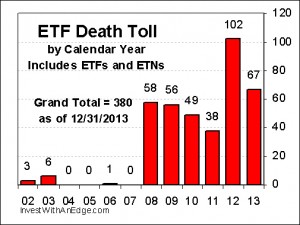

Sixty-seven exchange traded products (“ETPs”) saw their last day of listed trading in 2013. This is the second highest annual death toll for the relatively young industry, surpassed only by the 102 closures of the prior year. The departed are a mixture of 50 ETFs and 17 ETNs, and the lifetime count now stands at 380 (324 ETFs and 56 ETNs).

Closures affected 16 different brands, with FactorShares, KEYnotes, and STREAM becoming brands that are no longer with us. We welcomed the closure of FactorShares, as it removed an industry blight due to these ETFs having ludicrous expense ratios as high as 33%. JPMorgan closed out its only KEYnotes ETN in October along with two other ETNs under the JPMorgan brand. However, it did not liquidate the KEYnotes product at the time. JPMorgan is now down to a single ETP, the JPMorgan Alerian MLP Index ETN (AMJ). AMJ has ceased creating new shares though, rendering it a broken product subject to price premiums.

BNP Paribas entered the U.S. ETF market in 2012 with the introduction of the STREAM S&P Dynamic Roll Global Commodities ETF (BNPC). BNP Paribas committed ETF sponsor suicide in April of 2013 by closing and delisting the fund without any plan to liquidate the assets and return the money to shareholders. Eventually, BNP Paribas came around, but it took 199 days to render payments, providing an excellent example of why investors should sell shares prior to delisting and avoid the liquidation process. That may seem extreme, but Credit Suisse finally got around to liquidating three ETNs in 2013 that it delisted in 2009, taking 1,422 days for shareholders to get their money.

BNP Paribas entered the U.S. ETF market in 2012 with the introduction of the STREAM S&P Dynamic Roll Global Commodities ETF (BNPC). BNP Paribas committed ETF sponsor suicide in April of 2013 by closing and delisting the fund without any plan to liquidate the assets and return the money to shareholders. Eventually, BNP Paribas came around, but it took 199 days to render payments, providing an excellent example of why investors should sell shares prior to delisting and avoid the liquidation process. That may seem extreme, but Credit Suisse finally got around to liquidating three ETNs in 2013 that it delisted in 2009, taking 1,422 days for shareholders to get their money.

Most of 2013’s closures had become Zombie ETFs, and 57 of the 67 (85%) were on ETF Deathwatch at the time of their closure announcements. Typically, closures are the result of failing to attract enough assets, and in turn, not generating enough revenue for the sponsor. There were some exceptions, like the triggering of an early termination event to prevent the price from going to zero for two ETNs. Three bond ETFs had graceful closings due to reaching their planned maturity and liquidation dates. Guggenheim had the most closures of funds not on ETF Deathwatch, suggesting the firm has been aggressive in removing unprofitable products from its lineup.

The average age of funds that closed in 2013 was 37.7 months (3.1 years). This is greater than the 28.4-month average and much greater than the 18.9-year median lifespan of all 380 closed products. Sponsors were apparently willing to subsidize these non-profitable products a little longer in the hopes the bull market would help them attract more assets.

The interactive table below is currently sorted by product name.

ETF AND ETN CLOSURES OF 2013

| # | Ticker | Name | Last Day | Deathwatch | Notes |

|---|---|---|---|---|---|

| 1 | SSAM | AdvisorShares Rockledge SectorSAM | 06/14/2013 | Yes | 1 |

| 2 | BXDC | Barclays ETN+ S&P 500 Lvrgd 2x Short C ETN | 01/10/2013 | Yes | 3 |

| 3 | INSD | Direxion Large Cap Insider Sentiment | 01/18/2013 | Yes | |

| 4 | VSPR | Direxion S&P 1500 DRRC Volatility Response | 01/18/2013 | Yes | |

| 5 | VLAT | Direxion S&P Latin America 40 DRRC Vlty Res | 01/18/2013 | Yes | |

| 6 | LGEM | EGShares Basic Materials GEMS | 10/04/2013 | Yes | |

| 7 | GGEM | EGShares Consumer Goods GEMS | 10/04/2013 | Yes | |

| 8 | VGEM | EGShares Consumer Services GEMS | 10/04/2013 | Yes | |

| 9 | EMT | EGShares Emerging Markets Metals & Mining | 10/04/2013 | Yes | |

| 10 | OGEM | EGShares Energy GEMS | 10/04/2013 | Yes | |

| 11 | FGEM | EGShares Financials GEMS | 10/04/2013 | Yes | |

| 12 | AGEM | EGShares GEMS Composite | 10/04/2013 | Yes | |

| 13 | HGEM | EGShares Health Care GEMS | 10/04/2013 | Yes | |

| 14 | IGEM | EGShares Industrials GEMS | 10/04/2013 | Yes | |

| 15 | QGEM | EGShares Technology GEMS | 10/04/2013 | Yes | |

| 16 | TGEM | EGShares Telecom GEMS | 10/04/2013 | Yes | |

| 17 | UGEM | EGShares Utilities GEMS | 10/04/2013 | Yes | |

| 18 | GWO | ELEMENTS CS Global Warming ETN | 02/25/2013 | Yes | |

| 19 | PTD | ETRACS CMCI Short Platinum ER ETN | 06/05/2013 | Yes | |

| 20 | BLND | ETRACS DJ-UBS Comdty 2-4-6 Blnd Fut ETN | 06/05/2013 | Yes | |

| 21 | SSDD | ETRACS ISE Solid State Drive ETN | 06/05/2013 | Yes | |

| 22 | LSKY | ETRACS Mth 2x ISE Cloud Computing ETN | 06/05/2013 | Yes | |

| 23 | SSDL | ETRACS Mth 2x ISE Solid State Drive ETN | 06/05/2013 | Yes | |

| 24 | EIPL | ETRACS Mth 2x Next Generation Internet ETN | 06/05/2013 | Yes | |

| 25 | EIPO | ETRACS Next Generation Internet ETN | 06/05/2013 | Yes | |

| 26 | FSG | FactorShares 2X: Gold Bull/S&P500 Bear | 11/21/2013 | Yes | |

| 27 | FOL | FactorShares 2X: Oil Bull/S&P500 Bear | 11/21/2013 | Yes | |

| 28 | FSE | FactorShares 2X: S&P500 Bull/TBond Bear | 11/21/2013 | Yes | |

| 29 | FSU | FactorShares 2X: S&P500 Bull/USD Bear | 11/21/2013 | Yes | |

| 30 | FSA | FactorShares 2X: TBond Bull/S&P500 Bear | 11/21/2013 | Yes | |

| 31 | RSU | Guggenheim 2x S&P 500 | 03/15/2013 | – | |

| 32 | ABCS | Guggenheim ABC High Dividend | 03/15/2013 | Yes | |

| 33 | FAA | Guggenheim Airline | 03/15/2013 | – | |

| 34 | BSCD | Guggenheim BulletShares 2013 Corp Bond | 12/30/2013 | – | 2 |

| 35 | BSJD | Guggenheim BulletShares 2013 HY Bond | 12/30/2013 | – | 2 |

| 36 | RSW | Guggenheim Inverse 2x S&P 500 | 03/15/2013 | – | |

| 37 | EWEF | Guggenheim MSCI EAFE Equal Weight | 03/15/2013 | – | |

| 38 | EWMD | Guggenheim S&P MidCap 400 Equal Weight | 03/15/2013 | Yes | |

| 39 | EWSM | Guggenheim S&P SmallCap 600 Equal Weight | 03/15/2013 | Yes | |

| 40 | WXSP | Guggenheim Wilshire 4500 Completion | 03/15/2013 | Yes | |

| 41 | WFVK | Guggenheim Wilshire 5000 Total Market | 03/15/2013 | – | |

| 42 | RMB | Guggenheim Yuan Bond | 06/14/2013 | Yes | |

| 43 | MFSA | iPath Short Enh -2x MSCI EAFE Index ETN | 09/16/2013 | Yes | 3 |

| 44 | MUAB | iShares 2013 S&P AMT-Free Muni Term ETF | 08/15/2013 | – | 2 |

| 45 | ALT | iShares Diversified Alternative Trust | 05/28/2013 | – | 1 |

| 46 | DSXJ | JPM Qtrly Dbl Short US 10-Yr Treas Futures ETN | 10/02/2013 | Yes | |

| 47 | DSTJ | JPM Qtrly Dbl Short US Long Treas Futures ETN | 10/02/2013 | Yes | |

| 48 | JFT | KEYnotes FT Enhanced 130/30 Large Cap ETN | 10/09/2013 | Yes | |

| 49 | NASI | Pax MSCI North America ESG | 03/13/2013 | Yes | |

| 50 | PLK | PowerShares Active Low Duration | 02/26/2013 | Yes | 1 |

| 51 | PMA | PowerShares Active Mega-Cap Portfolio | 02/26/2013 | Yes | 1 |

| 52 | CVRT | PowerShares Convertible Securities Portfolio | 02/26/2013 | Yes | |

| 53 | PJB | PowerShares Dynamic Banking | 02/26/2013 | Yes | |

| 54 | PIC | PowerShares Dynamic Insurance | 02/26/2013 | Yes | |

| 55 | PKOL | PowerShares Global Coal Portfolio | 02/26/2013 | – | |

| 56 | PKN | PowerShares Global Nuclear Energy | 02/26/2013 | Yes | |

| 57 | PSTL | PowerShares Global Steel Portfolio | 02/26/2013 | Yes | |

| 58 | PWND | PowerShares Global Wind Energy | 02/26/2013 | Yes | |

| 59 | PTO | PowerShares Ibbotson Alternative Completion | 02/26/2013 | Yes | |

| 60 | PYH | PowerShares Morningstar StockInvestor Core | 02/26/2013 | Yes | |

| 61 | PAO | PowerShares Riverfront Tactical Bal Growth | 02/26/2013 | Yes | |

| 62 | PCA | PowerShares Riverfront Tactical Gr & Inc | 02/26/2013 | Yes | |

| 63 | BNPC | STREAM S&P Dynamic Roll Global Commodities | 04/12/2013 | Yes | |

| 64 | IPLT | VelocityShares 2x Inverse Platinum ETN | 12/26/2013 | Yes | |

| 65 | LPLT | VelocityShares 2x Long Platinum ETN | 12/26/2013 | Yes | |

| 66 | DOIL | VelocityShares 3x Inverse Brent Crude ETN | 12/26/2013 | Yes | |

| 67 | UOIL | VelocityShares 3x Long Brent Crude ETN | 12/26/2013 | Yes |

Notes: 1) actively managed, 2) reached planned maturity, 3) hit early termination trigger, 4) less than 6 months at time of closure announcement. All exchange traded notes are identified with “ETN” as part of their name description.

Additional resources:

- List of 102 ETF Closures in 2012

- List of 38 ETF Closures in 2011

- List of 49 ETF Closures in 2010

- List of 56 ETF Closures in 2009

- List of 58 ETF Closures in 2008

- Free weekly newsletter to stay abreast of future ETF closings

- Catalog of ETF Closure Articles

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.