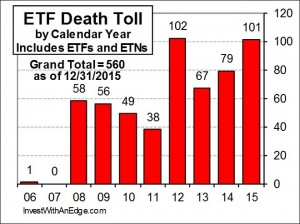

A total of 101 U.S.-listed exchange traded funds (“ETFs”) and exchange traded notes (“ETNs”) had their listings removed in 2015, one shy of the record 102 closures in 2012. Of the 2,405 U.S. exchange traded products (“ETPs”) launched since 1993, when the industry began, only 1,845 remain, making the lifetime death toll 560 (475 ETFs and 85 ETNs). This puts the historical mortality rate at 23.3%, up from 21.6% a year ago. It’s getting tougher to survive out there.

A significant but uncelebrated milestone was achieved in 2015: the lifetime death toll reached 500. Broken down by major categories, the 101 closures of 2015 consisted of 11 sector, 14 style and strategy, 21 global and international, 12 bond, 10 inverse, 17 leveraged and inverse, 12 commodity, and four currency products. Slicing another direction reveals 79 of the closures were ETFs and 22 were ETNs. Nine of the shuttered ETFs were actively managed funds.

A significant but uncelebrated milestone was achieved in 2015: the lifetime death toll reached 500. Broken down by major categories, the 101 closures of 2015 consisted of 11 sector, 14 style and strategy, 21 global and international, 12 bond, 10 inverse, 17 leveraged and inverse, 12 commodity, and four currency products. Slicing another direction reveals 79 of the closures were ETFs and 22 were ETNs. Nine of the shuttered ETFs were actively managed funds.

Percentage-wise, ETN closures were more significant. During 2015, there were only a dozen launches, and ETNs declined from 211 to 201. This is the largest-ever annual decline of ETNs, and the number of active listings remains well below the peak of 218 established in mid-2012.

Closures affected 20 brands and sponsors. Three firms completely exited the business by closing their entire product lines. The Royal Bank of Scotland (RBS) closed all 13 of its ETNs, Russell closed its one remaining ETF after shutting down the other 25 back in 2012, and Source closed its one-and-only U.S.-listed ETF. As an ETF sponsor, Source lasted less than seven months in the U.S. market and now holds the record for the shortest sponsor lifespan.

Sponsors and brands with the highest closure quantities for the year included BlackRock iShares (19), ProShares (19), RBS ETNs (13), Deutsche X-trackers (7), Invesco PowerShares (6), and AdvisorShares (6).

Assets in these closed products averaged $25.4 million for a total of $2.57 billion. However, a large portion can be attributed to the three target-maturity ETFs with their planned maturity and liquidation dates. These were Guggenheim BulletShares 2015 High Yield Corporate Bond (BSJF) at $469 million, Guggenheim BulletShares 2015 Corporate Bond (BSCF) at $363 million, and iShares iBonds Sep 2015 AMT-Free Muni Bond (IBMD) at $89 million.

Strategic closures also had an impact on the numbers. The decision by RBS to exit the business left $827 million on the table, including $488 million in the RBS US Large Cap Trendpilot ETN (TRND) and $144 million in the RBS US Mid Cap Trendpilot ETN (TRNM). Deutsche Bank (DB) bet the farm on currency hedging and closed most of its non-hedged products, including two with assets of more than $40 million each. The Invesco-DB partnership appeared to come to an end when all of the PowerShares ETNs issued by DB were closed and liquidated.

With the exception of out-of-the-blue strategic closure decisions, ETF Deathwatch continues to do a good job of identifying the zombie ETFs and warning investors of potential fund closures. Of the 101 liquidated products, 79 were on ETF Deathwatch when their terminations were announced. Excluding the strategic decisions mentioned above, just nine of the closures were not on ETF Deathwatch. Many of those had assets above $25 million, which suggests the current criteria may not be strict enough.

Ages of the liquidated products ranged from less than seven months for the Source EUROSTOX 50 ETF (ESTX) to 7.9 years for a dozen of the ProShares ETFs. In all, 21 of the products were more than seven years old, suggesting that sponsors had been willing to subsidize these funds for many years before giving up hope of them ever becoming profitable. Given the increasingly competitive landscape, it’s not clear sponsors will exhibit such patience going forward.

The interactive table below is currently sorted by product name.

ETF AND ETN CLOSURES OF 2015

| # | Ticker | Name | Last Day | Deathwatch | Notes |

|---|---|---|---|---|---|

| 1 | AGLS | AdvisorShares Accuvest Global Long Short | 08/07/2015 | Yes | 1 |

| 2 | ACCU | AdvisorShares Accuvest Global Opportunities | 01/09/2015 | 1 | |

| 3 | HDGI | AdvisorShares Athena International Bear | 01/09/2015 | Yes | 1 |

| 4 | GGBP | AdvisorShares Gartman Gold/British Pound | 01/26/2015 | Yes | 1 |

| 5 | GLDE | AdvisorShares International Gold | 01/26/2015 | Yes | 1 |

| 6 | DBIZ | AdvisorShares Pring Turner Business Cycle | 10/02/2015 | Yes | 1 |

| 7 | CSMB | CS X-Links 2x Monthly Merger Arbitrage ETN | 07/02/2015 | Yes | |

| 8 | CSMN | CS X-Links HOLT Market Neutral Global Equity ETN | 07/02/2015 | Yes | |

| 9 | TDD | Deutsche X-trackers 2010 Target Date | 05/18/2015 | Yes | |

| 10 | TDH | Deutsche X-trackers 2020 Target Date | 05/18/2015 | ||

| 11 | TDN | Deutsche X-trackers 2030 Target Date | 05/18/2015 | ||

| 12 | TDV | Deutsche X-trackers 2040 Target Date | 05/18/2015 | ||

| 13 | TDX | Deutsche X-trackers In-Target Date | 05/18/2015 | Yes | |

| 14 | UTLT | Deutsche X-trackers Regulated Utilities | 09/09/2015 | Yes | |

| 15 | SUBD | Deutsche X-trackers Solactive Investment Grade Subordinated Debt | 09/09/2015 | Yes | |

| 16 | SYTL | Direxion Daily 7-10 Year Treasury Bull 2x | 10/20/2015 | Yes | |

| 17 | MATL | Direxion Daily Basic Materials Bull 3x | 10/20/2015 | Yes | |

| 18 | BAR | Direxion Daily Gold Bull 3x | 06/19/2015 | Yes | |

| 19 | MDLL | Direxion Daily Mid Cap Bull 2x | 10/20/2015 | Yes | |

| 20 | BCHP | EGShares Blue Chip | 10/30/2015 | Yes | |

| 21 | BRXX | EGShares Brazil Infrastructure | 10/30/2015 | Yes | |

| 22 | AGOL | ETFS Physical Asian Gold Shares | 08/12/2015 | ||

| 23 | BRAF | Global X Brazil Financials | 10/08/2015 | Yes | |

| 24 | AZIA | Global X Central Asia & Mongolia Index | 10/08/2015 | Yes | |

| 25 | GURX | Global X Guru Small Cap Index | 10/08/2015 | Yes | |

| 26 | JUNR | Global X Junior Miners | 10/08/2015 | Yes | |

| 27 | BSCF | Guggenheim BulletShares 2015 Corp Bond | 12/30/2015 | 2 | |

| 28 | BSJF | Guggenheim BulletShares 2015 HY Corp Bond | 12/30/2015 | 2 | |

| 29 | HFIN | Horizons S&P Financial Sel Sec Covered Call | 03/20/2015 | Yes | |

| 30 | IFAS | iShares Asia Developed Real Estate | 08/21/2015 | Yes | |

| 31 | MONY | iShares Financials Bond | 08/21/2015 | Yes | |

| 32 | FCHI | iShares FTSE China | 08/21/2015 | ||

| 33 | IBMD | iShares iBonds Sep 2015 AMT-Free Muni Bond | 09/01/2015 | 2 | |

| 34 | ENGN | iShares Industrials Bond | 08/21/2015 | Yes | |

| 35 | AAIT | iShares MSCI All Country Asia Info Tech | 08/21/2015 | Yes | |

| 36 | AXJS | iShares MSCI All Country Asia x-Japan SmallCap | 08/21/2015 | Yes | |

| 37 | EWAS | iShares MSCI Australia Small-Cap | 08/21/2015 | Yes | |

| 38 | EWCS | iShares MSCI Canada Small-Cap | 08/21/2015 | Yes | |

| 39 | EMDI | iShares MSCI Emerging Markets Cons Discretionary | 08/21/2015 | Yes | |

| 40 | ESR | iShares MSCI Emerging Markets Eastern Europe | 08/21/2015 | ||

| 41 | EEME | iShares MSCI Emerging Markets EMEA | 08/21/2015 | Yes | |

| 42 | EMEY | iShares MSCI Emerging Markets Energy Sector | 08/21/2015 | Yes | |

| 43 | EGRW | iShares MSCI Emerging Markets Growth | 08/21/2015 | Yes | |

| 44 | EVAL | iShares MSCI Emerging Markets Value | 08/21/2015 | ||

| 45 | EWHS | iShares MSCI Hong Kong Small-Cap | 08/21/2015 | ||

| 46 | EWSS | iShares MSCI Singapore Small-Cap | 08/21/2015 | Yes | |

| 47 | IFNA | iShares North America Real Estate | 08/21/2015 | ||

| 48 | AMPS | iShares Utilities Bond | 08/21/2015 | ||

| 49 | QEM | Market Vectors MSCI Emerging Markets Quality | 09/18/2015 | Yes | |

| 50 | QDEM | Market Vectors MSCI Emerging Markets Quality Dividend | 09/18/2015 | Yes | |

| 51 | QXUS | Market Vectors MSCI International Quality | 09/18/2015 | Yes | |

| 52 | QDXU | Market Vectors MSCI International Quality Dividend | 09/18/2015 | Yes | |

| 53 | BARL | Morgan Stanley S&P 500 Crude Oil ETN | 01/29/2015 | Yes | |

| 54 | FIVZ | PIMCO 3-7 Year U.S. Treasury Index | 09/23/2015 | Yes | |

| 55 | TENZ | PIMCO 7-15 Year U.S. Treasury Index | 09/23/2015 | ||

| 56 | FORX | PIMCO Foreign Currency Strategy Active | 09/23/2015 | Yes | 1 |

| 57 | ITLT | PowerShares DB 3x Italian T-Bond Futures ETN | 02/24/2015 | ||

| 58 | UUPT | PowerShares DB 3x Long USD Idx Futures ETN | 02/24/2015 | ||

| 59 | UDNT | PowerShares DB 3x Short USD Idx Futures ETN | 02/24/2015 | Yes | |

| 60 | ITLY | PowerShares DB Italian T-Bond Futures ETN | 02/24/2015 | Yes | |

| 61 | DEFL | PowerShares DB US Deflation ETN | 02/24/2015 | Yes | |

| 62 | INFL | PowerShares DB US Inflation ETN | 02/24/2015 | Yes | |

| 63 | FINF | ProShares Short 30 Year TIPS/TSY Spread | 01/08/2015 | Yes | |

| 64 | GDAY | ProShares Ultra Australian Dollar | 06/18/2015 | Yes | |

| 65 | UKW | ProShares Ultra Russell Midcap Growth | 01/08/2015 | Yes | |

| 66 | UVU | ProShares Ultra Russell Midcap Value | 01/08/2015 | Yes | |

| 67 | UKF | ProShares Ultra Russell1000 Growth | 01/08/2015 | Yes | |

| 68 | UVG | ProShares Ultra Russell1000 Value | 01/08/2015 | Yes | |

| 69 | UKK | ProShares Ultra Russell2000 Growth | 01/08/2015 | Yes | |

| 70 | UVT | ProShares Ultra Russell2000 Value | 01/08/2015 | Yes | |

| 71 | UWC | ProShares Ultra Russell3000 | 01/08/2015 | Yes | |

| 72 | UINF | ProShares UltraPro 10 Year TIPS/TSY Spread | 01/08/2015 | Yes | |

| 73 | SINF | ProShares UltraPro Short 10yr TIPS/TSY Sprd | 01/08/2015 | Yes | |

| 74 | SDK | ProShares UltraShort Russell Midcap Growth | 01/08/2015 | Yes | |

| 75 | SJL | ProShares UltraShort Russell Midcap Value | 01/08/2015 | Yes | |

| 76 | SFK | ProShares UltraShort Russell1000 Growth | 01/08/2015 | Yes | |

| 77 | SJF | ProShares UltraShort Russell1000 Value | 01/08/2015 | Yes | |

| 78 | SKK | ProShares UltraShort Russell2000 Growth | 01/08/2015 | Yes | |

| 79 | SJH | ProShares UltraShort Russell2000 Value | 01/08/2015 | Yes | |

| 80 | TWQ | ProShares UltraShort Russell3000 | 01/08/2015 | Yes | |

| 81 | TLL | ProShares UltraShort Telecommunications | 09/14/2015 | Yes | |

| 82 | TCHI | RBS China Trendpilot ETN | 07/06/2015 | Yes | |

| 83 | DRGS | RBS Global Big Pharma ETN | 07/06/2015 | Yes | |

| 84 | TBAR | RBS Gold Trendpilot ETN | 07/06/2015 | ||

| 85 | TNDQ | RBS NASDAQ 100 Trendpilot ETN | 07/06/2015 | ||

| 86 | TWTI | RBS Oil Trendpilot ETN | 07/06/2015 | Yes | |

| 87 | RGRA | RBS Rogers Enhanced Agriculture ETN | 07/06/2015 | Yes | |

| 88 | RGRC | RBS Rogers Enhanced Commodity Index ETN | 07/06/2015 | Yes | |

| 89 | RGRE | RBS Rogers Enhanced Energy ETN | 07/06/2015 | Yes | |

| 90 | RGRI | RBS Rogers Enhanced Industrial Metals ETN | 07/06/2015 | Yes | |

| 91 | RGRP | RBS Rogers Enhanced Precious Metals ETN | 07/06/2015 | Yes | |

| 92 | ALTL | RBS US Large Cap Alternator ETN | 07/06/2015 | Yes | |

| 93 | TRND | RBS US Large Cap Trendpilot ETN | 07/06/2015 | ||

| 94 | TRNM | RBS US Mid Cap Trendpilot ETN | 07/06/2015 | ||

| 95 | ONEF | Russell Equity | 01/26/2015 | Yes | 1 |

| 96 | ESTX | Source EURO STOXX 50 | 04/10/2015 | ||

| 97 | VRD | SPDR Nuveen S&P VRDO Municipal Bond | 03/18/2015 | Yes | |

| 98 | KME | SPDR S&P Mortgage Finance | 03/18/2015 | Yes | |

| 99 | GMFS | SPDR S&P Small Cap Emerging Asia Pacific | 03/18/2015 | Yes | |

| 100 | USMI | United States Metals | 03/18/2015 | Yes | |

| 101 | EU | WisdomTree Euro Debt | 02/11/2015 | Yes | 1 |

Notes: 1) actively managed, 2) reached planned maturity. All exchange traded notes are identified with “ETN” as part of their name description.

Additional resources:

- List of 79 ETF Closures in 2014

- List of 67 ETF Closures in 2013

- List of 102 ETF Closures in 2012

- List of 38 ETF Closures in 2011

- List of 49 ETF Closures in 2010

- List of 56 ETF Closures in 2009

- List of 58 ETF Closures in 2008

- Free weekly newsletter to stay abreast of future ETF closings

- Catalog of ETF Closure Articles

Disclosure: Author has no positions in any of the securities, companies, or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) is received from, or on behalf of, any of the companies or ETF sponsors mentioned.