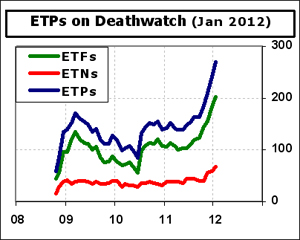

Thirty-six new names joined January’s ETF Deathwatch while only ten left, leaving a net increase of 26. Total Deathwatch membership now stands at a new all-time high of 268.

The 36 additions consisted of 27 ETFs and nine ETNs. Three-quarters of them just came out of the six-month new product grace period. Given the record number of new launches in 2011, the Deathwatch list seems likely to grow further in the coming months.

Only two of the ten funds coming off the list managed to do so gracefully. iShares MSCI Ireland Capped Investable Market (EIRL) and Russell 2000 High Momentum ETF (SHMO) had increases in trading activity. The other eight removals were all funds that closed in December.

The 268 current members consist of 201 ETFs and 67 ETNs. The ETF count includes 17 of the 39 (44%) currently listed actively-managed funds. The average age of products on the list is just under two years at 23.3 months, while assets average just $5.7 million each.

The 268 current members consist of 201 ETFs and 67 ETNs. The ETF count includes 17 of the 39 (44%) currently listed actively-managed funds. The average age of products on the list is just under two years at 23.3 months, while assets average just $5.7 million each.

Typically, only a few products go an entire month with no trading activity. For December, the number surged to seven and six of them came from the iPath brand. For the third month in a row, iPath US Treasury 5-Year Bull ETN (DFVL) had no trading activity at all. It would have been four calendar months but for a small trade on September 1, 2011. DFVL’s inability to attract any volume is even more alarming given the fact that it represents one of the year’s best performing asset classes. It is truly a zombie ETF.

iPath Long Enhanced MSCI EAFE Index ETN (MFLA) is not far behind, having last traded on October 4, 2011. The other five products with zero activity for the month December were iPath Pure Beta Aluminum ETN (FOIL), iPath Pure Beta Energy ETN (ONG), iPath Pure Beta S&P GSCI-Weighted ETN (SBV), iPath Short Enhanced (-2x) MSCI EAFE Index ETN (MFSA), and Russell Small Cap Contrarian ETF (SCTR).

The 36 ETPs Added to ETF Deathwatch for January 2012:

- AdvisorShares Madrona Domestic ETF (FWDD)

- AdvisorShares Madrona Global Bond ETF (FWDB)

- AdvisorShares Madrona International ETF (FWDI)

- AdvisorShares Meidell Tactical Advantage ETF (MATH)

- Credit Suisse Merger Arb Liquid 2x Monthly ETN (CSMB)

- db-X MSCI Brazil Currency-Hedged Equity (DBBR)

- db-X MSCI Canada Currency-Hedged Equity (DBCN)

- db-X MSCI Emerging Markets Currency-Hedged Equity (DBEM)

- db-X MSCI Japan Currency-Hedged Equity (DBJP)

- Direxion Daily Agribusiness Bear 3x (COWS)

- Direxion Daily Basic Materials Bear 3x (MATS)

- Direxion Daily Healthcare Bear 3x (SICK)

- Direxion Daily Healthcare Bull 3x (CURE)

- Direxion Daily Total Market Bear 1x (TOTS)

- EGShares Basic Materials GEMS ETF (LGEM)

- EGShares Consumer Goods GEMS ETF (GGEM)

- EGShares Consumer Services GEMS ETF (VGEM)

- EGShares Health Care GEMS ETF (HGEM)

- EGShares Industrials GEMS ETF (IGEM)

- EGShares Technology GEMS ETF (QGEM)

- EGShares Telecom GEMS ETF (TGEM)

- EGShares Utilities GEMS ETF (UGEM)

- ELEMENTS MLCX Biofuels ETN (FUE)

- Global X Farming ETF (BARN)

- Guggenheim ABC High Dividend ETF (ABCS)

- iPath DJ-UBS Lead ETN (LD)

- iPath EUR/USD Exchange Rate ETN (ERO)

- iPath US Treasury 2-year Yield Bull ETN (DTUL)

- IQ US Real Estate Small Cap ETF (ROOF)

- Morgan Stanley Cushing MLP High Income ETN (MLPY)

- Morgan Stanley S&P 500 Crude Oil ETN (BARL)

- PowerShares Fundamental Pure Large Growth (PXLG)

- PowerShares Global Nuclear Energy (PKN)

- SPDR S&P International Energy (IPW)

- UBS ETRACS Natural Gas Futures Contango ETN (GASZ)

- UBS ETRACS Oil Futures Contango ETN (OILZ)

The 10 ETPs removed from ETF Deathwatch for January 2012:

- HOLDRS Europe 2001 (EKH) closed

- HOLDRS Internet Infrastructure (IIH) closed

- HOLDRS Merrill Lynch Market 2000+ (MKH) closed

- HOLDRS Wireless (WMH) closed

- IQ Hong Kong Small Cap ETF (HKK) closed

- IQ Taiwan Small Cap (TWON) closed

- iShares MSCI Ireland Capped Investable Market (EIRL)

- Jefferies|TR/J CRB Global Agriculture Equity (CRBA) closed

- Jefferies|TR/J CRB Global Industrial Metals Equity (CRBI) closed

- Russell 2000 High Momentum ETF (SHMO)

The ETF Deathwatch criteria produced the following list of 268 ETPs for January:

ETF DEATHWATCH FOR JANUARY 2012

| # | Ticker Sym | ETF Name | Age (mths) | AUM (millions) | 3-mth Avg Daily $ Volume |

|---|---|---|---|---|---|

| 1 | AGLS | AdvisorShares Accuvest Global Long Short ETF | 18.0 | $3 | $62,431 |

| 2 | DENT | AdvisorShares Dent Tactical ETF | 27.9 | $13 | $85,646 |

| 3 | FWDD | AdvisorShares Madrona Domestic ETF | 6.4 | $14 | $20,713 |

| 4 | FWDB | AdvisorShares Madrona Global Bond ETF | 6.4 | $15 | $33,347 |

| 5 | FWDI | AdvisorShares Madrona International ETF | 6.4 | $11 | $16,707 |

| 6 | MATH | AdvisorShares Meidell Tactical Advantage ETF | 6.4 | $2 | $35,362 |

| 7 | AADR | AdvisorShares WCM/BNY Mellon Foc Gr ADR | 17.6 | $6 | $107,749 |

| 8 | PGD | Barclays Asian&Gulf; Currency Reval. ETN | 43.0 | $4 | $49,794 |

| 9 | BXDC | Barclays ETN+ S&P; 500 2x Short C 2009 ETN | 25.8 | $6 | $896,805 |

| 10 | JEM | Barclays GEMS Currency Index ETN | 47.6 | $1 | $10,703 |

| 11 | GCE | Claymore CEF Index GS Connect ETN | 49.4 | $3 | $36,755 |

| 12 | GVT | Columbia Concentrated Large Cap Value Strat | 32.4 | $3 | $3,104 |

| 13 | GMTB | Columbia Core Bond Strategy Fund | 23.4 | $5 | $80,394 |

| 14 | RPX | Columbia Growth Equity Strategy Fund | 27.3 | $1 | $15,242 |

| 15 | GMMB | Columbia Intermediate Municipal Bond Strategy | 23.4 | $5 | $15,080 |

| 16 | RWG | Columbia Large-Cap Growth Equity | 27.3 | $8 | $43,190 |

| 17 | CSMB | Credit Suisse Merger Arb Liquid 2x Mth ETN | 9.9 | $24 | $47,262 |

| 18 | FXRU | CurrencyShares Russian Ruble Shares | 38.2 | $5 | $31,169 |

| 19 | TDD | db-X 2010 Target Date Fund | 51.7 | $14 | $19,681 |

| 20 | TDX | db-X In-Target Date Fund | 51.7 | $15 | $20,975 |

| 21 | DBBR | db-X MSCI Brazil Currency-Hedged Equity | 6.8 | $4 | $15,982 |

| 22 | DBCN | db-X MSCI Canada Currency-Hedged Equity | 6.8 | $4 | $1,164 |

| 23 | DBEM | db-X MSCI Emerging Mkts Currency-Hdg Eqty | 6.8 | $4 | $62,793 |

| 24 | DBJP | db-X MSCI Japan Currency-Hedged Equity | 6.8 | $4 | $6,735 |

| 25 | TYBS | Direxion Daily 20+ Year Treasury Bear 1x | 9.4 | $3 | $12,876 |

| 26 | TYNS | Direxion Daily 7-10 Year Treasury Bear 1x | 9.4 | $3 | $10,042 |

| 27 | COWS | Direxion Daily Agribusiness Bear 3x | 7.3 | $3 | $316,635 |

| 28 | MATS | Direxion Daily Basic Materials Bear 3x | 6.6 | $3 | $589,428 |

| 29 | BRIS | Direxion Daily BRIC Bear 3x | 22.0 | $3 | $95,876 |

| 30 | BRIL | Direxion Daily BRIC Bull 3x | 22.0 | $4 | $135,243 |

| 31 | SICK | Direxion Daily Healthcare Bear 3x | 6.6 | $3 | $23,086 |

| 32 | CURE | Direxion Daily Healthcare Bull 3x | 6.6 | $3 | $132,716 |

| 33 | INDZ | Direxion Daily India Bear 3x | 22.0 | $4 | $172,016 |

| 34 | GASX | Direxion Daily Natural Gas Related Bear 3x | 17.8 | $3 | $219,052 |

| 35 | RETS | Direxion Daily Retail Bear 3x | 17.8 | $2 | $89,213 |

| 36 | RETL | Direxion Daily Retail Bull 3x | 17.8 | $6 | $413,874 |

| 37 | TOTS | Direxion Daily Total Market Bear 1x | 6.6 | $4 | $39,491 |

| 38 | LGEM | EGShares Basic Materials GEMS ETF | 6.4 | $1 | $2,926 |

| 39 | GGEM | EGShares Consumer Goods GEMS ETF | 6.4 | $1 | $7,517 |

| 40 | VGEM | EGShares Consumer Services GEMS ETF | 6.4 | $1 | $1,786 |

| 41 | FGEM | EGShares Financials GEMS ETF | 27.9 | $3 | $13,643 |

| 42 | HGEM | EGShares Health Care GEMS ETF | 6.4 | $1 | $8,196 |

| 43 | IGEM | EGShares Industrials GEMS ETF | 6.4 | $1 | $4,005 |

| 44 | QGEM | EGShares Technology GEMS ETF | 6.4 | $1 | $7,442 |

| 45 | TGEM | EGShares Telecom GEMS ETF | 6.4 | $1 | $6,526 |

| 46 | UGEM | EGShares Utilities GEMS ETF | 6.4 | $1 | $18,759 |

| 47 | GWO | ELEMENTS CS Global Warming ETN | 45.6 | $3 | $13,391 |

| 48 | DOD | ELEMENTS Dogs of the Dow Total Return ETN | 50.5 | $5 | $97,606 |

| 49 | FUE | ELEMENTS MLCX Biofuels ETN | 47.4 | $2 | $50,494 |

| 50 | WMW | ELEMENTS Morningstar Wide Moat Focus ETN | 51.2 | $10 | $49,241 |

| 51 | EEH | ELEMENTS Spctrm LgCap US Sector Mo ETN | 53.7 | $1 | $1,792 |

| 52 | EAPS | ESG Shares Pax MSCI EAFE ESG Index ETF | 11.2 | $4 | $53,649 |

| 53 | FOL | FactorShares 2X: Oil Bull/S&P500; Bear | 10.3 | $2 | $66,155 |

| 54 | FSE | FactorShares 2X: S&P500; Bull/TBond Bear | 10.3 | $1 | $26,595 |

| 55 | FSU | FactorShares 2X: S&P500; Bull/USD Bear | 10.3 | $2 | $6,239 |

| 56 | FSA | FactorShares 2X: TBond Bull/S&P500; Bear | 10.3 | $3 | $56,229 |

| 57 | FPA | First Trust Asia Pacific Ex-Japan AlphaDEX | 8.5 | $2 | $38,739 |

| 58 | FBZ | First Trust Brazil AlphaDEX Fund | 8.5 | $7 | $55,635 |

| 59 | FCA | First Trust China AlphaDEX Fund | 8.5 | $3 | $26,927 |

| 60 | FDD | First Trust DJ STOXX European Select Div | 52.8 | $10 | $83,358 |

| 61 | FEP | First Trust Europe AlphaDEX Fund | 8.5 | $5 | $114,986 |

| 62 | FJP | First Trust Japan AlphaDEX | 8.5 | $4 | $18,040 |

| 63 | FLN | First Trust Latin America AlphaDEX | 8.5 | $2 | $34,627 |

| 64 | FMK | First Trust Mega Cap AlphaDEX Fund | 7.8 | $4 | $67,358 |

| 65 | FNK | First Trust Mid Cap Value AlphaDEX | 8.5 | $7 | $217,982 |

| 66 | QABA | First Trust NASDAQ ABA Community Bank | 30.4 | $13 | $57,791 |

| 67 | FONE | First Trust NASDAQ CEA Smartphone | 10.5 | $13 | $47,684 |

| 68 | CARZ | First Trust NASDAQ Global Auto Index | 7.8 | $3 | $9,725 |

| 69 | FYT | First Trust Small Cap Value AlphaDEX | 8.5 | $2 | $160,187 |

| 70 | FKO | First Trust South Korea AlphaDEX | 8.5 | $1 | $14,291 |

| 71 | FPX | First Trust US IPO Index Fund | 69.6 | $16 | $53,445 |

| 72 | FVI | First Trust Value Line Equity Allocation | 61.7 | $6 | $124,764 |

| 73 | FBM | Focus Morningstar Basic Materials Index ETF | 9.2 | $4 | $49,685 |

| 74 | FCQ | Focus Morningstar Communication Srvcs ETF | 9.2 | $5 | $8,882 |

| 75 | FCL | Focus Morningstar Consumer Cyclical ETF | 9.2 | $5 | $9,245 |

| 76 | FCD | Focus Morningstar Consumer Defensive ETF | 9.2 | $5 | $25,987 |

| 77 | FEG | Focus Morningstar Energy Index ETF | 9.2 | $4 | $151,432 |

| 78 | FFL | Focus Morningstar Financial Services ETF | 9.2 | $4 | $34,810 |

| 79 | FHC | Focus Morningstar Health Care Index ETF | 9.2 | $5 | $40,033 |

| 80 | FIL | Focus Morningstar Industrials Index ETF | 9.2 | $5 | $49,761 |

| 81 | FLG | Focus Morningstar Large Cap Index ETF | 9.2 | $5 | $85,426 |

| 82 | FMM | Focus Morningstar Mid Cap Index ETF | 9.2 | $5 | $65,418 |

| 83 | FRL | Focus Morningstar Real Estate Index ETF | 9.2 | $5 | $14,287 |

| 84 | FOS | Focus Morningstar Small Cap Index ETF | 9.2 | $5 | $63,697 |

| 85 | FTQ | Focus Morningstar Technology Index ETF | 9.2 | $5 | $54,343 |

| 86 | FUI | Focus Morningstar Utilities Index ETF | 9.2 | $7 | $49,620 |

| 87 | ALUM | Global X Aluminum ETF | 12.0 | $3 | $39,837 |

| 88 | VROM | Global X Auto ETF | 7.5 | $4 | $16,956 |

| 89 | BRAF | Global X Brazil Financials ETF | 17.3 | $5 | $76,777 |

| 90 | CHIE | Global X China Energy ETF | 24.8 | $4 | $27,463 |

| 91 | CHIX | Global X China Financials ETF | 25.0 | $14 | $384,846 |

| 92 | CHII | Global X China Industrial ETF | 25.3 | $4 | $44,052 |

| 93 | CHIM | Global X China Materials ETF | 23.9 | $2 | $42,346 |

| 94 | BARN | Global X Farming ETF | 7.1 | $3 | $34,284 |

| 95 | FISN | Global X Fishing Industry ETF | 8.0 | $2 | $6,588 |

| 96 | EATX | Global X Food ETF | 8.1 | $3 | $31,009 |

| 97 | AND | Global X FTSE Andean 40 ETF | 11.0 | $6 | $49,820 |

| 98 | ARGT | Global X FTSE Argentina 20 ETF | 10.1 | $4 | $24,203 |

| 99 | MEXS | Global X Mexico Small-Cap ETF | 8.0 | $1 | $3,648 |

| 100 | QQQC | Global X NASDAQ China Technology ETF | 25.1 | $4 | #N/A |

| 101 | XOIL | Global X Oil Equities ETF | 9.7 | $3 | $41,789 |

| 102 | GGGG | Global X Pure Gold Miners ETF | 9.7 | $4 | $104,149 |

| 103 | EMGX | Global X Russell Emerging Markets Growth ETF | 11.3 | $2 | $7,171 |

| 104 | EMVX | Global X Russell Emerging Markets Value ETF | 11.3 | $2 | $5,706 |

| 105 | TSXV | Global X S&P;/TSX Venture 30 Canada ETF | 9.6 | $2 | $36,338 |

| 106 | WSTE | Global X Waste Management ETF | 8.7 | $1 | $8,588 |

| 107 | ABCS | Guggenheim ABC High Dividend ETF | 6.9 | $7 | $50,195 |

| 108 | GIY | Guggenheim Enhanced Core Bond ETF | 47.3 | $5 | $61,774 |

| 109 | GSY | Guggenheim Enhanced Short Duration Bond | 47.3 | $15 | $65,610 |

| 110 | EEN | Guggenheim EW Euro-Pacific LDRs ETF | 58.9 | $2 | $12,210 |

| 111 | XGC | Guggenheim International Small Cap LDRs | 57.8 | $5 | $21,756 |

| 112 | OTP | Guggenheim Ocean Tomo Patent ETF | 61.4 | $21 | $227,395 |

| 113 | XRO | Guggenheim Sector Rotation ETF | 64.2 | $11 | $54,089 |

| 114 | WXSP | Guggenheim Wilshire 4500 Completion ETF | 22.1 | $6 | $1,468 |

| 115 | WFVK | Guggenheim Wilshire 5000 Total Market ETF | 22.1 | $6 | $35,878 |

| 116 | JJU | iPath DJ-UBS Aluminum ETN | 42.8 | $4 | $41,521 |

| 117 | LD | iPath DJ-UBS Lead ETN | 42.8 | $4 | $108,427 |

| 118 | ERO | iPath EUR/USD Exchange Rate ETN | 56.6 | $5 | $34,310 |

| 119 | GBB | iPath GBP/USD Exchange Rate ETN | 56.6 | $3 | $10,087 |

| 120 | GRN | iPath Global Carbon ETN | 42.8 | $1 | $11,307 |

| 121 | MFLA | iPath Long Enh 2x MSCI EAFE Index ETN | 13.2 | $3 | $341 |

| 122 | EMLB | iPath Long Enh 2x MSCI Emerging Mkts ETN | 13.2 | $2 | $12,595 |

| 123 | ROLA | iPath Long Ext 3x Russell 1000 TR ETN | 13.2 | $5 | $9,336 |

| 124 | RTLA | iPath Long Ext 3x Russell 2000 TR ETN | 13.2 | $4 | $469,125 |

| 125 | SFLA | iPath Long Ext 3x S&P; 500 TR Index ETN | 13.2 | $5 | $214,031 |

| 126 | DIRT | iPath Pure Beta Agriculture ETN | 8.5 | $2 | $18,384 |

| 127 | FOIL | iPath Pure Beta Aluminum ETN | 8.5 | $3 | $1,029 |

| 128 | BCM | iPath Pure Beta Broad Commodity ETN | 8.5 | $9 | $107,439 |

| 129 | CHOC | iPath Pure Beta Cocoa ETN | 8.5 | $2 | $40,683 |

| 130 | CAFE | iPath Pure Beta Coffee ETN | 8.5 | $2 | $39,591 |

| 131 | CUPM | iPath Pure Beta Copper ETN | 8.5 | $2 | $30,436 |

| 132 | CTNN | iPath Pure Beta Cotton ETN | 8.5 | $2 | $17,447 |

| 133 | OLEM | iPath Pure Beta Crude Oil ETN | 8.5 | $2 | $28,979 |

| 134 | ONG | iPath Pure Beta Energy ETN | 8.5 | $2 | $8,364 |

| 135 | WEET | iPath Pure Beta Grains ETN | 8.5 | $2 | $69,153 |

| 136 | HEVY | iPath Pure Beta Industrial Metals ETN | 8.5 | $2 | $21,451 |

| 137 | LEDD | iPath Pure Beta Lead ETN | 8.5 | $3 | $10,814 |

| 138 | NINI | iPath Pure Beta Nickel ETN | 8.5 | $1 | $3,419 |

| 139 | BLNG | iPath Pure Beta Precious Metals ETN | 8.5 | $4 | $28,411 |

| 140 | SBV | iPath Pure Beta S&P; GSCI-Weighted ETN | 8.5 | $5 | $14,469 |

| 141 | GRWN | iPath Pure Beta Softs ETN | 8.5 | $3 | $13,484 |

| 142 | DCNG | iPath Seasonal Natural Gas ETN | 8.5 | $2 | $13,761 |

| 143 | MFSA | iPath Short Enh -2x MSCI EAFE Index ETN | 13.2 | $6 | $5,057 |

| 144 | ROSA | iPath Short Ext -3x Russell 1000 TR ETN | 13.2 | $3 | $21,662 |

| 145 | DTUL | iPath US Treasury 2-year Yield Bull ETN | 16.9 | $9 | $49,939 |

| 146 | STPP | iPath US Treasury Steepener ETN | 16.9 | $2 | $52,851 |

| 147 | IOIL | IQ Global Oil Small Cap ETF | 8.0 | $2 | $21,150 |

| 148 | ROOF | IQ US Real Estate Small Cap ETF | 6.7 | $10 | $67,818 |

| 149 | FNIO | iShares FTSE NAREIT Industrial/Office Cpd | 56.6 | $10 | $41,508 |

| 150 | IFNA | iShares FTSE NAREIT North America | 50.1 | $13 | $51,382 |

| 151 | RTL | iShares FTSE NAREIT Retail Capped | 56.6 | $9 | $48,549 |

| 152 | AXDI | iShares MSCI ACWI ex US Consumer Discr | 17.8 | $5 | $4,522 |

| 153 | AXSL | iShares MSCI ACWI ex US Consumer Staples | 17.8 | $3 | $54,775 |

| 154 | AXEN | iShares MSCI ACWI ex US Energy | 17.8 | $6 | $30,862 |

| 155 | AXFN | iShares MSCI ACWI ex US Financials | 23.6 | $2 | $10,298 |

| 156 | AXHE | iShares MSCI ACWI ex US Health Care | 17.8 | $9 | $83,178 |

| 157 | AXID | iShares MSCI ACWI ex US Industrials | 17.8 | $2 | $1,201 |

| 158 | AXIT | iShares MSCI ACWI ex US Info Technology | 17.8 | $2 | $9,107 |

| 159 | AXMT | iShares MSCI ACWI ex US Materials | 17.8 | $3 | $8,327 |

| 160 | AXTE | iShares MSCI ACWI ex US Telecom Services | 17.8 | $3 | $7,854 |

| 161 | AXUT | iShares MSCI ACWI ex US Utilities | 17.8 | $2 | $17,699 |

| 162 | EMFN | iShares MSCI Emerging Markets Financials | 23.6 | $3 | $27,761 |

| 163 | EMMT | iShares MSCI Emerging Markets Materials | 23.6 | $8 | $42,447 |

| 164 | FEFN | iShares MSCI Far East Financials Sector | 23.6 | $2 | $918 |

| 165 | NUCL | iShares S&P; Global Nuclear Energy | 42.8 | $11 | $45,896 |

| 166 | TZL | iShares S&P; Target Date 2030 Index Fund | 38.4 | $13 | $83,400 |

| 167 | TZO | iShares S&P; Target Date 2035 Index Fund | 38.4 | $8 | $36,467 |

| 168 | TZV | iShares S&P; Target Date 2040 Index Fund | 38.4 | $16 | $71,136 |

| 169 | TGR | iShares S&P; Target Date Retirement Inc. | 38.4 | $9 | $53,101 |

| 170 | DSXJ | JPM Qtrly Dbl Short US 10-Yr Treas Fut ETN | 15.1 | $8 | $111,759 |

| 171 | DSTJ | JPM Qtrly Dbl Short US Long Treas Fut ETN | 15.1 | $7 | $11,583 |

| 172 | JFT | KEYnotes FT Enhanced 130/30 Large Cap ETN | 43.9 | $3 | $5,172 |

| 173 | COLX | Market Vectors Colombia ETF | 9.7 | $2 | $6,237 |

| 174 | URR | Market Vectors Double Long Euro ETN | 44.4 | $1 | $22,729 |

| 175 | GERJ | Market Vectors Germany Small-Cap ETF | 9.0 | $3 | $24,188 |

| 176 | INR | Market Vectors Indian Rupee/USD ETN | 46.1 | $4 | $43,406 |

| 177 | FLTR | Market Vectors Investment Grd Floating Rate | 8.3 | $7 | $39,196 |

| 178 | BONO | Market Vectors LatAm Aggregate Bond ETF | 7.8 | $7 | $53,231 |

| 179 | RSXJ | Market Vectors Russia Small-Cap ETF | 8.7 | $3 | $55,734 |

| 180 | MLPY | Morgan Stanley Cushing MLP High Income ETN | 9.6 | $18 | $66,649 |

| 181 | BARL | Morgan Stanley S&P; 500 Crude Oil ETN | 6.2 | $9 | $6,920 |

| 182 | NASI | Pax MSCI North America ESG Index | 19.7 | $5 | $47,060 |

| 183 | TRSY | PIMCO Broad U.S. Treasury Index Fund | 14.2 | $19 | $30,440 |

| 184 | PMA | PowerShares Active Mega-Cap Portfolio | 45.2 | $5 | $57,153 |

| 185 | CVRT | PowerShares Convertible Securities Portfolio | 7.3 | $9 | $70,637 |

| 186 | JGBT | PowerShares DB 3x Japanese G-Bond Fut ETN | 9.4 | $4 | $7,513 |

| 187 | UDNT | PowerShares DB 3x Short USD Idx Futures ETN | 7.4 | $4 | $33,262 |

| 188 | ADZ | PowerShares DB Agriculture Short ETN | 45.1 | $2 | $48,269 |

| 189 | BDG | PowerShares DB Base Metals Long ETN | 43.1 | $1 | $5,216 |

| 190 | DEE | PowerShares DB Commodity Dbl Short ETN | 44.7 | $3 | $72,859 |

| 191 | DPU | PowerShares DB Commodity Long ETN | 44.7 | $6 | $16,383 |

| 192 | JGBL | PowerShares DB Japanese G-Bond Fut ETN | 9.4 | $5 | $6,572 |

| 193 | PJB | PowerShares Dynamic Banking | 63.5 | $12 | $39,003 |

| 194 | PEZ | PowerShares Dynamic Cons Discretionary | 63.5 | $18 | $190,574 |

| 195 | PIC | PowerShares Dynamic Insurance | 75.2 | $7 | $27,548 |

| 196 | PIQ | PowerShares Dynamic Magniquant | 63.5 | $17 | $36,786 |

| 197 | PXLC | PowerShares Fundamental Pure Large Core | 61.9 | $23 | $59,664 |

| 198 | PXLG | PowerShares Fundamental Pure Large Gr | 6.6 | $2 | $28,638 |

| 199 | PXMC | PowerShares Fundamental Pure Mid Core | 61.9 | $20 | $43,351 |

| 200 | PKN | PowerShares Global Nuclear Energy | 45.6 | $15 | $64,828 |

| 201 | PSTL | PowerShares Global Steel Portfolio | 39.8 | $4 | $14,827 |

| 202 | PWND | PowerShares Global Wind Energy | 42.6 | $15 | $73,592 |

| 203 | PTO | PowerShares Ibbotson Alternative Completion | 44.0 | $8 | $34,019 |

| 204 | KBWX | PowerShares KBW International Financial | 13.1 | $3 | $1,691 |

| 205 | KBWY | PowerShares KBW Premium Yield Equity REIT | 13.1 | $7 | $39,186 |

| 206 | KBWP | PowerShares KBW Property & Casualty Ins | 13.1 | $4 | $4,464 |

| 207 | PMNA | PowerShares MENA Frontier Countries | 42.3 | $19 | $94,474 |

| 208 | PYH | PowerShares Morningstar StockInvestor Core | 61.9 | $16 | $22,838 |

| 209 | PSCM | PowerShares S&P; SmallCap Materials | 21.1 | $4 | $46,514 |

| 210 | IGS | ProShares Short Investment Grade Corporate | 9.2 | $4 | $57,116 |

| 211 | UJB | ProShares Ultra High Yield | 8.7 | $2 | $18,879 |

| 212 | IGU | ProShares Ultra Investment Grade Corporate | 8.7 | $2 | $65,243 |

| 213 | KRU | ProShares Ultra KBW Regional Banking | 20.6 | $4 | $409,281 |

| 214 | UPV | ProShares Ultra MSCI Europe | 20.4 | $2 | $293,527 |

| 215 | UMX | ProShares Ultra MSCI Mexico Investable Mkt | 20.4 | $1 | $23,632 |

| 216 | UXJ | ProShares Ultra MSCI Pacific Ex-Japan | 20.4 | $2 | $124,713 |

| 217 | UVG | ProShares Ultra Russell 1000 Value | 59.1 | $6 | $44,097 |

| 218 | UWC | ProShares Ultra Russell3000 | 30.4 | $7 | $81,486 |

| 219 | LTL | ProShares Ultra Telecommunications | 45.8 | $3 | $225,337 |

| 220 | TBZ | ProShares UltraShort 3-7 Year Treasury | 9.0 | $4 | $14,230 |

| 221 | RXD | ProShares UltraShort Healthcare | 59.9 | $3 | $90,932 |

| 222 | SMK | ProShares UltraShort MSCI Mexico | 30.9 | $3 | $133,774 |

| 223 | JPX | ProShares UltraShort MSCI Pacific ex-Japan | 30.9 | $3 | $66,351 |

| 224 | BIS | ProShares UltraShort Nasdaq Biotechnology | 21.1 | $2 | $57,443 |

| 225 | SFK | ProShares UltraShort Russell 1000 Growth | 59.1 | $6 | $216,368 |

| 226 | SJF | ProShares UltraShort Russell 1000 Value | 59.1 | $2 | $104,631 |

| 227 | SDK | ProShares UltraShort Russell Midcap Growth | 59.1 | $3 | $166,638 |

| 228 | SJL | ProShares UltraShort Russell Midcap Value | 59.1 | $2 | $140,987 |

| 229 | TWQ | ProShares UltraShort Russell3000 | 30.4 | $2 | $55,587 |

| 230 | TLL | ProShares UltraShort Telecom | 45.8 | $3 | $259,821 |

| 231 | TPS | ProShares UltraShort TIPS | 10.8 | $1 | $27,171 |

| 232 | SDP | ProShares UltraShort Utilities | 59.9 | $3 | $361,473 |

| 233 | RWW | RevenueShares Financials Sector Fund | 38.2 | $7 | $48,235 |

| 234 | HMTM | Russell 1000 High Momentum ETF | 7.3 | $5 | $220,621 |

| 235 | HVOL | Russell 1000 High Volatility ETF | 7.3 | $4 | $36,874 |

| 236 | LBTA | Russell 1000 Low Beta ETF | 7.3 | $5 | $18,745 |

| 237 | SHBT | Russell 2000 High Beta ETF | 7.3 | $4 | $16,431 |

| 238 | SLBT | Russell 2000 Low Beta ETF | 7.3 | $5 | $1,181 |

| 239 | SLVY | Russell 2000 Low Volatility ETF | 7.3 | $5 | $206,865 |

| 240 | AGRG | Russell Aggressive Growth ETF | 7.5 | $5 | $11,797 |

| 241 | CNTR | Russell Contrarian ETF | 7.5 | $4 | $5,338 |

| 242 | ONEF | Russell Equity ETF | 20.0 | $6 | $53,785 |

| 243 | LWPE | Russell Low P/E ETF | 7.5 | $9 | $13,275 |

| 244 | EWAC | Rydex MSCI All Country World Equal Weight | 11.8 | $3 | $19,399 |

| 245 | VRD | SPDR Nuveen S&P; VRDO Municipal Bond ETF | 27.6 | $12 | $102,244 |

| 246 | JPP | SPDR Russell/Nomura PRIME Japan | 62.4 | $14 | $107,423 |

| 247 | IPW | SPDR S&P; International Energy | 41.8 | $10 | $80,842 |

| 248 | IPU | SPDR S&P; International Utilities | 41.8 | $12 | $96,810 |

| 249 | KME | SPDR S&P; Mortgage Finance ETF | 32.5 | $3 | $5,040 |

| 250 | NAGS | Teucrium Natural Gas Fund | 11.1 | $1 | $40,691 |

| 251 | MLPS | UBS ETRACS 1x Mthly Short Alerian MLP ETN | 15.3 | $11 | $18,347 |

| 252 | MLPG | UBS ETRACS Alerian Natural Gas MLP ETN | 17.8 | $14 | $72,977 |

| 253 | UBN | UBS ETRACS CMCI Energy TR ETN | 45.6 | $3 | $24,534 |

| 254 | UBG | UBS ETRACS CMCI Gold TR ETN | 45.6 | $9 | $175,009 |

| 255 | UBM | UBS ETRACS CMCI Industrial Metals TR ETN | 45.6 | $5 | $77,833 |

| 256 | UBC | UBS ETRACS CMCI Livestock TR ETN | 45.6 | $5 | $27,430 |

| 257 | PTD | UBS ETRACS CMCI Short Platinum ER ETN | 44.4 | $3 | $7,245 |

| 258 | GASZ | UBS ETRACS Natural Gas Fut. Contango ETN | 6.6 | $11 | $9,724 |

| 259 | OILZ | UBS ETRACS Oil Futures Contango ETN | 6.6 | $10 | $4,967 |

| 260 | BDCS | UBS ETRACS Wells Fargo BDC ETN | 8.2 | $8 | $59,798 |

| 261 | MLPW | UBS ETRACS Wells Fargo MLP Index ETN | 14.2 | $18 | $32,302 |

| 262 | VTWV | Vanguard Russell 2000 Value ETF | 15.5 | $11 | $44,556 |

| 263 | IVOV | Vanguard S&P; Mid-Cap 400 Value ETF | 15.9 | $11 | $163,960 |

| 264 | VIIZ | VelocityShares VIX Medium-Term ETN | 13.2 | $8 | $26,196 |

| 265 | EU | WisdomTree Euro Debt Fund | 44.2 | $5 | $47,886 |

| 266 | HEDJ | WisdomTree International Hedged Equity | 24.3 | $18 | $48,993 |

| 267 | ROI | WisdomTree LargeCap Growth | 37.4 | $18 | $77,675 |

| 268 | GULF | WisdomTree Middle East Dividend | 42.1 | $15 | $78,746 |

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data, AUM from the ETF Industry Association, and all other information compiled by Invest With An Edge.

Past issues of ETF Deathwatch are available here.

Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.