yes | |

| 76 | CRUD | Teucrium WTI Crude Oil | 12/18/2014 | Yes | |

| 77 | ASDR | VelocityShares Emerging Asia DR ETF | 11/20/2014 | Yes | |

| 78 | EMDR | VelocityShares Emerging Markets DR ETF | 11/20/2014 | Yes | |

| 79 | RUDR | VelocityShares Russia DR ETF | 11/20/2014 | Yes |

Notes: 1) actively managed, 2) reached planned maturity, 3) hit early termination trigger, 4) launched in 2014 and less than 1 year old at time of closure, 5) converted to mutual fund. All exchange traded notes are identified with “ETN” as part of their name description.

Additional resources:

- List of 67 ETF Closures in 2013

- List of 102 ETF Closures in 2012

- List of 38 ETF Closures in 2011

- List of 49 ETF Closures in 2010

- List of 56 ETF Closures in 2009

- List of 58 ETF Closures in 2008

- Free weekly newsletter to stay abreast of future ETF closings

- Catalog of ETF Closure Articles

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.

Comments

Feel free to leave a comment…