ProShares Introduces Volatility Futures in an ETF

ProShares Introduces Volatility Futures in an ETF

Prior to January 4, ETNs (exchange-traded notes) were the only way to get exposure to VIX volatility futures via an exchange-traded product (ETP). Now, ProShares provides access in the more desirable ETF format with ProShares VIX Short-Term Futures (VIXY) and ProShares VIX Mid-Term Futures (VIXM)…

XVIX: The First Volatility Strategy ETP

XVIX: The First Volatility Strategy ETP

The stock market is volatile. Exchange-traded products that measure the volatility of the stock market are even more volatile. Yes, volatility is volatile. When used properly (and managed daily), adding an extremely volatile volatilty ETN to a stock portfolio can reduce the overall portfolio volatility. …

Eleven New iPath ETNs With Indescribable Leverage

Eleven New iPath ETNs With Indescribable Leverage

Barclays launched eleven new iPath exchange-traded notes (ETNs) yesterday, November 30, 2010. The new products provide leveraged long and short exposure to MSCI Emerging Markets, MSCI EAFE, Russell 1000, Russell 2000, and S&P 500 Indexes. A new mid-term VIX product is also included. The press…

Newcomer VelocityShares Introduces Suite of Volatility ETNs

Newcomer VelocityShares Introduces Suite of Volatility ETNs

VelocityShares LLC, a new exchange-traded product sponsor, introduced six new exchange-traded notes (ETNs) today (November 30, 2010). Issued by Credit Suisse, these unsecured notes offer long, inverse, and leveraged exposure to indexes based on Volatility Index (VIX) futures. Investors should keep…

Citigroup Belly-Flops Into ETP Sponsor Pool

Citigroup Belly-Flops Into ETP Sponsor Pool

Citigroup (C) entered the pool of exchange traded product (ETP) sponsors on November 15, 2010 with the introduction of C-Tracks Citi Volatility Index Total Return ETN (CVOL). One would think that Citi would pull out all the stops in an attempt to make a favorable first impression in a competitive market. …

Barclays Finally Puts iPath Brand on XXV

Barclays Finally Puts iPath Brand on XXV

It took two months, but Barclays finally came around to my way of thinking, rebranding its inverse volatility ETN with the iPath name. What was once Barclays ETN+ Inverse S&P 500 VIX Short-Term Futures ETN (XXV) is now (effective 9/28/10) the iPath Inverse S&P 500 VIX Short-Term Futures ETN…

![]() VQT: S&P 500 With A Volatility Hedge

VQT: S&P 500 With A Volatility Hedge

Barclays yesterday (9/1/2010) launched the Barclays ETN+ S&P VEQTOR ETN (VQT) exchange-traded notes (ETNs) that are linked to the performance of the S&P 500 Dynamic VEQTOR Total Return Index (press release). Barclays takes “dynamic indexing” to a new level with VQT. The underlying index…

![]() XXV: Barclays Abandons iPath Brand with Inverse Volatility ETN

XXV: Barclays Abandons iPath Brand with Inverse Volatility ETN

Barclays launched a new inverse volatility exchange-traded note yesterday (7/19/10). Offering no explanation in the press release, Barclays decided to abandon the popular and successful iPath brand of its two existing “long” volatility products. Instead, Barclays is using the ETN+ brand…

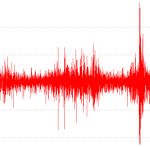

The Volatility of Volatility

The Volatility of Volatility

The VIX index is one of the most widely followed market volatility gauges. Investors trying to capture volatility have had two ETNs at their disposal the past 15 months: iPath S&P 500 VIX Short-Term Futures ETN (VXX) and iPath S&P 500 VIX Mid-Term Futures ETN (VXZ). Anyone who has followed…

Play the VIX (VXZ or VXX)

Play the VIX (VXZ or VXX)

Investors live with volatility. It’s as much a part of the market as trends, support and resistance levels, and, of course, prices. According to Investopedia, volatility is a statistical measure of the dispersion of returns for a given security. It can be measured by standard deviation or variance…