The longs are in control with the stock market inching up the charts through the summer. The S&P 500 broke thru 1000 on August 3rd and then got another boost from better-than-expected July employment numbers.

The longs are in control with the stock market inching up the charts through the summer. The S&P 500 broke thru 1000 on August 3rd and then got another boost from better-than-expected July employment numbers.

And yet, we like to remind our readers that better-than-expected employment figures are not the same as good ones. Consumers make up 70% of economic activity. When a significant portion of consumers are out of work, they’re not likely to buy more plane tickets, toy trains, or automobiles. In short, the bleeding may have stopped, but our economy has lost a lot of blood. That’s one reason stocks may trade more or less sideways for a long time.

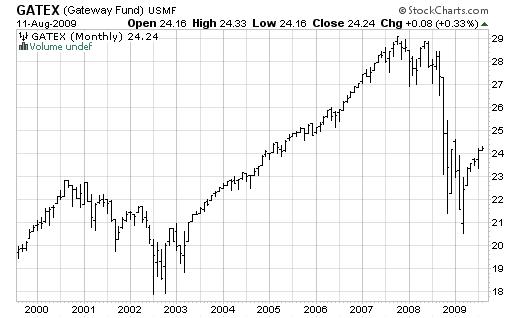

Now is not the time to get aggressive on the long side. Gateway Fund (GATEX) is an open-end mutual fund with less risk than a typical diversified growth fund, and it’s an idea to consider in a market that may trade sideways for a long time. According to their fact sheet, GATEX is “a hedged-equity portfolio that seeks to capture the majority of returns associated with equity securities with less risk than other equity investments.” In other words, if you like stocks but want to reduce your market volatility, GATEX may be for you.

The Gateway Fund has an excellent strategy for a choppy market. The managers purchase large cap domestic stocks like Exxon (XOM), AT&T (T), Microsoft (MSFT), Johnson & Johnson (JNJ), and JP Morgan (JPM), then they sell call options on the stocks. The revenue from the call options provides a cushion against market losses. It also means the fund will not rise as much in a bullish market.

In essence, Gateway gives up some potential on the long side in exchange for better returns during a correction. Although GATEX will decline in value when the market falls, it has done better over the long haul because of the option income.

The fund’s managers have proven the theory in both the short-term and long-term. As of 6/30/09, the S&P 500 Index fell -26.2% over the previous 12 months. At the same time, GATEX was off only -12.8%. Even better: over the past 10 years, yearly returns averaged 2.66% versus the S&P losing -2.22% per year. Not a bad record.

GATEX is best in a choppy, sideways market, but it is still a good long-term bet for risk-averse investors who want equity exposure. Take a look at GATEX when we get the next market correction. We suspect you’ll be glad you did.