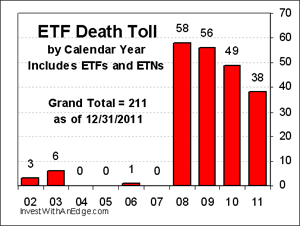

U.S. exchange traded product delistings and closures totaled 38 in 2011, consisting of 32 ETFs and six ETNs. The all-time death toll now stands at 211 (192 ETFs and 19 ETNs). Delistings dropped 22% from the 49 closures of 2010 and marked a third straight year of decline since the surge in 2008.

Closures affected ten different sponsors, with three making a 100% exit from the market: FaithShares terminated all five of its faith-based funds, Javelin shuttered its last remaining ETF, and Merrill Lynch delisted all seventeen of its HOLDRS.

Closures affected ten different sponsors, with three making a 100% exit from the market: FaithShares terminated all five of its faith-based funds, Javelin shuttered its last remaining ETF, and Merrill Lynch delisted all seventeen of its HOLDRS.

Most of the closures had become Zombie ETFs. They failed to attract enough assets, and it turn, did not generate enough revenue for the sponsor. There were some exceptions, like the triggering of an early termination event to prevent the price from going to zero as with some Barclay’s no-reset products.

A handful of the Merrill Lynch HOLDRS remained popular with investors, but the antiquated structure did not really generate any revenue for Merrill. About two-thirds of HOLDRS assets found a new home in similar Market Vector ETFs launched the following day.

Finally, the closure of Guggenheim BulletShares 2011 Corporate Bond ETF (BSCB) was unique. BSCB became the first target maturity ETF to reach maturity, closing as per the schedule it announced at its time of launch.

The average age of funds that closed in 2011 was 73.9 months (6.2 years). This significant deviation from the 18.8-month average lifespan of all 211 closed products was primarily due to the closure of HOLDRS. All had been in existence for at least 10 years and a couple of them had been around for more than 12 years.

The table below is sorted by product name.

ETF AND ETN CLOSURES OF 2011

| # | Ticker | Name | Last Day |

|---|---|---|---|

| 1 | BXDD | Barclays ETN+ S&P; 500 3x Short D 2009 ETN | 05/04/2011 |

| 2 | FLYX | Direxion Airline Shares | 10/10/2011 |

| 3 | BVL | ELEMENTS Benjamin Graham Large Cap Value ETN | 08/25/2011 |

| 4 | BSC | ELEMENTS Benjamin Graham Small Cap Value ETN | 08/25/2011 |

| 5 | BVT | ELEMENTS Benjamin Graham Total Market Value ETN | 08/25/2011 |

| 6 | FZB | FaithShares Baptist Values Fund | 07/15/2011 |

| 7 | FCV | FaithShares Catholic Values Fund | 07/15/2011 |

| 8 | FOC | FaithShares Christian Values Fund | 08/31/2011 |

| 9 | FKL | FaithShares Lutheran Values Fund | 07/15/2011 |

| 10 | FMV | FaithShares Methodist Values Fund | 07/15/2011 |

| 11 | BSCB | Guggenheim BulletShares 2011 Corporate Bond ETF | 12/29/2011 |

| 12 | BHH | HOLDRS B2B Internet ETF | 12/23/2011 |

| 13 | BBH | HOLDRS Biotech ETF | 12/20/2011 |

| 14 | BDH | HOLDRS Broadband ETF | 12/23/2011 |

| 15 | EKH | HOLDRS Europe 2001 | 12/23/2011 |

| 16 | HHH | HOLDRS Internet | 12/23/2011 |

| 17 | IAH | HOLDRS Internet Architecture | 12/23/2011 |

| 18 | IIH | HOLDRS Internet Infrastructure | 12/23/2011 |

| 19 | MKH | HOLDRS Merrill Lynch Market 2000+ | 12/23/2011 |

| 20 | OIH | HOLDRS Oil Services | 12/20/2011 |

| 21 | PPH | HOLDRS Pharmaceutical | 12/20/2011 |

| 22 | RKH | HOLDRS Regional Bank | 12/20/2011 |

| 23 | RTH | HOLDRS Retail | 12/20/2011 |

| 24 | SMH | HOLDRS Semiconductor | 12/20/2011 |

| 25 | SWH | HOLDRS Software | 12/23/2011 |

| 26 | TTH | HOLDRS Telecom | 12/23/2011 |

| 27 | UTH | HOLDRS Utilities | 12/23/2011 |

| 28 | WMH | HOLDRS Wireless | 12/23/2011 |

| 29 | IVO | iPath Inverse S&P; 500 VIX Short-Term Futures ETN | 09/16/2011 |

| 30 | VZZ | iPath Long Enhanced S&P; 500 VIX Mid-Term Futures ETN | 07/08/2011 |

| 31 | HKK | IQ Hong Kong Small Cap ETF | 12/23/2011 |

| 32 | RSUN | IQ Japan Mid Cap ETF | 12/23/2011 |

| 33 | TWON | IQ Taiwan Small Cap | 12/23/2011 |

| 34 | CRBA | Jefferies|TR/J CRB Global Agriculture Equity | 12/22/2011 |

| 35 | CRBI | Jefferies|TR/J CRB Global Industrial Metals Equity | 12/22/2011 |

| 36 | JCO | JETS Contrarian Opportunities | 09/29/2011 |

| 37 | PQZ | PowerShares Active Alpha Multi-Cap | 09/30/2011 |

| 38 | PQY | PowerShares Active AlphaQ | 09/30/2011 |

Additional resources:

- List of 49 ETF Closures in 2010

- List of 56 ETF Closures in 2009

- List of 58 ETF Closures in 2008

- Free weekly newsletter to stay abreast of future ETF closings

- Catalog of ETF Closure Articles

Disclosure covering writer, editor, publisher, and affiliates: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.