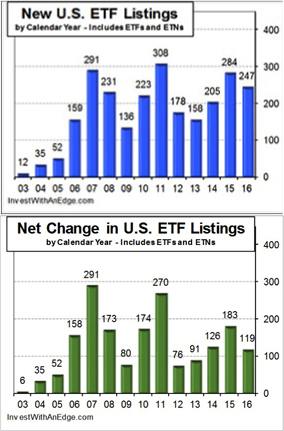

U.S. ETF providers launched 247 new products in 2016, consisting of 229 exchange-traded funds (“ETFs”) and 18 exchange-traded notes (“ETNs”). Subtracting out the 128 closures results in a net increase of 119 for the year. The 247 launches ran ahead of the 10-year average of 226, while the net increase came in below the 10-year average of 158.

U.S. ETF providers launched 247 new products in 2016, consisting of 229 exchange-traded funds (“ETFs”) and 18 exchange-traded notes (“ETNs”). Subtracting out the 128 closures results in a net increase of 119 for the year. The 247 launches ran ahead of the 10-year average of 226, while the net increase came in below the 10-year average of 158.

The ETF industry is still in its infancy by many measures, but the growth rates for new product introductions and overall product counts have stalled, which is a sign of maturity. Calendar year 2007 produced the largest net growth, and 2011 was not far behind.

For nearly a decade, some industry analysts have been predicting that a surge in actively managed ETF offerings was just over the horizon. While the 41 actively managed ETFs introduced in 2016 represents a record, the 15 closures also established an all-time high. Maybe it will happen someday, but so far, the 163 actively managed ETFs have yet to make a significant impact on the overall industry.

Investor acceptance of smart-beta ETFs is one of the reasons actively managed ETFs have not gained much traction. Smart-beta ETFs are active in a sense, but they are only active at the index level, while the ETFs themselves passively follow an active index. Smart-beta ETFs accounted for 152 (61.5%) of 2016’s product launches and now represent 692 (35%) of the 1,964 listed ETFs and ETNs.

Although the actively managed portion of the ETF pie is much smaller than the smart-beta slice, active management has been successful at grabbing market share from ETNs. Assets in actively managed ETFs overtook ETN assets a year ago. They are now 38% ahead of assets in ETNs ($29.9 billion versus $21.7 billion), and product count is on a path to surpass that of ETNs also. There were just 18 new ETNs launched in 2016 but 29 closures, resulting in a shrinkage of the ETN count by 11 to 190.

We separate ETFs into nine major groupings (shown here with the number of launches in each during 2016):

- Global and International: 73

- Style and Strategy: 61

- Sector: 46

- Bond: 34

- Leveraged: 11

- Inverse: 10

- Commodity: 7

- Volatility: 5

- Currency: 0

These groups are arranged by quantity of launches, and by sheer coincidence, they are in the same order as last year. Based on these divisions, the Global and International group was the largest contributor with 73 new products. Unlike 2015, when the majority of the new international ETFs employed currency hedging, only 16 took this approach last year. Instead, smart beta was the thrust in 2016, with 55 (75%) of the new foreign market ETFs falling into this classification.

The Style and Strategy group was home to the second-largest contingent of new ETFs in 2016. The primary data point to take away here is the fact that none of the 61 new ETFs in this group use traditional capitalization-weighted indexes. Instead, 51 employ a smart-beta index, and the other 10 are actively managed ETFs.

Sector funds remain popular, and 46 came to market in 2016, which is 53% more than in 2015. Smart beta is a theme within this category also, as 34 of the new sector ETF offerings use alternative selection or weighting schemes.

Bonds ETFs saw 34 introductions in 2016, with 12 being actively managed, eight having a smart-beta index, and 13 using a traditional index. Interest-rate hedging was a popular feature for bond ETFs launched in 2015, but none of 2016’s new Bond ETF arrivals include this feature.

Analyzing new ETFs based on features and characteristics is another way to observe industry trends. Using this approach, here are the new launch quantities with unique features:

- 152 Smart Beta

- 45 Dividend (including 5 MLP funds)

- 41 Actively Managed

- 28 Hedged (18 currency, 3 VIX, 2 equity, 2 gold, 2 managed futures, and 1 with option writing)

- 21 ESG

- 19 Thematic

- 16 Fund-of-Funds

- 5 MLP

- 2 C-Corporations

This breakdown reinforces the fact that smart beta is the dominant characteristic behind new ETF offerings, a trend that continues to accelerate. In 2014, a little more than 25% of new products were smart beta. In 2015, the percentage jumped to 59% and edged up to 61.5% for 2016.

Dividend-focused ETFs continue to be popular, especially in the current low interest-rate environment. However, the category is becoming saturated, as evidenced by the 22% drop from the 58 launches of 2015 to 45 this past year.

Various forms of hedging were included with 28 of the new offerings. As mentioned previously, there were no interest-rate-hedged ETFs brought out in 2016, but 18 employ currency hedging, three use volatility hedging, two have equity hedges (short selling), two are gold hedged, two use managed futures, and one hedges with option writing.

The burst of 21 new environmental, social, and governance (“ESG”) ETFs prompted a new category in our list. ESG is often used as a catchall designation for “socially responsible” investing, but the category can have somewhat fuzzy boundaries that may or may not include faith-based criteria.

Thematic investing also joins our list of characteristics this year with 19 new offerings. A thematic ETF is one that targets an identifiable area of the market, although its holdings are not confined to traditional sector boundaries. Thematic ETFs have been around for years, but there was a noticeable increase in launch activity in 2016. Some of the new themes are FinTech (Financial Technology), drones, longevity, millennials, 3D printing, and obesity.

As usual, BlackRock (BLK) launched the largest quantity of ETFs with 23 new products carrying the iShares brand name. Other sponsors with double-digit product introductions in 2016 included First Trust with 17, Elkhorn 13, WisdomTree (WETF) 12, and Direxion 10.

These 247 new ETFs were able to gather $6.3 billion in assets before the end of the year. The two largest were the UBS AG FI Enhanced Global Yield ETN (FIHD) $526 million and UBS AG FI Enhanced Europe 50 ETN (FIEE) $425 million, although both of these were created as customized securities for Fisher Investments. Other new ETFs with large end-of-year asset bases include WisdomTree Dynamic Currency-Hedged International Equity (DDWM) $300 million, SPDR SSGA Gender Diversity (SHE) $272 million, First Trust Dorsey Wright Dynamic Focus 5 (FVC) $253 million, and Franklin LibertyQ Emerging Markets (FLQE) $250 million. Since funds launched in January had 12 times as many months as those launched in December to attract assets, the year-end asset levels do not necessarily equate to the fastest-growing products.

It doesn’t happen very often, but three of 2016’s new launches were closed and liquidated by the end of the year. Two were crude-oil funds from AccuShares, which set records for the shortest life span of any ETF, lasting less than three months. They were saddled with an unworkable teeter-totter arrangement, and they were built on the dreaded C-corporation structure also. The third new product that failed to make it to the end of the year was the thematic CrowdInvest Wisdom ETF (former ticker WIZE), which lasted just five months. Apparently, the wisdom of crowds decided it was not a wise ETF.

The table below lists all 247 new products sorted by launch date, although you have the ability to sort on other columns. The SB/A column indicates whether it is a Smart Beta, Actively Managed, or traditional Index ETF. The IPO date is the first day the product was listed and available for purchase. An ETF’s first trade may be a later date in some cases, as a few products do not have any first-day volume. Additionally, the “inception date” listed for many ETFs from other data providers is typically a meaningless date, as it is often a day or more before it actually becomes listed and available for purchase.

| # | Ticker | Security Name | Group | SB/A | IPO Date | Notes |

|---|---|---|---|---|---|---|

| 1 | LEAD | Reality Shares DIVCON Leaders Dividend | Style/Strat | SB | 1/6/2016 | 3 |

| 2 | DEFA | iShares Adaptive Curr-Hdg MSCI EAFE | Global/Intl | 1/7/2016 | 1,2 | |

| 3 | DEZU | iShares Adaptive Curr-Hdg MSCI Eurozone | Global/Intl | 1/7/2016 | 1,2 | |

| 4 | DEWJ | iShares Adaptive Curr-Hdg MSCI Japan | Global/Intl | 1/7/2016 | 1,2 | |

| 5 | DDEZ | WisdomTree Dynamic Curr-Hdg Europe Equity | Global/Intl | SB | 1/7/2016 | 2,3 |

| 6 | DDWM | WisdomTree Dynamic Curr-Hdg International Eq | Global/Intl | SB | 1/7/2016 | 2,3 |

| 7 | DDLS | WisdomTree Dynamic Curr-Hdg Intl SmallCap Eq | Global/Intl | SB | 1/7/2016 | 2,3 |

| 8 | DDJP | WisdomTree Dynamic Curr-Hdg Japan Equity | Global/Intl | SB | 1/7/2016 | 2,3 |

| 9 | GNRX | VanEck Vectors Generic Drug | Sector | 1/13/2016 | ||

| 10 | DFND | Reality Shares DIVCON Dividend Defenders | Style/Strat | SB | 1/14/2016 | 2,3 |

| 11 | GARD | Reality Shares DIVCON Dividend Guard | Style/Strat | SB | 1/14/2016 | 2,3 |

| 12 | XITK | SPDR FactSet Innovative Technology | Sector | SB | 1/14/2016 | |

| 13 | EMDV | ProShares MSCI Emerg Mkts Dividend Growers | Global/Intl | SB | 1/27/2016 | 3 |

| 14 | OIIL | CS X-Links WTI Crude Oil Index ETN | Commodity | 2/9/2016 | ||

| 15 | MLPQ | ETRACS 2xMonthly Alerian MLP Infra Ser B ETN | Leveraged | 2/9/2016 | ||

| 16 | MLPZ | ETRACS 2xMonthly S&P MLP Series B ETN | Leveraged | 2/9/2016 | ||

| 17 | GTO | Guggenheim Total Return Bond ETF | Bond | A | 2/10/2016 | |

| 18 | FIEE | UBS AG FI Enhanced Europe 50 ETN | Leveraged | 2/16/2016 | ||

| 19 | OILX | ETRACS S&P GSCI Crude Oil Total Return ETN | Commodity | 2/18/2016 | ||

| 20 | FUT | ProShares Managed Futures Strategy | Global/Intl | A | 2/18/2016 | 2 |

| 21 | FIHD | UBS AG FI Enhanced Global Yield ETN | Leveraged | SB | 2/22/2016 | 3 |

| 22 | SOVB | Cambria Sovereign High Yield Bond ETF | Bond | A | 2/23/2016 | |

| 23 | PGHD | Pacer Global High Dividend ETF | Global/Intl | SB | 2/23/2016 | 3 |

| 24 | PUTW | WisdomTree CBOE S&P 500 PutWrite Strategy | Style/Strat | SB | 2/24/2016 | 2 |

| 25 | JSML | Janus Small Cap Growth Alpha ETF | Style/Strat | SB | 2/25/2016 | |

| 26 | JSMD | Janus Small/Mid Cap Growth Alpha ETF | Style/Strat | SB | 2/25/2016 | |

| 27 | VIGI | Vanguard International Dividend Appreciation | Global/Intl | SB | 3/2/2016 | 3 |

| 28 | VYMI | Vanguard International High Dividend Yield | Global/Intl | SB | 3/2/2016 | 3 |

| 29 | GSEU | Goldman Sachs ActiveBeta Europe Equity | Global/Intl | SB | 3/4/2016 | |

| 30 | GSJY | Goldman Sachs ActiveBeta Japan Equity | Global/Intl | SB | 3/4/2016 | |

| 31 | SHE | SPDR SSGA Gender Diversity Index | Style/Strat | SB | 3/8/2016 | |

| 32 | IFLY | PureFunds Drone Economy Strategy | Sector | SB | 3/9/2016 | |

| 33 | GAMR | PureFunds Video Game Tech | Sector | SB | 3/9/2016 | |

| 34 | DWIN | PowerShares DWA Tactical Multi-Asset Income | Global/Intl | SB | 3/10/2016 | 1,3 |

| 35 | FVC | First Trust Dorsey Wright Dynamic Focus 5 | Style/Strat | SB | 3/18/2016 | 1 |

| 36 | PSET | Principal Price Setters | Style/Strat | SB | 3/22/2016 | |

| 37 | PY | Principal Shareholder Yield | Style/Strat | SB | 3/22/2016 | 3 |

| 38 | CEZ | Victory CEMP Emerging Market Volatility Wtd | Global/Intl | SB | 3/23/2016 | |

| 39 | JHMS | John Hancock Multifactor Consumer Staples | Sector | SB | 3/29/2016 | |

| 40 | JHME | John Hancock Multifactor Energy | Sector | SB | 3/29/2016 | |

| 41 | JHMI | John Hancock Multifactor Industrials | Sector | SB | 3/29/2016 | |

| 42 | JHMA | John Hancock Multifactor Materials | Sector | SB | 3/29/2016 | |

| 43 | JHMU | John Hancock Multifactor Utilities | Sector | SB | 3/29/2016 | |

| 44 | JUNE | Dhandho Junoon ETF | Style/Strat | SB | 4/4/2016 | |

| 45 | JPEH | JPMorgan Diversified Return Europe Curr Hdg | Global/Intl | SB | 4/4/2016 | 2 |

| 46 | JPIH | JPMorgan Diversified Return Intl Curr Hdg | Global/Intl | SB | 4/4/2016 | 2 |

| 47 | GHE | REX Gold Hedged FTSE Emerging Markets | Global/Intl | A | 4/5/2016 | 1,2 |

| 48 | GHS | REX Gold Hedged S&P 500 | Style/Strat | A | 4/5/2016 | 1,2 |

| 49 | ERYY | Direxion Daily Energy Bear 1x | Inverse | 4/7/2016 | ||

| 50 | FAZZ | Direxion Daily Financial Bear 1x | Inverse | 4/7/2016 | ||

| 51 | TECZ | Direxion Daily Technology Bear 1x | Inverse | 4/7/2016 | ||

| 52 | DVEM | WisdomTree Emerging Markets Dividend | Global/Intl | SB | 4/7/2016 | 3 |

| 53 | IQDG | WisdomTree International Quality Dividend Gr | Global/Intl | SB | 4/7/2016 | 3 |

| 54 | RFAP | First Trust RiverFront Dynamic Asia Pacific | Global/Intl | A | 4/14/2016 | 2 |

| 55 | RFDI | First Trust RiverFront Dynamic Developed Intl | Global/Intl | A | 4/14/2016 | 2 |

| 56 | RFEU | First Trust RiverFront Dynamic Europe | Global/Intl | A | 4/14/2016 | 2 |

| 57 | EMTL | SPDR DoubleLine Emerging Markets Fixed Inc | Bond | A | 4/14/2016 | |

| 58 | STOT | SPDR DoubleLine Short Duration Tot Ret Tact | Bond | A | 4/14/2016 | |

| 59 | DEMG | Deutsche X-trackers FTSE Emerg Compr Factor | Global/Intl | SB | 4/19/2016 | |

| 60 | CATH | Global X S&P 500 Catholic Values | Style/Strat | SB | 4/19/2016 | |

| 61 | OPD | Guggenheim Large Cap Optimized Diversification | Style/Strat | SB | 4/19/2016 | |

| 62 | BUZ | Sprott Buzz Social Media Insights | Style/Strat | SB | 4/19/2016 | |

| 63 | IBUY | Amplify Online Retail | Sector | SB | 4/20/2016 | |

| 64 | MPCT | iShares Sustainable MSCI Global Impact | Global/Intl | SB | 4/22/2016 | |

| 65 | WIZE | CrowdInvest Wisdom | Style/Strat | SB | 4/26/2016 | 4 |

| 66 | WFIG | WisdomTree Fundamental U.S. Corporate Bond | Bond | SB | 4/27/2016 | |

| 67 | WFHY | WisdomTree Fundamental U.S. HY Corp Bond | Bond | SB | 4/27/2016 | |

| 68 | SFIG | WisdomTree Fundamental U.S. S-T Corp Bond | Bond | SB | 4/27/2016 | |

| 69 | SFHY | WisdomTree Fundamental U.S. S-T HY Bond | Bond | SB | 4/27/2016 | |

| 70 | VMIN | REX VolMAXX Inverse VIX Weekly Futures Strat | Volatility | A | 5/3/2016 | |

| 71 | VMAX | REX VolMAXX Long VIX Weekly Futures Strategy | Volatility | A | 5/3/2016 | |

| 72 | MILN | Global X Millennials Thematic | Style/Strat | SB | 5/5/2016 | |

| 73 | BFIT | Global X Health & Wellness Thematic | Global/Intl | SB | 5/10/2016 | |

| 74 | LNGR | Global X Longevity Thematic | Global/Intl | SB | 5/10/2016 | |

| 75 | OVLC | Guggenheim U.S. Large Cap Optimized Volatility | Style/Strat | SB | 5/10/2016 | |

| 76 | AGGE | IQ Enhanced Core Bond U.S. | Bond | SB | 5/10/2016 | 1 |

| 77 | AGGP | IQ Enhanced Core Plus Bond U.S. | Bond | SB | 5/10/2016 | 1 |

| 78 | AMJL | CS X-Links Monthly Pay 2x Alerian MLP ETN | Leveraged | 5/12/2016 | ||

| 79 | CNDF | iShares Edge MSCI Multifactor Consumer Disc | Sector | SB | 5/12/2016 | |

| 80 | CNSF | iShares Edge MSCI Multifactor Consumer Stap | Sector | SB | 5/12/2016 | |

| 81 | ERGF | iShares Edge MSCI Multifactor Energy | Sector | SB | 5/12/2016 | |

| 82 | FNCF | iShares Edge MSCI Multifactor Financials | Sector | SB | 5/12/2016 | |

| 83 | HCRF | iShares Edge MSCI Multifactor Healthcare | Sector | SB | 5/12/2016 | |

| 84 | INDF | iShares Edge MSCI Multifactor Industrials | Sector | SB | 5/12/2016 | |

| 85 | MATF | iShares Edge MSCI Multifactor Materials | Sector | SB | 5/12/2016 | |

| 86 | TCHF | iShares Edge MSCI Multifactor Technology | Sector | SB | 5/12/2016 | |

| 87 | UTLF | iShares Edge MSCI Multifactor Utilities | Sector | SB | 5/12/2016 | |

| 88 | JPME | JPMorgan Diversified Return U.S. Mid Cap Equity | Style/Strat | SB | 5/12/2016 | |

| 89 | BMLA | Bullmark LatAm Select Leaders | Global/Intl | SB | 5/19/2016 | 3 |

| 90 | FAAR | First Trust Alternative Absolute Return Strategy | Global/Intl | A | 5/19/2016 | 2 |

| 91 | IGRO | iShares International Dividend Growth | Global/Intl | SB | 5/19/2016 | 3 |

| 92 | EPRF | Elkhorn S&P High Quality Preferred | Style/Strat | SB | 5/24/2016 | 3 |

| 93 | DWFI | SPDR Dorsey Wright Fixed Income Allocation | Bond | SB | 6/2/2016 | 1 |

| 94 | FLQE | Franklin LibertyQ Emerging Markets | Global/Intl | SB | 6/3/2016 | |

| 95 | FLQD | Franklin LibertyQ Global Dividend | Global/Intl | SB | 6/3/2016 | 3 |

| 96 | FLQG | Franklin LibertyQ Global Equity | Global/Intl | SB | 6/3/2016 | |

| 97 | FLQH | Franklin LibertyQ International Equity Hedged | Global/Intl | SB | 6/3/2016 | 2 |

| 98 | RFDA | RiverFront Dynamic US Dividend Advantage | Style/Strat | A | 6/7/2016 | 3 |

| 99 | RFFC | RiverFront Dynamic US Flex-Cap | Style/Strat | A | 6/7/2016 | |

| 100 | FITS | The Health and Fitness ETF | Global/Intl | SB | 6/7/2016 | |

| 101 | OLD | The Long-Term Care ETF | Global/Intl | SB | 6/7/2016 | |

| 102 | SLIM | The Obesity ETF | Global/Intl | SB | 6/7/2016 | |

| 103 | ORG | The Organics ETF | Global/Intl | SB | 6/7/2016 | |

| 104 | SPDN | Direxion Daily S&P 500 Bear 1x | Inverse | 6/8/2016 | ||

| 105 | BEMO | Aptus Behavioral Momentum | Style/Strat | SB | 6/9/2016 | |

| 106 | ESGW | Columbia Sustainable Global Equity Income | Global/Intl | SB | 6/13/2016 | 3 |

| 107 | ESGN | Columbia Sustainable International Equity Inc | Global/Intl | SB | 6/13/2016 | 3 |

| 108 | ESGS | Columbia Sustainable U.S. Equity Income | Style/Strat | SB | 6/13/2016 | 3 |

| 109 | RFCI | RiverFront Dynamic Core Income | Bond | A | 6/14/2016 | |

| 110 | RFUN | RiverFront Dynamic Unconstrained Income | Bond | A | 6/14/2016 | |

| 111 | RFEM | First Trust RiverFront Dynamic Emerging Markets | Global/Intl | A | 6/15/2016 | 2 |

| 112 | CNYA | iShares MSCI China A | Global/Intl | 6/15/2016 | ||

| 113 | HYDD | Direxion Daily High Yield Bear 2x | Inverse | 6/16/2016 | ||

| 114 | FALN | iShares Fallen Angels USD Bond | Bond | 6/16/2016 | ||

| 115 | HYXE | iShares iBoxx $ High Yield ex Oil & Gas Corp Bnd | Bond | 6/16/2016 | ||

| 116 | OILD | AccuShares S&P GSCI Crude Oil Down (C-corp) | Inverse | 6/28/2016 | 4 | |

| 117 | OILU | AccuShares S&P GSCI Crude Oil Up (C-corp) | Commodity | 6/28/2016 | 4 | |

| 118 | DESC | Deutsche X-trackers Russell 2000 Comp Factor | Style/Strat | SB | 6/28/2016 | |

| 119 | TALL | RBC S&P 500 Trend Allocator PR Index ETN | Style/Strat | SB | 6/28/2016 | |

| 120 | XWEB | SPDR S&P Internet | Sector | SB | 6/28/2016 | |

| 121 | XTH | SPDR S&P Technology Hardware | Sector | SB | 6/28/2016 | |

| 122 | OEW | Guggenheim S&P 100 Equal Weight | Style/Strat | SB | 6/30/2016 | |

| 123 | ESGD | iShares MSCI EAFE ESG Select | Global/Intl | SB | 6/30/2016 | |

| 124 | ESGE | iShares MSCI EM ESG Select | Global/Intl | SB | 6/30/2016 | |

| 125 | SCAP | AdvisorShares Cornerstone Small Cap | Style/Strat | A | 7/7/2016 | |

| 126 | KRMA | Global X Conscious Companies | Style/Strat | SB | 7/12/2016 | |

| 127 | REML | CS X-Links Mthly Pay 2x Mortgage REIT ETN | Leveraged | 7/13/2016 | ||

| 128 | EYLD | Cambria Emerging Shareholder Yield | Global/Intl | SB | 7/14/2016 | 3 |

| 129 | ESGG | FlexShares STOXX Global ESG Impact | Global/Intl | SB | 7/14/2016 | |

| 130 | ESG | FlexShares STOXX US ESG Impact | Style/Strat | SB | 7/14/2016 | |

| 131 | DWLV | PowerShares DWA Momo & Low Volty Rotation | Style/Strat | SB | 7/14/2016 | 1 |

| 132 | IGEM | VanEck Vectors EM IG + BB USD Sovereign Bond | Bond | 7/14/2016 | ||

| 133 | XIVH | VelocityShares VIX Short Volatility Hedged ETN | Volatility | SB | 7/14/2016 | 2 |

| 134 | BSWN | VelocityShares VIX Tail Risk ETN | Volatility | SB | 7/14/2016 | 2 |

| 135 | LSVX | VelocityShares VIX Variable Long/Short ETN | Volatility | SB | 7/14/2016 | 2 |

| 136 | PRNT | The 3D Printing ETF | Global/Intl | SB | 7/19/2016 | |

| 137 | EUFL | Direxion Daily European Financials Bull 2x | Leveraged | 7/27/2016 | ||

| 138 | MELT | Direxion Daily Gold Miners Index Bear 1x | Inverse | 7/27/2016 | ||

| 139 | WBIR | WBI Tactical Rotation | Global/Intl | A | 7/27/2016 | 1 |

| 140 | LVHI | Legg Mason Intl Low Volatility High Dividend | Global/Intl | SB | 7/28/2016 | 2,3 |

| 141 | MLPE | C-Tracks Miller/Howard MLP Fndmntl Ser B ETN | Sector | SB | 8/9/2016 | |

| 142 | WTRX | Summit Water Infrastructure Multifactor | Sector | SB | 8/9/2016 | |

| 143 | EUFS | Direxion Daily European Financials Bear 1x | Inverse | 8/10/2016 | ||

| 144 | PMPT | iSectors Post-MPT Growth | Style/Strat | A | 8/17/2016 | 1 |

| 145 | BTEC | Principal Healthcare Innovators | Sector | SB | 8/22/2016 | |

| 146 | GENY | Principal Millennials I | Global/Intl | SB | 8/22/2016 | |

| 147 | HDMV | First Trust Horizon Managed Volatility Dev Intl | Global/Intl | A | 8/25/2016 | |

| 148 | HUSV | First Trust Horizon Managed Volatility Domestic | Style/Strat | A | 8/25/2016 | |

| 149 | IMED | PureFunds ETFx HealthTech | Global/Intl | SB | 8/31/2016 | |

| 150 | FINQ | PureFunds Solactive FinTech | Global/Intl | SB | 8/31/2016 | |

| 151 | DULL | Direxion Daily Silver Miners Index Bear 2x | Inverse | 9/8/2016 | ||

| 152 | SHNY | Direxion Daily Silver Miners Index Bull 2x | Leveraged | 9/8/2016 | ||

| 153 | GBIL | Goldman Sachs TreasuryAccess 0-1 Year | Bond | 9/8/2016 | ||

| 154 | SMMV | iShares Edge MSCI Min Vol USA Small-Cap | Style/Strat | SB | 9/9/2016 | |

| 155 | FINX | Global X FinTech Thematic | Global/Intl | SB | 9/13/2016 | |

| 156 | SNSR | Global X Internet of Things Thematic | Global/Intl | SB | 9/13/2016 | |

| 157 | BOTZ | Global X Robotics & Artificial Intelligence Theme | Global/Intl | SB | 9/13/2016 | |

| 158 | BSJO | Guggenheim BulletShares 2024 High Yield Corp | Bond | 9/14/2016 | ||

| 159 | BSCQ | Guggenheim BulletShares 2026 Corporate Bond | Bond | 9/14/2016 | ||

| 160 | JPHF | JPMorgan Diversified Alternatives | Global/Intl | A | 9/14/2016 | |

| 161 | FDVV | Fidelity Core Dividend | Style/Strat | SB | 9/15/2016 | 3 |

| 162 | FDRR | Fidelity Dividend ETF for Rising Rates | Global/Intl | SB | 9/15/2016 | 3 |

| 163 | FDLO | Fidelity Low Volatility Factor | Style/Strat | SB | 9/15/2016 | |

| 164 | FDMO | Fidelity Momentum Factor | Style/Strat | SB | 9/15/2016 | |

| 165 | FQAL | Fidelity Quality Factor | Style/Strat | SB | 9/15/2016 | |

| 166 | FVAL | Fidelity Value Factor | Style/Strat | SB | 9/15/2016 | |

| 167 | IBDR | iShares iBonds Dec 2026 Term Corporate | Bond | 9/15/2016 | ||

| 168 | JPHY | JPMorgan Disciplined High Yield | Bond | A | 9/15/2016 | |

| 169 | NUAG | NuShares Enhanced Yield U.S. Aggregate Bond | Bond | SB | 9/15/2016 | |

| 170 | USMR | Recon Capital USA Managed Risk ETF | Style/Strat | SB | 9/20/2016 | |

| 171 | ITML | VanEck Vectors AMT-Free 12-17 Year Municipal | Bond | 9/20/2016 | ||

| 172 | ITMS | VanEck Vectors AMT-Free 6-8 Year Municipal | Bond | 9/20/2016 | ||

| 173 | CWS | AdvisorShares Focused Equity ETF | Style/Strat | A | 9/21/2016 | |

| 174 | PFV | Amplify YieldShares Prime 5 Dividend ETF | Style/Strat | SB | 9/21/2016 | 1,3 |

| 175 | DWAC | Elkhorn DWA Commodity Rotation ETF | Commodity | A | 9/21/2016 | |

| 176 | RCOM | Elkhorn Fundamental Commodity Strategy ETF | Commodity | A | 9/21/2016 | |

| 177 | FTXO | First Trust Nasdaq Bank ETF | Sector | SB | 9/21/2016 | |

| 178 | FTXG | First Trust Nasdaq Food & Beverage ETF | Sector | SB | 9/21/2016 | |

| 179 | FTXN | First Trust Nasdaq Oil & Gas ETF | Sector | SB | 9/21/2016 | |

| 180 | FTXH | First Trust Nasdaq Pharmaceuticals ETF | Sector | SB | 9/21/2016 | |

| 181 | FTXD | First Trust Nasdaq Retail ETF | Sector | SB | 9/21/2016 | |

| 182 | FTXL | First Trust Nasdaq Semiconductor ETF | Sector | SB | 9/21/2016 | |

| 183 | FTXR | First Trust Nasdaq Transportation ETF | Sector | SB | 9/21/2016 | |

| 184 | FLLV | Franklin Liberty U.S. Low Volatility ETF | Style/Strat | A | 9/22/2016 | |

| 185 | VRIG | PowerShares Variable Rate Investment Grade | Bond | A | 9/22/2016 | |

| 186 | PSC | Principal U.S. Small Cap Index | Style/Strat | SB | 9/22/2016 | 3 |

| 187 | FCEF | First Trust CEF Income Opportunities | Global/Intl | A | 9/28/2016 | 3 |

| 188 | MCEF | First Trust Municipal CEF Income Opportunity | Bond | A | 9/28/2016 | |

| 189 | OILK | ProShares K-1 Free Crude Oil Strategy | Commodity | A | 9/28/2016 | |

| 190 | TTAC | TrimTabs Float Shrink | Style/Strat | A | 9/28/2016 | |

| 191 | KOR | AdvisorShares KIM Korea Equity | Global/Intl | A | 9/29/2016 | |

| 192 | RORE | Hartford Multifactor REIT ETF | Sector | SB | 10/4/2016 | |

| 193 | FLCO | Franklin Liberty Investment Grade Corporate | Bond | A | 10/5/2016 | |

| 194 | WSKY | Spirited Funds/ETFMG Whiskey & Spirits | Sector | 10/12/2016 | ||

| 195 | LVHB | Elkhorn Lunt Low Vol/High Beta Tactical | Style/Strat | SB | 10/20/2016 | |

| 196 | IFIX | Deutsche X-trackers Barclays Intl Corp Bnd Hdg | Bond | 10/25/2016 | 2 | |

| 197 | IGVT | Deutsche X-trackers Barclays Intl Treas Bnd Hdg | Bond | 10/25/2016 | 2 | |

| 198 | EFAX | SPDR MSCI EAFE Fossil Fuel Reserves Free | Global/Intl | SB | 10/25/2016 | |

| 199 | EEMX | SPDR MSCI Emg Mkts Fossil Fuel Resrv Free | Global/Intl | SB | 10/25/2016 | |

| 200 | MVIN | Natixis Seeyond International Minimum Volatility | Global/Intl | A | 10/27/2016 | |

| 201 | TCTL | Premise Capital Frontier Advantage Divers Tact | Global/Intl | SB | 10/28/2016 | 1 |

| 202 | ESGL | Oppenheimer ESG Revenue | Style/Strat | SB | 10/31/2016 | |

| 203 | ESGF | Oppenheimer Global ESG Revenue | Global/Intl | SB | 10/31/2016 | |

| 204 | ACSI | American Customer Satisfaction Core Alpha | Style/Strat | SB | 11/1/2016 | |

| 205 | CWEB | Direxion Daily CSI China Internet Index Bull 2X | Leveraged | 11/2/2016 | ||

| 206 | FLEU | Barclays ETN+ FI Enh Europe 50 Series B ETN | Leveraged | 11/3/2016 | ||

| 207 | GVIP | Goldman Sachs Hedge Industry VIP | Style/Strat | SB | 11/3/2016 | |

| 208 | IMTB | iShares Core 5-10 Year USD Bond | Bond | 11/3/2016 | ||

| 209 | DHDG | WisdomTree Dynamic Cur Hdg Intl Qual Div Gr | Global/Intl | SB | 11/3/2016 | 2,3 |

| 210 | MENU | USCF Restaurant Leaders | Sector | SB | 11/8/2016 | |

| 211 | EFAS | Global X MSCI SuperDividend EAFE | Global/Intl | SB | 11/15/2016 | 3 |

| 212 | JPSE | JPMorgan Diversified Return U.S. Small Cap Eq | Style/Strat | SB | 11/16/2016 | |

| 213 | VNLA | Janus Short Duration Income | Bond | A | 11/17/2016 | |

| 214 | OILB | iPath Series B S&P GSCI Crude Oil ETN | Commodity | 11/18/2016 | ||

| 215 | LVHE | Legg Mason Emerging Markets Low Vlty High Div | Global/Intl | SB | 11/18/2016 | 3 |

| 216 | BNDC | FlexShares Core Select Bond | Bond | A | 11/21/2016 | 1 |

| 217 | IDHD | PowerShares S&P Intl Dev High Div Low Vlty | Global/Intl | SB | 12/1/2016 | 3 |

| 218 | XSHD | PowerShares S&P SmallCap High Div Low Vlty | Style/Strat | SB | 12/1/2016 | 3 |

| 219 | ESGU | iShares MSCI USA ESG Optimized | Style/Strat | SB | 12/2/2016 | |

| 220 | BLHY | Virtus Newfleet Dynamic Credit | Bond | A | 12/6/2016 | |

| 221 | HYLB | Deutsche X-trackers USD High Yield Corp Bond | Bond | 12/7/2016 | ||

| 222 | SGQI | Janus SocGen Global Quality Income | Global/Intl | SB | 12/8/2016 | 3 |

| 223 | WEAR | The WEAR ETF | Global/Intl | 12/9/2016 | ||

| 224 | DWT | VelocityShares 3x Inverse Crude ETN | Inverse | 12/9/2016 | ||

| 225 | UWT | VelocityShares 3x Long Crude ETN | Leveraged | 12/9/2016 | ||

| 226 | DIVO | Amplify YieldShares CWP Div & Option Income | Style/Strat | A | 12/14/2016 | 3 |

| 227 | NULG | NuShares ESG Large-Cap Growth | Style/Strat | SB | 12/14/2016 | |

| 228 | NULV | NuShares ESG Large-Cap Value | Style/Strat | SB | 12/14/2016 | |

| 229 | NUMG | NuShares ESG Mid-Cap Growth | Style/Strat | SB | 12/14/2016 | |

| 230 | NUMV | NuShares ESG Mid-Cap Value | Style/Strat | SB | 12/14/2016 | |

| 231 | NUSC | NuShares ESG Small-Cap | Style/Strat | SB | 12/14/2016 | |

| 232 | JHMD | John Hancock MultiFactor Developed Intl | Global/Intl | SB | 12/16/2016 | |

| 233 | COWZ | Pacer US Cash Cows 100 | Style/Strat | SB | 12/19/2016 | |

| 234 | BMLP | BMO Elkhorn DWA MLP Select Index ETN | Sector | SB | 12/20/2016 | |

| 235 | NURE | NuShares Short-Term REIT | Sector | 12/20/2016 | ||

| 236 | WBIY | WBI Power Factor High Dividend | Style/Strat | SB | 12/21/2016 | 3 |

| 237 | XD | Elkhorn S&P MidCap Consumer Discretionary | Sector | 12/30/2016 | ||

| 238 | XS | Elkhorn S&P MidCap Consumer Staples | Sector | 12/30/2016 | ||

| 239 | XE | Elkhorn S&P MidCap Energy | Sector | 12/30/2016 | ||

| 240 | XF | Elkhorn S&P MidCap Financials | Sector | 12/30/2016 | ||

| 241 | XH | Elkhorn S&P MidCap Health Care | Sector | 12/30/2016 | ||

| 242 | XI | Elkhorn S&P MidCap Industrials | Sector | 12/30/2016 | ||

| 243 | XK | Elkhorn S&P MidCap Information Technology | Sector | 12/30/2016 | ||

| 244 | XM | Elkhorn S&P MidCap Materials | Sector | 12/30/2016 | ||

| 245 | XU | Elkhorn S&P MidCap Utilities | Sector | 12/30/2016 | ||

| 246 | INFR | Legg Mason Global Infrastructure | Sector | SB | 12/30/2016 | |

| 247 | OUSM | O’Shares FTSE Russell Small Cap Quality Div | Style/Strat | SB | 12/30/2016 | 3 |

Notes: 1) Fund-of-Funds, 2) employs hedging, 3) dividend focus, 4) closed before the end of the year. All exchange-traded notes are identified with “ETN” and C-corporations with “C-corp” as part of their name description.

Disclosure: No positions in any of the securities, companies, or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) is received from, or on behalf of, any of the companies or ETF sponsors mentioned.