Warning: The SEC Has Determined an 8% Expense Ratio is Hazardous to Your Wealth.

Warning: The SEC Has Determined an 8% Expense Ratio is Hazardous to Your Wealth.

Unfortunately, the SEC has not followed the example of the Surgeon General and does not require such warning labels on ETFs and mutual funds. The Alerian MLP ETF (AMLP) was the first ETF structured as a C-corporation, making it the first ETF to incur income tax liabilities. For about two years, AMLP claimed the income tax liability was unknown and therefore made the bold assumption it was zero percent.

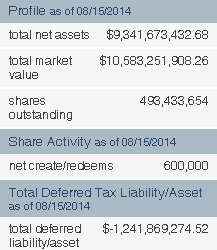

However, AMLP knew exactly what its income tax liability was every single day, and it made daily adjustments to its net asset value to reflect that liability. The firm prided itself for “unlocking the secret” of holding MLPs inside of an ETF. Its secret is to take money from shareholders to pay its corporate taxes. As of last Friday, its unpaid tax liabilities totaled more than $1 billion – $1,241,869,274.52 to be exact. This is money that has been taken away from shareholders to pay the fund’s expenses, making it a very real part of its expense ratio.

However, AMLP knew exactly what its income tax liability was every single day, and it made daily adjustments to its net asset value to reflect that liability. The firm prided itself for “unlocking the secret” of holding MLPs inside of an ETF. Its secret is to take money from shareholders to pay its corporate taxes. As of last Friday, its unpaid tax liabilities totaled more than $1 billion – $1,241,869,274.52 to be exact. This is money that has been taken away from shareholders to pay the fund’s expenses, making it a very real part of its expense ratio.

AMLP has been very slow to reveal its true expense ratio. From its inception on August 25, 2010 through April 18, 2012 it clung tightly to the notion that investors were only paying 0.85% per year. The following day, it filed paperwork with the SEC saying its expense ratio was 1.40%. A few days later (4/22/12), I published my analysis showing that AMLP had an actual expense ratio of 8.5%.

Two months later, AMLP raised its stated expense ratio to 4.86% and the following March revised it downward slightly to 4.85%. In May of last year, I updated my analysis, showing once again the actual expense ratio shareholders were incurring was greater than 8.4%. Meanwhile, the SEC let AMLP get away with this gross understatement of expenses.

Earlier this year, AMLP finally got around to filing an amendment to its prospectus admitting a total expense ratio of 8.56%. Investors may be inclined to believe this is the “new” expense ratio going forward. However, an analysis of the performance data on AMLP’s website shows this is the expense ratio investors have incurred since the fund’s inception four years ago this month.

AMLP is designed to track the Alerian MLP Infrastructure Index minus expenses. It is simple mathematical calculation to subtract AMLP’s annual total return of 12.9% (as of 6/30/14) from its benchmark’s return of 20.8% to see that shareholders have incurred annual expenses around 8%. This starts to add up after nearly four years, with AMLP returning 47.7% less than its index on a cumulative basis.

AMLP shareholders now need to prepare for another tax surprise. Kinder Morgan Energy Partners (KMP) is the fund’s largest holding at more than 11% of assets, and El Paso Pipeline Partners (EPB) takes up another 3%. Both of these MLPs have Kinder Morgan Inc (KMI) as their general partner, and KMI has announced plans to forgo the MLP structure on these two entities and absorb them into a C-corporation structure. This will be a taxable event to shareholders of each MLP. AMLP is a shareholder of both, and 14% of its portfolio will be taken away by the KMI transaction. AMLP will of course pass these additional tax liabilities on to its shareholders, which has a high probability of increasing the expense ratio even further.

Disclosure covering writer, editor, and publisher: No positions in any of the securities, companies, or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.